EUROPE MARKETS: Europe Markets Jump On Draghi Stimulus Promise

June 18 2019 - 6:24AM

Dow Jones News

By Dave Morris

European markets shot higher as European Central Bank President

Mario Draghi promised stimulus if economic conditions didn't

improve.

How did markets perform?

The Stoxx 600 leapt 0.7% to 381.3 after falling 0.1% Monday.

The U.K.'s FTSE 100 was up 0.5% at 7,395.5. On Monday it dipped

0.2%.

The pound fell by 0.2% to $1.2525, after declining Monday by

0.4%.

In Germany, the DAX popped 0.8% to 12,183.1, following Monday's

close down 0.1%.

France's CAC 40 climbed 1% to 5,445.1, adding to its increase of

0.4% Monday.

Italy's FTSE MIB surged 1% to 20,834.5, up 0.1% from Monday's

close.

Following a dovish speech by ECB President Draghi, the euro

dropped 0.3% against the U.S. dollar, falling to $1.1187.

What's moving the markets?

Markets reacted to a speech in Portugal by ECB President Draghi

(http://www.marketwatch.com/story/euro-drops-global-equities-rise-as-ecbs-draghi-hits-of-more-stimulus-2019-06-18),

who said that if the region's economy slows and the Bank's

inflation target is threatened, "additional stimulus will be

required". He cited the threat of protectionism as one of the key

factors weighing on exports, particularly manufacturing, and said

that the bank's asset purchase program "still has considerable

headroom".

U.S. President Donald Trump is deploying 1,000 additional U.S.

troops to the Middle East

(http://www.marketwatch.com/story/us-to-send-another-1000-troops-to-middle-east-to-counter-iran-threat-2019-06-17)

amid tensions with Iran. The order follows an incident around

alleged attacks on oil tankers near the Strait of Hormuz, which

U.S. officials have attributed to Iran. Although investors

typically bid up the oil price at times of conflict in the region,

oil reacted only minimally on Tuesday.

In the U.K., Conservative Party MPs are preparing to hold its

second ballot Tuesday to choose a replacement for Prime Minister

Theresa May. Boris Johnson remains the front-runner, which was

cited as the reason

(http://www.marketwatch.com/story/brexit-brief-prospect-of-no-deal-brexit-sends-pound-to-nearly-six-month-low-2019-06-18)

the pound slumped against the U.S. dollar.

Which stocks are active?

Ashtead Group PLC (AHT.LN) shares climbed 2.8% after the

industrial equipment rental firm reported strong fourth quarter

fiscal 2019 earnings. Pretax profit was GBP208.6 million, up from

GBP174.7 million in the fourth quarter of fiscal 2018. The company

attributed the rise to organic growth in rentals, and predicted

continuing strength in North American markets.

Siltronic AG (WAF.XE) cut its outlook for 2019, anticipating

lower sales by a figure of between 10% and 15%. The German silicon

wafer company cited the tariffs battle between the U.S. and China

as a factor, which has hurt semiconductor companies elsewhere in

Europe. Siltronic shares plunged 12.8%, as did other companies in

the sector such as AMS AG (AMS.EB), which was down 4.6%, and

STMicroelectronics NV (STM.FR), which sank 2.4%.

(END) Dow Jones Newswires

June 18, 2019 06:09 ET (10:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

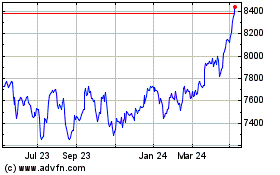

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

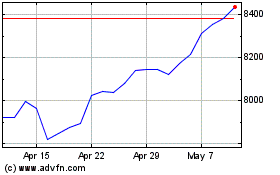

FTSE 100

Index Chart

From Apr 2023 to Apr 2024