EUROPE MARKETS: China Data Whacks European Markets

June 14 2019 - 6:08AM

Dow Jones News

By Dave Morris

Weak China industrial data rattled European markets, sending

equity indexes into negative territory over global growth

fears.

How did markets perform?

The Stoxx 600 shrank 0.4% to 379, after rising 0.2%

Thursday.

The U.K.'s FTSE 100 was at 7,352.2, down 0.2% following

Thursday's flat close.

The pound fell 0.2% to $1.2645, after shrinking 0.3%

Thursday.

In Germany, the DAX was 0.6% lower at 12,097.9. It increased

0.4% on Thursday.

France's CAC 40 edged down 0.2% to 5,364. It also closed flat on

Thursday.

Italy's FTSE MIB retreated 0.2% to 20,595, after climbing 0.8%

Thursday.

What's moving the markets?

Economic data out of China

(http://www.marketwatch.com/story/chinas-economy-cools-further-in-may-2019-06-14-44851138)

set investors on a pessimistic path Friday, as U.S. tariffs

appeared to bite. Industrial production in May grew 5% year over

year, lower than the 5.5% consensus and the lowest growth figure in

the category in more than 17 years. Fixed asset investment was also

a disappointment, expanding 5.6% in the first five months of the

year versus 6% expected. The slowing of China's economy is forecast

to pressure the outlook for global growth in 2019.

One analyst believes Friday's weak trading volumes could

indicate complacency among investors that central banks will

support equities with fresh stimulus. Ian Williams, economics and

strategy research analyst at Peel Hunt, wrote: "The most notable

feature of yesterday's European equity trading session was the

subdued level of volumes... There is a danger that confidence in

the Fed rising to the rescue of risk assets once again next week

has been overdone."

In the U.S., more than 600 companies including Walmart Inc. and

Target Corp. and 150 trade associations signed a letter urging

President Donald Trump's administration to resolve the trade

dispute with China

(http://www.marketwatch.com/story/us-companies-urge-trump-to-find-solution-to-end-trade-war-2019-06-13)

to avoid damaging the national economy. The move comes ahead of a

potential meeting between Trump and Chinese President Xi Jinping at

the G-20 summit in Osaka, though nothing has yet been

confirmed.

In other international disputes, the Toronto Raptors beat the

Golden State Warriors 114-110

(http://www.marketwatch.com/story/raptors-hold-off-depleted-warriors-to-win-their-first-nba-title-2019-06-13)

to win the National Basketball Association championship four games

to two, the first championship in franchise history.

Which stocks are active?

Signs of weaker economic growth hit European financial

companies' shares, as lower interest rates are expected to restrain

lenders' profitability. HSBC Holdings PLC (HSBA.LN) shares fell

0.8%, while Banco Santander SA (SAN.MC) was down 0.6%.

European semiconductor companies were stung by Broadcom Inc.'s

(AVGO) announcement that it expected the U.S. ban on Huawei

equipment to cost it $2 billion in annual sales

(https://www.wsj.com/articles/broadcom-lowers-revenue-outlook-amid-trade-tensions-11560459528).

Broadcom is the first chip maker to quantify the impact of the ban.

Infineon Technologies AG (IFX.XE) shares slumped 5.3%,

STMicroelectronics (STM.FR) declined 4.2% and AMS AG (AMS.EB) sank

7.4%.

(END) Dow Jones Newswires

June 14, 2019 05:53 ET (09:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

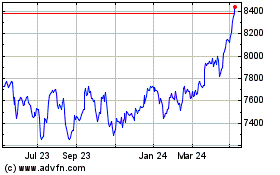

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

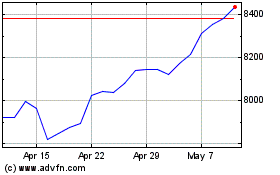

FTSE 100

Index Chart

From Apr 2023 to Apr 2024