Stocks Edge Higher as ECB Signals Negative Rates for Longer

June 06 2019 - 10:03AM

Dow Jones News

By Paul J. Davies

European and U.S. stocks advanced Thursday, as the European

Central Bank said it expected to leave interest rates in negative

territory for a longer period.

The Dow Jones Industrial Average opened about 27 points higher,

while the S&P 500 and Nasdaq Composite Index both added about

0.1%. The Stoxx Europe 600 gained 0.3% in midday trade. Germany's

DAX ticked up 0.3% while the U.K. FTSE 100 climbed 0.4%.

The ECB said in its policy statement Thursday that it was

keeping interest rates unchanged for now, and extended the period

during which it expected to leave rates on hold from the end of

2019 to at least through the first half of 2020.

The euro rose against the dollar to trade 0.4% higher. The yield

on 10-year German government bonds yielded minus 0.217% shortly

after the policy statement, having earlier hit a record low of

minus 0.238%, according to Tradeweb.

U.S. oil prices had dropped more than 22% below their April peak

in recent days as growth concerns and a rise in U.S. production led

to a big rise in U.S. crude inventories. Wider fears about the

global economy slowing have hit Brent crude prices, too, but not by

as much. However, banks have maintained their forecasts for higher

prices this year and WTI rebounded Thursday, rising 0.25% at $51.81

on Thursday, while global benchmark Brent crude was 0.8% higher at

$61.10.

The U.S. 10-year Treasury yield edged down further to 2.110%

from 2.119%

The collapse of merger talks between Renault and Fiat Chrysler

hit shares of both companies. Renault was hit hardest, tumbling

7.8% in early trade, while its existing partner Nissan was down

1.7% in Japan. Fiat Chrysler shares slipped 0.2% in Italy, but

Renault's French rival Peugeot was up 2.3% on hopes that it may get

a tie-up with Fiat instead.

Fears about the impact of President Trump's various standoffs

with the U.S.'s leading trade partners on the health of the global

economy have hurt stock markets in recent weeks. But U.S. indexes

extended a rebound on Wednesday, with the S&P 500 rising 0.8%.

That came after the Federal Reserve signaled it could cut rates to

boost economic growth and the central bank's "beige book" reported

modest growth in April and May.

That momentum didn't carry over into Asian markets Thursday.

Shares in Shanghai were down 1.2%, while those in Tokyo were

flat.

The U.S. and Mexico were set to enter the second day of

negotiations on Thursday that could avert tariffs. President

Trump's spat with Mexico is likely to mean an immediate spike in

car prices, according to some economists, which are one of the

biggest exports into the U.S. from its southern neighbor. That, in

turn, would hurt demand.

"While the exact price elasticity of vehicle demand is hard to

quantify, it is possible to imagine a 25% tariff bringing down

overall vehicle demand by 3m+ units, or an 18%+ reduction," said

Emmanuel Rosner, an economist at Deutsche Bank.

Italian yields also fell despite the decision by European

authorities to declare that the country is in breach of its debt

reduction agreements, which could heighten political tensions

between the country and the bloc. Italian 10-year yields were down

to 2.474% from 2.489%.

Gold rose 0.6% to $1,341.70 an ounce.

Write to Paul J. Davies at paul.davies@wsj.com

(END) Dow Jones Newswires

June 06, 2019 09:48 ET (13:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

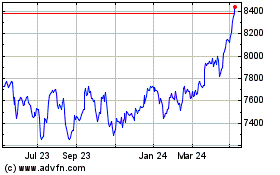

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

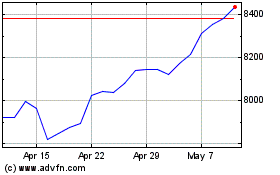

FTSE 100

Index Chart

From Apr 2023 to Apr 2024