By Newley Purnell

NEW DELHI--To win in India, home to many of the world's next

billion internet users, Netflix Inc. and Amazon.com Inc. are

copying the tactics of a video-streaming service built for the

local market.

Hotstar dominates the Indian market. Launched four years ago by

media conglomerate Star India as a mobile-first streaming platform

for watching cricket, movies and TV, it now has 300 million monthly

users--roughly 10% more than YouTube, India's second-biggest video

content platform. While only three million users pay for access,

that is still more than Amazon has, and more than twice as many as

Netflix. Walt Disney Co. now owns Hotstar.

Netflix and Amazon, shut out of China and facing stiff

competition in the maturing U.S. market, are adopting the

strategies that fueled Hotstar's success--low prices that the

average Indian viewer can afford and loads of local content in

multiple Indian languages.

Netflix is churning out Indian-language dramas, love stories and

thrillers and slashing its monthly rates. Amazon has signed up

local stand-up comedians and backed a "Sex and the City" clone

about a group of women in Mumbai that is broadcast in three Indian

languages.

India's plummeting mobile-data prices and cheap smartphones have

triggered an internet-access revolution in the world's

second-most-populous country. Global streaming services, local

broadcasters and telecommunications companies are trying to

capitalize with competing offerings to win new users, in a market

where subscription and ad revenue are expected to skyrocket to $5

billion in 2023 from $500 million last year, according to BCG, a

consultancy.

Streaming players are after consumers like Ashish Dubey. The

35-year-old driver watches Hotstar while waiting for his boss at

his New Delhi office. He has heard of Netflix and Amazon but isn't

interested in their programs. "I subscribed mainly for cricket," he

says.

Hotstar says its global rivals can't match its library of

decades of popular shows, which it inherited as a subsidiary of

Star India. Disney acquired Star India, a 28-year-old network of

more than 10 Indian television channels, as part of its $71.3

billion deal in March to buy the bulk of the 21st Century Fox

entertainment assets.

"We have a two-decade head start," says Varun Narang, Hotstar's

chief product officer. About 80% of content on the platform is

free; the rest costs as little as $1.19 a month for everything.

When Amazon and Netflix landed in India, they each brought

global libraries of hundreds of shows and movies, but only a small

portion was in local languages. They had little popular content

from India.

Netflix executives initially targeted well-to-do,

English-speaking urban Indians, according to a person familiar with

the matter, and quickly figured out they had to slash prices to

reach beyond India's upper crust, the person said. Netflix costs

around $7 a month in India, but to juice growth the company has

introduced smartphone-only plans that cost less than $1 for one

week of access at a time.

"We're trying to broaden the accessibly of Netflix," with lower

prices and local-language options, said Bela Bajaria, vice

president of international originals. Netflix has six original

series and 13 original films from India in the pipeline, in

addition to productions such as "Lust Stories," a new Indian

original movie about sex and relationships. The Mumbai office now

has about 70 people, up from a handful just a few years ago.

Asked last year at a business conference where Netflix will get

new subscribers in the years ahead, Chief Executive Reed Hastings

said: "The next 100 million is from India." Currently, of Netflix's

nearly 149 million global users, only about 1.2 million are in

India, according to research firm IHS Markit.

Amazon has about 2.5 million subscribers in India, IHS Markit

says. Prime Video, which launched in India in 2016, costs as little

as $1.19 a month. As in other markets, subscribers also get Amazon

music streaming and expedited shipping. Amazon is aiming to release

eight Indian original shows this year, up from one 2017 and five in

2018. Last year, Amazon added an interface for its app and website

in Hindi, Telugu and Tamil, and now has content in nine local

languages. Jennifer Salke, head of Amazon Studios, visited Mumbai

last year to meet with local staff, directors and writers.

"We are going for extreme localization," said Gaurav Gandhi,

Amazon Prime Video's India director. In March, Amazon launched

"Made in Heaven, " a slick drama about wedding planners that the

company says has been "successful."

Hotstar, in contrast, has eschewed big-budget productions. It

has rights to popular television shows in eight Indian languages

from Star India, ranging from romances and supernatural thrillers

to family-friendly dramas and sports. About three million people

pay for Hotstar's premium service, according to IHS Markit. It

costs $4.29 for one month at a time, or $1.19 a month if they buy a

yearly plan and pay up front.

Cricket is a major offering. Star India had exclusive digital

rights to popular Indian Premier League cricket when it launched

Hotstar and expanded that in 2017 to global TV and digital rights

in a deal valued at $2.3 billion.

The pressure on Netflix and Amazon is likely to increase when

Disney launches its Disney+ streaming service in November and rolls

it out internationally over the next two years. Still, there is

room for everyone, because only 3% of India's 4G-enabled smartphone

users subscribe to video services, said Constantinos

Papavassilopoulos, an analyst who follows India streaming trends at

IHS Markit.

Vibhuti Agarwal contributed to this article.

Write to Newley Purnell at newley.purnell@wsj.com

(END) Dow Jones Newswires

June 04, 2019 07:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

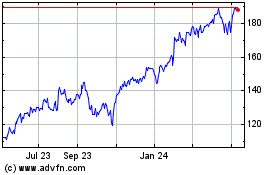

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

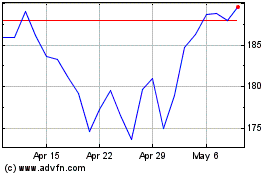

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024