Indian Rupee Recovers From 3-day Low Versus U.S. Dollar After RBI Rate Cut

June 06 2019 - 1:15AM

RTTF2

The Indian rupee recouped its early losses against the U.S.

dollar in afternoon deals on Thursday, after the Reserve Bank of

India lowered its key repo rate by a quarter point for the third

straight meeting and tweaked its monetary policy stance to

accommodative from neutral.

Policymakers of the Reserve Bank of India unanimously decided to

slash the repo rate by 25 basis points to 5.75 percent from 6.00

percent. Consequently, the reverse repo rate was adjusted to 5.50

percent.

The six-member committee headed by Shaktikanta Das also

unanimously decided to change the stance of monetary policy from

neutral to accommodative.

Even after two rate cuts, the committee observed scope to

accommodate growth concerns as the headline inflation trajectory

remains below the target.

The rupee appreciated to 69.14 against the greenback, up by 0.4

percent from a 3-day low of 69.41 seen in the morning session. At

Wednesday's close, the pair was worth 69.39. Next key resistance

for the rupee is seen around the 68.00 region.

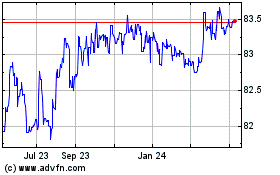

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

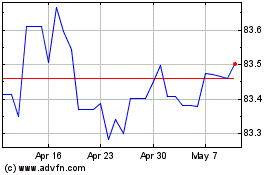

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024