LONDON MARKETS: London Markets Push Higher As Global Crude Oil Spikes

June 07 2019 - 7:56AM

Dow Jones News

By Emily Horton

London stocks and sterling gained on Friday, as a spike in

global crude oil prices lifted stocks across all sectors. Investors

were also optimistic about a possible resolution between the U.S.

and Mexico to avoid the imposition of tariffs on Monday .

How did markets perform?

The U.K.'s FTSE 100 moved up by 0.7% at 7,31.19, after adding

0.55% on Thursday.

The pound rose to $1.2709 from $1.2692 the previous day.

What's moving the markets?

A sharp rise in Royal Dutch Shell PLC (RDSA.LN) and BP

PLC(BP.LN) helped the FTSE 100 gain for the fifth day in a row,

after a spike in global crude prices pushed all sectors higher.

Investors were also hopeful that a trade deal between the U.S.

and Mexico could be reached before tariffs take effect next week.

Late on Thursday evening, the Mexican government offered to deploy

6,000 National Guard officers to stop the inflow of migrants from

Central America to the U.S. in an attempt to prevent President

Donald Trump's tariff threat, Reuters reported

(https://www.reuters.com/article/us-usa-trade-mexico-nationalguard/mexico-offers-to-send-national-guard-to-southern-border-to-stem-migration-sources-idUSKCN1T72NY).

The decision by the European Central Bank on Thursday to leave

interest rates unchanged

(http://www.marketwatch.com/story/european-central-bank-says-now-plans-to-leave-rates-on-hold-at-least-through-first-half-2020-2019-06-06),

and extend the period it expects rates to remain on hold through at

least the first half of 2020 was also supportive. Later today,

investors will turn to the expected U.S. jobs data for an

indication of the potential for a Federal Reserve interest rate

cut.

On Friday, U.K. Prime Minister Theresa May will step down as

leader of the Conservative party, after failing three times to get

her Brexit agreement through parliament. Meanwhile, in a crucial

by-election in the U.K. constituency of Peterborough, the

opposition Labour narrowly retained its parliamentary seat, fending

off threats from the increasingly popular Brexit Party.

Which stocks are active?

Games Workshop Group PLC (GAW.LN), the British miniature

manufacturer,

(https://uk.reuters.com/article/uk-britain-stocks/ftse-100-heads-for-fifth-day-of-gains-idUKKCN1T80LH)added

5% after the firm reported a rise in annual earnings year-on-year

and reached its targets.

"This truly is a business which has hit the right formula to

drive up earnings," said Russ Mould, investment director at AJ

Bell. "Ultimately it is a very well-run company that invests in its

business and its staff and that should put it in a strong position

to be around for a long time," he added.

Pharmaceuticals giant GlaxoSmithKline PLC (GSK.LN) climbed by

1%, after it announced that the U.S. Food and Drug Administration

has approved two new methods for administering Nucala, an

auto-injector and a pre-filled safety syringe, Proactive Investors

reported

(https://www.proactiveinvestors.co.uk/companies/news/221701/glaxosmithkline-gets-us-green-light-for-severe-asthma-home-treatment-221701.html).

(END) Dow Jones Newswires

June 07, 2019 07:41 ET (11:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

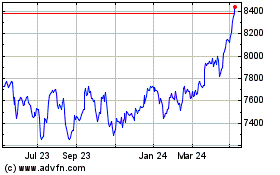

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

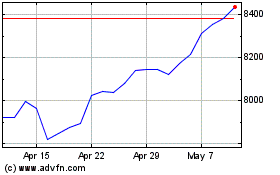

FTSE 100

Index Chart

From Apr 2023 to Apr 2024