Euro Drops On Rumors Of ECB Revising Inflation Goal

July 18 2019 - 4:43AM

RTTF2

The euro weakened against its major counterparts in the European

session on Thursday, following a media report that European Central

Bank's staff are studying the possibility of revising inflation

goal.

Bloomberg reported that the staff of the ECB have begun studying

a possible revamp of their inflation goal, which currently is

below, but close to, 2 percent over the medium term.

Such a move could allow policymakers to pump monetary stimulus

for a longer period.

The ECB's inflation mandate has been kept unchanged since 2003.

The study includes questioning of the current inflation target and

whether or not it is desirable in the present scenario.

European stocks fell in cautious trade as investors fretted

about the outlook for corporate earnings in a slowing growth

environment.

The currency traded mixed against its major opponents in the

Asian session. While it held steady against the franc and the

pound, it rose against the greenback. Against the yen, it

dropped.

The euro slipped to a 3-day low of 0.8979 against the pound,

from a high of 0.9039 hit at 8:45 pm ET. The euro is seen finding

support around the 0.88 region.

Data from the Office for National Statistics showed that UK

retail sales recovered unexpectedly in June.

Retail sales volume increased 1 percent month-on-month in June

largely driven by non-food product sales. Sales were forecast to

fall 0.3 percent after easing 0.6 percent in May.

The euro eased to 1.1205 against the greenback, after rising to

a 2-day high of 1.1244 at 2:00 am ET. Further downtrend may take

the euro to a support around the 1.10 level.

The euro depreciated to a 1-1/2-month low of 120.78 against the

yen from yesterday's closing value of 121.16. The next possible

support for the euro is seen around the 118.00 mark.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade surplus of 589.5 billion yen in June.

That exceeded expectations for a surplus of 403.5 billion yen

following the 968.3 billion yen deficit of May.

The euro fell to a 3-1/2-month low of 1.6626 against the kiwi,

more than 2-month low of 1.5943 against the aussie and a 2-day low

of 1.4631 versus the loonie, from its early highs of 1.6696 and

1.6033, and a 2-day high of 1.4679, respectively. Next key support

for the euro is likely seen around 1.64 against the kiwi, 1.575

against the aussie and 1.44 versus the loonie.

The European currency declined to a 2-day low of 1.1063 against

the franc, following an advance to 1.1089 at 7:00 am ET. If the

euro slides further, it may find support around the 1.09 level.

Data from the Federal Customs Administration showed that

Switzerland's exports decreased marginally in June amid a faster

growth in imports.

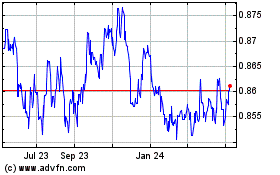

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

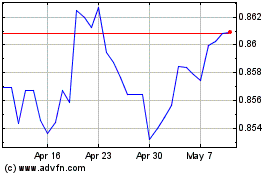

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024