EUROPE MARKETS: Europe Markets Rise On Central Bank Hopes

June 06 2019 - 7:29AM

Dow Jones News

By Dave Morris

European markets rose on hopes that the European Central Bank

would announce investor-friendly stimulative policies Thursday amid

prevailing economic weakness.

How are markets performing?

The Stoxx 600 moved up 0.6% to 376.4. On Wednesday it climbed

0.4%.

The U.K.'s FTSE 100 rose 0.6% to 7,261.1. It had edged up 0.1%

Wednesday.

The pound inched up to $1.2690, after nudging 0.4% higher

Wednesday.

In Germany, the DAX was 0.7% higher at 12,066.7, having also

ticked 0.1% up on Wednesday.

France's CAC 40 was 0.6% higher at 5,324.2. It rose 0.5%

Wednesday.

Italy's FTSE MIB bounced back 1% to 20,367, having fallen 0.4%

Wednesday.

What's moving the markets?

German economic data ahead of the European Central Bank meeting

Thursday reinforced the view that the ECB will loosen policy. While

German factory orders

(http://www.marketwatch.com/story/german-manufacturing-orders-rise-slightly-2019-06-06)

for April beat economists' expectations, coming in at 0.3% month

over month versus 0.1% expected, they were down from the previous

month's 0.8% figure.

U.S. President Donald Trump tweeted an update on discussions in

Washington, D.C. with representatives of the Mexican government,

saying that "progress is being made, but not nearly enough". The

U.S. will levy tariffs on Mexico starting Monday, barring a

breakthrough.

Ratings agency Fitch downgraded Mexico to 'BBB' from 'BBB+'

(http://www.marketwatch.com/story/mexico-sovereign-debt-rating-cut-one-notch-by-fitch-2019-06-06),

citing state oil company Pemex's credit troubles as well as

possible trade action by the U.S. The agency changed the outlook

for Mexico from Negative to Stable.

The International Monetary Fund revised down its GDP

expectations for China to 6.2% for 2019 and 6% for 2020, reflecting

the potential impact of trade tensions with the U.S. Managing

Director Christine Lagarde told Reuters

(https://www.reuters.com/article/us-g20-japan-imf-lagarde/imfs-lagarde-says-tariff-actions-dont-pose-global-recession-threat-idUSKCN1T62Y2?il=0)

that the international body's base case was that tariffs might

dampen growth but would not tip the global economy into

recession.

Which stocks are active?

Fiat Chrysler Automobiles NV

(https://www.wsj.com/articles/fiat-chrysler-withdraws-merger-offer-for-renault-11559773129)(FCA.MI)

withdrew its merger proposal from Renault SA (RNO.FR) citing a lack

of backing from the French government. WSJ sources said the

sticking point was that Nissan, Renault's partner in a long-term

alliance, had not yet given its backing. Renault sank 7.3%, while

Fiat Chrysler edged down 0.3%.

Rolls-Royce Holdings PLC (RR.LN) shares moved 2% higher on news

its pensions unit had struck a GBP4.6 annuity deal with Legal &

General Group PLC (LGEN.LN), the insurance company.

Entertainment One Ltd. (ETO.LN) rebounded 15.1% after issuing a

statement refuting a Variety article saying Mark Gordon, President

and Chief Content Officer of EOne's film and TV unit, was in talks

to exit his role. Shares had fallen 17% Wednesday after the initial

Variety report.

(END) Dow Jones Newswires

June 06, 2019 07:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

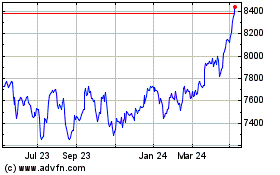

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

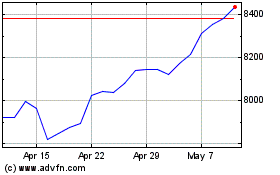

FTSE 100

Index Chart

From Apr 2023 to Apr 2024