By Sean McLain

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 26, 2019).

YOKOHAMA, Japan -- Nissan Motor Co. said it would cut 12,500

jobs, or 9% of its global workforce, after reporting an implosion

in profit in the latest quarter that stemmed in large part from the

U.S.

The Japanese car maker is struggling to find its footing after a

turbulent eight months that included the arrest of former Chairman

Carlos Ghosn and tensions with alliance partner Renault SA over

whether the two should combine.

During the turmoil, problems that had festered for years in the

U.S. have worsened. Nissan tried to cut back on low-margin sales to

rental-car companies but found it couldn't find enough ordinary

customers to keep up volume, leaving factories without enough to

do.

Chief Executive Hiroto Saikawa said the company aimed to

complete the job cuts by March 2023 and shave operating costs by

more than Yen300 billion ($2.8 billion). Most of those cuts will

come from the factory floor, but the company is also offering

buyouts to white-collar workers.

Some of the biggest trims are coming in the U.S., where Nissan

is cutting more than 1,400 jobs out of a total of 21,000. Hundreds

of workers at Nissan's U.S. headquarters in Tennessee are being

offered buyouts, said a person familiar with those plans.

India and Indonesia together will lose more than 2,500 jobs as

Nissan seeks to stem losses from a failed relaunch of its low-cost

Datsun brand in 2012. Job cuts are also coming in Europe, as it

slashes production in the U.K. and in Spain.

"We will stop spending money on things that are less profitable,

or where we don't see an increase in profit," Mr. Saikawa said.

"Around 10% of the model lineup will be cut. This is under way.

Compact cars and the Datsun lineup will be the main ones."

Driving Mr. Saikawa's cost cuts is a precipitous decline in

profitability. Nissan's operating profit in the April-June quarter

fell to about $15 million, a 98.5% decline from the same period a

year earlier. Sales in the U.S. declined 3.7% for the period.

Car makers typically try to run plants at nearly full capacity

to maximize profits. Nissan said its plants are operating at around

70% capacity, a figure it wants to lift to 86%.

Nissan's declining profitability in the U.S. was long a point of

contention between Mr. Saikawa and his former boss, Mr. Ghosn. Two

years ago, when he took the helm at Nissan, Mr. Saikawa was already

pushing back on Mr. Ghosn's demands for growth, saying the company

needed to keep a closer eye on its margins. The focus on the U.S.

also created tension within Nissan's headquarters, as some

executives felt it came at the cost of investing in Nissan's home

market, Japan.

Mr. Saikawa is trying to polish Nissan's brand image, which took

a hit from the bulk sales to rental-car fleets and, more recently,

from publicity surrounding the criminal charges in Japan against

Mr. Ghosn, who says he is innocent.

Mr. Saikawa cited progress in lifting prices in the U.S. Nissan

vehicles sold for an average $29,935 in June, an increase of around

$200 from the previous year, according to Kelley Blue Book. That is

below the industry average of $37,285.

By three years from now, Nissan hopes to sell around six million

vehicles annually, around a million fewer than originally planned.

Mr. Saikawa said he didn't expect big growth in revenue but wanted

to double operating margin to 6% by the end of those three

years.

There is a chance the 65-year-old Mr. Saikawa won't be around to

see that happen. A new board took over in June with a majority of

independent directors, and they already are restive. Before

Thursday's meeting, the directors had decided to give Mr. Saikawa a

year to make headway on his plan.

At a board meeting Thursday ahead of the announcement, some

independent directors expressed displeasure they weren't informed

earlier about the extent of the job cuts, according to people

familiar with the board discussion. The directors didn't know that

Mr. Saikawa was planning more than 10,000 job cuts until reading

about the plan in Japanese media the day before the announcement,

one of the people said.

A Nissan spokesman said: "It is understandable that our board

members got upset. We as a company should have a better control

over information."

Mr. Saikawa said Thursday his sole focus was on cutting costs to

hit revenue and profit targets. Anything beyond that was the job of

the "next generation," he said.

Nissan's nomination committee has begun work on finding a

successor. People familiar with the discussions say they have a

shortlist, including the current head of China, Makoto Uchida, and

the executive in charge of the turnaround efforts, Jun Seki.

"I think we should try to have a succession plan as soon as

possible," said Masakazu Toyoda, an independent director who will

oversee the search for Mr. Saikawa's successor, on Wednesday.

Nissan said its revenue fell 12.7% to Yen2.37 trillion in the

first quarter, missing a FactSet consensus estimate of Yen2.63

trillion.

Nissan backed its annual sales and profit guidance, saying it

expects revenue to decrease 2.4% in the fiscal year ending March

2020, while net profit is projected to fall 46.7%.

--Kosaku Narioka contributed to this article.

Write to Sean McLain at sean.mclain@wsj.com

(END) Dow Jones Newswires

July 26, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

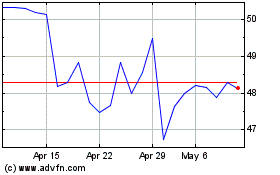

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

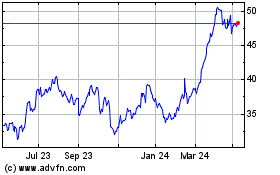

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024