MARKET SNAPSHOT: Stock-index Futures Drift Lower Ahead Of U.S. Inflation Reading

June 12 2019 - 7:16AM

Dow Jones News

By William Watts, MarketWatch

Tesla shares rise after Musk denies demand problem

Stock-index futures drifted lower Wednesday, a day after the Dow

Jones Industrial Average snapped a six-day winning streak, with

investors awaiting a reading on May consumer inflation as they

continue to eye the U.S.-China trade fight.

Dow futures fell 54 points, or 0.2%, to 26,011, while S&P

500 futures lost 5.4 points, or 0.2%, to 2,881.50. Nasdaq-100

futures were off 30 points, or 0.4%, at 7,488.25.

What's driving the market?

Stocks ended with small losses Tuesday after flipping between

positive and negative territory. The Dow closed 14.17 points lower

at 26,048.51, off 0.1%, while the S&P 500 shed 1.01 points, or

less than 0.1%, to close at 2,885.72. The Nasdaq finished with a

loss of 0.6 points at 7,822.57. The declines ended five-day winning

streaks for both the S&P and the Nasdaq.

U.S. President Donald Trump on Tuesday said he was the one

"holding up" a trade deal with China,

(http://www.marketwatch.com/story/trump-i-have-no-interest-in-trade-deal-until-china-reverses-its-stance-2019-06-11)

saying the two countries would "either do a great deal...or we're

not doing a deal at all."

Analysts blamed the remarks for casting a somewhat negative tone

over global equities.

Investors are also watching protests in Hong Kong. Police on

Wednesday fired tear gas and high-pressure water hoses

(http://www.marketwatch.com/story/renewed-protests-in-hong-kong-as-government-debates-extradition-bill-2019-06-11)

at protesters who massed outside government headquarters in

opposition to a proposed extradition bill that has sparked concerns

over China's control of the semi-autonomous territory.

What's on the economic calendar?

Investors are focusing on inflation data, with the May consumer

price index set for release at 8:30 a.m. Eastern.

What companies are in focus?

Shares of electric car maker Tesla Inc. (TSLA) were 2.6% higher

in premarket action, after Chief Executive Elon Musk late Tuesday

took the stage at the company's shareholder meeting and denied the

company was facing demand and production problems

(http://www.marketwatch.com/story/elon-musk-tesla-does-not-have-a-demand-problem-2019-06-11).

In deal news, France's Dassault Systems SE said it reached an

agreement to acquire U.S. technology group Medidata Solutions

Inc.(MDSO) in an agreement valued at $5.8 billion. Dassault will

offer $92.25 a share for Medidata in an all-cash deal. Medidata

shares were down 4% in premarket action at $90.75 a share.

What are analysts saying?

"President Trump has defended his use of levies, and the threat

of higher levies, as a way of trying to rebalance the trading

relationship with China. Beijing have reiterated their willingness

to hold a firm line against the U.S. The standoff is back at the

forefront of dealers' minds and it has prompted some investors to

take some money off the table," said David Madden, market analyst

at CMC Markets UK, in a note.

(END) Dow Jones Newswires

June 12, 2019 07:01 ET (11:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

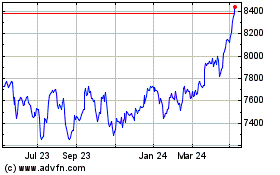

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

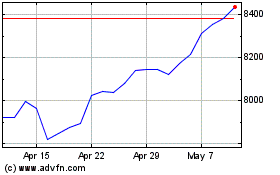

FTSE 100

Index Chart

From Apr 2023 to Apr 2024