Sinclair Set to Complete Largest Junk Bond Sale Since 2016

July 18 2019 - 2:33PM

Dow Jones News

By Sam Goldfarb

A subsidiary of Sinclair Broadcast Group Inc. is poised to

complete the largest U.S. junk-bond sale in more than three years,

drawing substantial demand from investors to support its purchase

of regional sports networks from Walt Disney Co.

The subsidiary, Diamond Sports Group LLC, is expected as early

as Thursday to sell a combined $4.9 billion of speculative-grade

bonds -- including both secured and unsecured notes -- the most

since Altice France SA issued $5.2 billion in April 2016, according

to LCD, a unit of S&P Global Market Intelligence.

Diamond Sports is also issuing a $3.3 billion loan to fund the

acquisition. And a different subsidiary, which houses Sinclair's

existing local television stations, plans to sell a $1.3 billion

loan to both fund the acquisition from Disney and refinance bonds

due in 2021.

Proposed interest rates on all of the new bonds and loans were

lowered from initial guidance set by a JPMorgan Chase & Co.-led

underwriting group, a sign of strong interest from investors.

Though some investors noted the risks from customers abandoning

cable TV, they also pointed to the value in sports networks, which

are typically among the most expensive channels for distributors

and customers.

Sinclair, the nation's biggest owner of local television

stations, said in May that it would buy 21 regional sports networks

from Disney in a deal valued at $10.6 billion.

After the acquisition, Diamond Sports' debt is expected to total

more than five-times its earnings before interest, taxes,

depreciation and amortization. But it should still generate roughly

$830 million of annual free cash flow, according to the research

firm CreditSights.

Sinclair's debt sale has benefited from favorable market

conditions.

With the Federal Reserve expected to cut interest rates later

this month, investors generally have a positive outlook on the U.S.

economy -- providing a boost to speculative-grade bonds and riskier

assets more broadly.

The loan market has been something of a weak spot. That is in

large part because loans become less appealing in a flat or

declining interest-rate environment due to their coupons that rise

and fall with benchmark rates.

Still, Sinclair's loans are rated at the high end of the

speculative-grade spectrum, making them attractive to investors who

have been searching for such debt.

In recent trading, the yield on the benchmark 10-year U.S.

Treasury note was 2.061%, according to Tradeweb, compared 2.059%

Wednesday. Yields rise when bond prices fall.

The WSJ Dollar Index, which measures the U.S. currency against a

basket of 16 others, was recently down 0.1% at 90.01.

Write to Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

July 18, 2019 14:18 ET (18:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

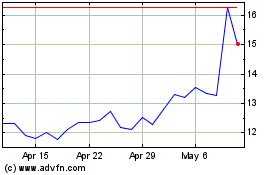

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

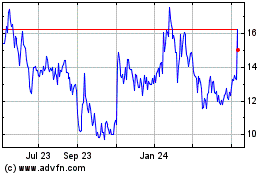

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Apr 2023 to Apr 2024