MARKET SNAPSHOT: Dow Futures Rally 150 Points As ECB's Draghi Hints At Rate Cuts Ahead Of Fed Meeting

June 18 2019 - 8:12AM

Dow Jones News

By Mark DeCambre, MarketWatch

The Federal Reserve's policy-setting meeting is set to start

later this morning

U.S. stocks on Tuesday were set to extend the previous session's

gains ahead of the start of the Federal Reserve's two-day policy

meeting. Dovish comments made by Mario Draghi, the European Central

Bank president, may add support to hope of easier Fed policy.

How are benchmarks faring?

Futures for the Dow Jones Industrial Average rose 147 points, or

0.6%, at 26,285, those for the S&P 500 index advanced 17.45

points, or 0.6%, at 2,913.50, while Nasdaq-100 futures climbed 71

points, or 0.9%, at 7,632.

On Monday, the Dow rose 22.92 points to 26,112.53. The S&P

500 climbed 2.69 points to 2,889.67 and the Nasdaq Composite Index

added 48.37 points, or 0.6%, to 7,845.02.

What's driving the market?

ECB President Mario Draghi at an annual central bank conference

in Sintra, Portugal said policy makers would consider "in the

coming weeks" how to adapt its policy tools "commensurate to the

severity of the risk" to the economic outlook, a signal that the

central bank may be willing to lower rates. The central banker's

remarks sent the euro sliding against the U.S. dollar .

Draghi's comments come as the Federal Reserve is set to kick off

its policy-setting meeting later Tuesday, with expectation that the

Fed will indicate its willingness to reduce benchmark borrowing

costs this year amid global trade tensions, a slowdown in the

global economy as well as in the U.S. Investors will want to see if

those expectations match up to what the Fed is thinking, though no

move on interest rates is expected at this week's meeting.

What are strategists saying?

"The prospect of 'additional stimulus' jolted stock markets

higher, and it appears the ECB is following in the Fed's footsteps

of using dovish language," wrote David Madden, market analyst at

CMC Markets UK, in a Tuesday research note.

"And his comments will add further pressure on the US Federal

Reserve to cut rates. Following his speech, yields on a 10 year

bund headed further into negative territory -- to around 30bps --

forcing people's hunt for yield to continue apace," Mark Benbow,

manager of the Kames Short-Dated Yield Bond Fund, said in a

note.

Which stocks are in focus

Facebook Inc. shares (FB) were rising more than 2% in premarket

trade Tuesday after the social-media giant unveiled its

cryptocurrency, Libra coin, offering users the ability to make

payments on the internet.

How are other assets trading?

Hong Kong's Hang Seng Index rose 1% and China's Shanghai

Composite Index inching up less than 0.1%. Japan's Nikkei 225 fell

0.7%, while in Europe, the Stoxx Europe 600 headed 1% higher after

Draghi's comments.

Meanwhile, the 10-year Treasury note was trading at a 19-month

low at 2.02%, while the comparable German debt , known as the bund,

was trading around a record-low yield at negative 0.313%. Bond

prices and yields move in the opposite direction.

West Texas Intermediate crude futures were edging lower, gold

futures bounded higher even as the U.S. dollar bucked up against

the euro, with the ICE U.S. Dollar index climbing 0.1% at

97.68.

(END) Dow Jones Newswires

June 18, 2019 07:57 ET (11:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

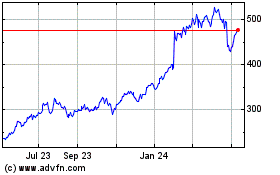

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

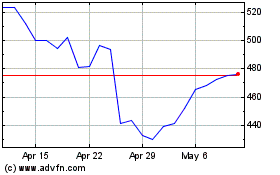

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024