Downbeat Coal Exports, Global Steel Markets to Weigh on Coal Stocks

June 18 2019 - 1:50PM

Dow Jones News

By Dave Sebastian

Investors are growing bearish on coal stocks amid concerns about

the export market and falling prices in a slowing global economy,

investment bank Seaport Global Securities LLC said in a report

Tuesday.

U.S. steam coal exports are slated to decline 12% this year and

an additional 25% in 2020, Seaport said. The decline could create a

domestic supply glut next year, potentially hurting the utility

market, if steel demand slows and prices don't rebound.

Shares of coal producers Contura Energy Inc. (CTRA), Ramaco

Resources Inc. (METC), Teck Resources Ltd. (TECK), Peabody Energy

Corp. (BTU) and CONSOL Energy Inc. (CEIX) have slumped over the

past 12 months.

Meanwhile, shares in Arch Coal Inc. (ARCH) and Warrior Met Coal

Inc. (HCC) have gained 14% and 5%, respectively, over the past 12

months.

Average per-ton spot prices for coal from the Northern

Appalachian region have fallen to about $53 after peaking above $70

in March, according to the Energy Information Administration,

citing data from SNL Energy. Meanwhile, Central Appalachian region

prices have fallen to about $59 a ton from nearly $84 a ton in

early January.

U.S. coal producers have been hungry to supply overseas markets

such as China and Europe in recent years as domestic coal

consumption has declined. Lower natural gas prices have also hurt

coal's competitiveness in the domestic market.

Prices of natural gas--which has grown its share of the U.S.

energy production in recent years--have slid below $2.50 per

million British thermal units since the end of May. Natural gas

futures hit $4.80 per million British thermal units in

mid-November.

The U.S. steel industry--a key end market for domestic coal

production--has also been one of the world's weakest steel markets

of late, according to Seaport. Prices for hot-rolled steel have

fallen to between $520 and $580 a ton, the report said, citing data

from CRU Group's Steel Market Update. About a year earlier, U.S.

hot rolled steel fetched about $900 a ton.

China, which produces half of the world's steel, has seen

blast-furnace profitability weakening in recent months as steel

prices have fallen and prices of raw materials such as iron ore

have increased, according to the report. Steel prices are also

unlikely to rebound as trade tensions remain high between the U.S.

and China, the report said.

"It becomes imperative for steel prices to rise greater than

their key raw material ingredients," the report said. "That simply

hasn't happened."

But there is a string of hope in China for U.S. coal exporters:

Chinese metallurgical coal customers are still poised to import

coking coal, as it is cheaper to import products than to source

coal domestically, the report said.

ArcelorMittal (MT), the world's largest steel producer, recently

cut production twice in the European Union, the report said,

indicating "all is not well on the continent."

"The company continues to cite weak demand and rising imports as

key reasons why it was forced to curtail production," the report

said. "Steel prices on the continent indicate this weakness."

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

June 18, 2019 13:35 ET (17:35 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

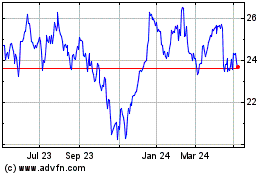

ArcelorMittal (EU:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

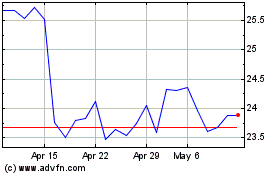

ArcelorMittal (EU:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024