By Chris Matthews and William Watts, MarketWatch

Tesla shares rise after Musk denies demand problem

Stocks fell modestly Wednesday, a day after the Dow Jones

Industrial Average snapped a six-day winning streak, as investors

digested a reading on May consumer inflation and continued to eye

the U.S.-China trade fight.

How are the benchmarks performing?

The Dow Jones Industrial Average fell 40 points, or 0.2%, to

26,007, while the S&P 500 index lost 6 points, or 0.2%, to

2,880. The Nasdaq Composite index fell 33 points, or 0.4%, at

7,790.

Stocks ended with small losses Tuesday after flipping between

positive and negative territory. The Dow closed 14.17 points lower

at 26,048.51, off 0.1%, while the S&P 500 shed 1.01 points, or

less than 0.1%, to close at 2,885.72. The Nasdaq finished with a

loss of 0.6 points at 7,822.57. The declines ended five-day winning

streaks for both the S&P and the Nasdaq.

What's driving the market?

U.S. price inflation remains tame, according to the Labor

Department's Consumer Price index

(http://www.marketwatch.com/story/consumer-inflation-rises-01-in-may-smallest-bump-in-4-months-cpi-shows-2019-06-12),

which showed prices rising 0.1% in April, in line with the

consensus forecast, according to a MarketWatch poll of

economists.

The increase in the cost of living over the past 12 months also

slowed to 1.8% from 2%. When eliminating volatile food and energy

prices, inflation fell from 2.1% annually to 2%.

Though the measure isn't as closely followed by the Federal

Reserve as the personal consumption expenditures index, this latest

evidence that price growth is slowing could support investors

belief that the Federal Reserve will cut interest rates sooner than

later.

But U.S. President Donald Trump on Tuesday said he was the one

"holding up" a trade deal with China,

(http://www.marketwatch.com/story/trump-i-have-no-interest-in-trade-deal-until-china-reverses-its-stance-2019-06-11)

saying the two countries would "either do a great deal...or we're

not doing a deal at all."

Analysts blamed the remarks for casting a somewhat negative tone

over global equities.

Investors are also watching protests in Hong Kong. Police on

Wednesday fired tear gas and high-pressure water hoses

(http://www.marketwatch.com/story/renewed-protests-in-hong-kong-as-government-debates-extradition-bill-2019-06-11)

at protesters who massed outside government headquarters in

opposition to a proposed extradition bill that has sparked concerns

over China's control of the semi-autonomous territory.

What companies are in focus?

Shares of electric car maker Tesla Inc. (TSLA) rose 1.8%, after

Chief Executive Elon Musk late Tuesday took the stage at the

company's shareholder meeting and denied the company was facing

demand and production problems

(http://www.marketwatch.com/story/elon-musk-tesla-does-not-have-a-demand-problem-2019-06-11).

In deal news, France's Dassault Systems SE said it reached an

agreement to acquire U.S. technology group Medidata Solutions

Inc.(MDSO) in an agreement valued at $5.8 billion. Dassault will

offer $92.25 a share for Medidata in an all-cash deal. Medidata

shares fell 3.6% Wednesday at $90.75 a share.

Shares of Mattel Inc. (MAT) rose 8.8% Wednesday, after reports

(http://www.marketwatch.com/story/mattel-shares-jump-5-on-reports-of-rejected-merger-offer-2019-06-12)

the toy company turned down a merger offer from MGA Entertainment

Inc. It also announced it has extended its licensing agreement with

Warner Bros.

Shares of Dave & Buster's Entertainment Inc. (PLAY) tumbled

21.3%

(http://www.marketwatch.com/story/dave-busters-stock-tanks-after-companys-quarterly-miss-lowered-guidance-2019-06-11)

Monday, after the operator of entertainment and dining venues

reported Tuesday evening first-quarter sales and earnings that fell

short of Wall Street expectations.

Neptune Wellness Solutions Inc. (NEPT.T) announced a 3-year

sourcing agreement

(http://www.marketwatch.com/story/neptune-wellness-stock-soars-again-after-another-3-year-extraction-deal-with-a-cannabis-company-2019-06-12)

with cannabis company Green Organic Dutchman Holdings Ltd. Neptune

shares rose 3.7% Wednesday.

Salesforce.com Inc. (CRM) said Wednesday

(http://www.marketwatch.com/story/salesforce-corrects-earnings-expectations-around-tableau-deal-2019-06-12)

that a recently announced acquisition of Tableau Software Inc.

(DATA) would reduce 2020 earnings less than initially assumed. The

stock rose 0.9% Wednesday morning.

Shares of Cisco Systems Inc. (CSCO) fell 1.5% Wednesday, after

William Blair analyst Jason Ader cut his rating

(http://www.marketwatch.com/story/cisco-stock-falls-after-william-blair-downgrade-2019-06-12)

on the stock to market perform from outperform.

What are analysts saying?

"This morning's inflation data adds more fuel to the rate cut

fire and increasingly supports the Fed's dovish stance,' wrote Mike

Loewengart, vice president of investment strategy at E-Trade, in an

email.

"We could likely see the markets react well to this news," he

added. "While we are experiencing pockets of weakness on the jobs

front, the big takeaway for investors today is that economic

fundamentals are still quite strong and there continues to be

reasons to be optimistic about the state of our economy--sure

growth is slowing, but that does not mean its shrinking."

"President Trump has defended his use of levies, and the threat

of higher levies, as a way of trying to rebalance the trading

relationship with China. Beijing have reiterated their willingness

to hold a firm line against the U.S. The standoff is back at the

forefront of dealers' minds and it has prompted some investors to

take some money off the table," said David Madden, market analyst

at CMC Markets UK, in a note.

How are other markets trading?

The yield on the 10-year U.S. Treasury note

(http://www.marketwatch.com/story/treasury-yields-extend-decline-after-may-cpi-data-2019-06-12)

retreated one basis point to 2.121%.

Asian markets traded down Wednesday

(http://www.marketwatch.com/story/asian-markets-retreat-hang-seng-sinks-amid-hong-kong-protests-2019-06-11),

with Japan's Nikkei 225 losing 0.4%, China's Shanghai Composite

index sliding 0.6%, and Hong Kong's Hang Seng index retreating

1.7%, amid civil unrest in the semi-autonomous territory. European

stocks were also trading lower, as evidenced by the 0.3% decline in

the Stoxx Europe

In commodities markets, the price of crude oil

(http://www.marketwatch.com/story/gold-renews-climb-spurred-on-by-weaker-stocks-and-worrisome-geopolitical-headlines-2019-06-12)

slid 2.8%, while gold

(http://www.marketwatch.com/story/gold-renews-climb-spurred-on-by-weaker-stocks-and-worrisome-geopolitical-headlines-2019-06-12)

jumped 0.5%. The U.S. dollar , meanwhile, edged higher against its

peers.

(END) Dow Jones Newswires

June 12, 2019 11:27 ET (15:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

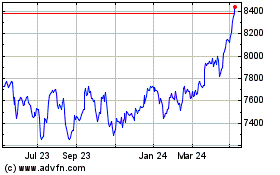

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

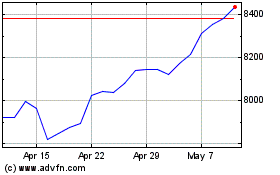

FTSE 100

Index Chart

From Apr 2023 to Apr 2024