U.S. Stocks Open Lower, Following Europe Down

July 09 2019 - 10:03AM

Dow Jones News

By Avantika Chilkoti

-- European stocks are dragged lower by a string of bad

corporate news

-- Most markets in Asia also decline

U.S. stocks opened lower on Tuesday, with declines in the Dow

Jones Industrial Average, the S&P 500 and the Nasdaq.

European stocks declined on Tuesday, following a spate of

unwelcome corporate news on some of the region's biggest banks,

chemical companies and auto makers.

The pan-continental Stoxx Europe 600 benchmark shed about 0.6%,

putting it on course to fall for a third straight day, with marquee

German stocks suffering some of the sharpest losses. U.S. stock

futures also dipped, while over in Asia, most markets declined

slightly, led by a 0.8% drop in Hong Kong's Hang Seng Index.

In Europe, the biggest decliners included BASF, which dropped

about 5% after the German chemicals giant slashed its profit

forecast on Monday evening, citing the continuing trade dispute

between the U.S. and China as well as sluggish demand in the auto

market. The warning prompted a drop in the stock of rivals such as

Covestro AG , which fell 4%, and Lanxess, which declined 1.5%.

"What's not clear is whether this is the start of a structural

downturn or whether it is a temporary blip," Martin Todd,

co-portfolio manager of the Hermes European Alpha Fund, said of the

European chemicals industry.

Deutsche Bank dropped 4.3%, extending its rout for a second day,

amid growing skepticism over Chief Executive Christian Sewing's

plan to cut jobs and restructure the investment bank. Smaller

Danish rival Danske Bank slumped about 3.2% after it published a

profit warning Monday.

There's widespread pessimism among investors about Europe, as

there's little room for the European Central Bank to cut rates

further, local banks are fragile and productivity gains have been

sluggish, according to Peter Westaway, chief European economist at

Vanguard. But Mr. Westaway says he encourages clients not to avoid

stocks in the region altogether.

"European equities are actually quite attractively priced

because there is so much bad news priced in and they probably

unperformed for the past few years compared to other markets," he

said. "The uncertainty has been removed but that still doesn't mean

there aren't people out there who are just skeptical about how

effective Q.E. can be," he said.

In a rare bright spot, shares in Ocado gained 9.4% in U.K.

trading after investors grew more optimistic about growth prospects

for the British online groceries group following its first-half

earnings report.

Meanwhile, stock futures linked to the S&P 500 index

declined 0.6%. The three main U.S. equity benchmarks, while still

hovering near record highs, have dropped for two consecutive days

after better-than-expected jobs data on Friday led investors to

speculate that the Federal Reserve may take it slow in easing key

interest rates.

Acacia Communications Inc. soared after Cisco Systems Inc.

Tuesday said it agreed to buy the company for $70 a share in cash,

or about $2.6 billion.

Inside currency markets, the pound slid 0.5% against the dollar.

It now trades at $1.2448 to GBP1, or close to the weakest level

since January, as investors digest disappointing economic data that

came out this week.

"The final leg of support for a Brexit riddled economy looks to

have been swiped away overnight as the BRC Sales Monitor points to

a third consecutive decline in official retail sales figures,

cementing the prospect of a negative Q2 GDP reading," Simon Harvey,

a currency market analyst at Monex Europe, said in a note to

clients.

Investors globally are also poised for fresh commentary from

U.S. Federal Reserve Chairman Jerome Powell and his deputy, Randal

Quarles, that may provide important signals on the chances of rate

cuts this year.

Pete Gunning, global chief investment officer at Russell

Investments, is among those investing carefully -- "thoughtfully

doing nothing," he said -- in anticipation of a global slowdown.

"While we are not expecting Armageddon, we are definitely late

cycle," he said.

The yield on 10-year Treasurys ticked up to 2.054% from 2.030%

on Monday. Yields and prices move in opposite directions.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

July 09, 2019 09:48 ET (13:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

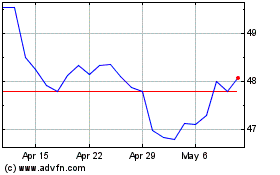

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

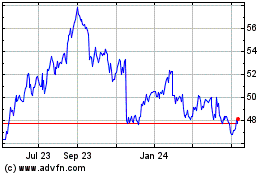

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024