EU Blocks Merger of European Steel Units of Tata, Thyssenkrupp -- 2nd Update

June 11 2019 - 8:31AM

Dow Jones News

By Valentina Pop

BRUSSELS -- The European Union's antitrust enforcer on Tuesday

blocked the planned merger of the European steel businesses of

India's Tata Steel Ltd. and Germany's Thyssenkrupp AG, saying the

resulting company would have reduced competition in the supply of

special steel for the car and packaging industries.

Competition commissioner Margrethe Vestager said the two

companies failed to propose sufficient remedies to address the EU's

concerns. "We prohibited the merger to avoid serious harm to

European industrial customers and consumers," Ms. Vestager said.

The planned merger, announced in 2017, would have created Europe's

second-largest steel producer after ArcelorMittal SA.

The blocked merger marks another defeat for executives and

politicians who have been pushing for the formation of more

European giants to counter competition from the U.S. and China.

Ms. Vestager dismissed criticism about her blocking the merger

of European companies able to compete globally. She said that over

the past 10 years, only ten mergers were blocked, while 3,000 were

approved. The commission last year allowed ArcelorMittal to buy

Italy's Ilva, Europe's largest steel plant, after the companies

offered sufficient concessions to allay the commission's concerns,

she said.

In February, the European Commission, the antitrust body,

stopped plans to merge the train-making operations of Germany's

Siemens AG with France's Alstom SA, a deal the companies said was

necessary to be able to competition in the future with Chinese rail

giant CRRC Corp., the world's largest rail supplier. The European

Commission said the Franco-German merger would have harmed

competition in the markets for high-speed trains and signaling

systems.

The expected negative decision by the commission to create a

second European steel giant was one of the main reasons that forced

Thyssenkrupp to abandon a plan to split itself into two companies.

Instead, the German company said it would pursue an initial public

offering of its elevators business and be open for partnerships of

its industrial operations.

Ruth Bender in Berlin contributed to this article.

Write to Valentina Pop at valentina.pop@wsj.com

(END) Dow Jones Newswires

June 11, 2019 08:16 ET (12:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

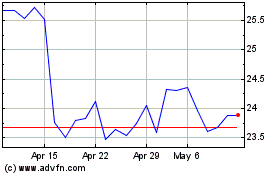

ArcelorMittal (EU:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

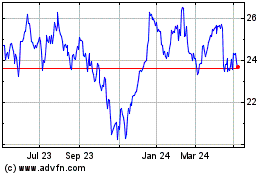

ArcelorMittal (EU:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024