By Carlo Martuscelli

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 3, 2019).

Amazon.com Inc., Alibaba Group Holding Ltd. and other online

retailers are competing more fiercely to gain a foothold in the

Arab world during this year's Ramadan, Islam's holy month of

fasting and gift giving.

Ramadan has long been a time when Middle Eastern retailers

offered steep discounts on everything from cars to toasters, but

the competition was mostly confined to traditional Arab markets and

the Persian Gulf's glitzy malls. Online retail lagged behind, but

that has begun to change this Ramadan, which started May 5 and is

scheduled to end Tuesday.

Online sales in the Middle East and Africa have doubled so far

during Ramadan this year when compared with a similar time frame

two months before the holiday, said Michele Iozzo, managing

director of Middle East and Africa at Criteo, an online advertising

platform that tracks data. In 2018, sales went up during Ramadan by

98% compared with the baseline in the preceding period, while in

2017 this figure was 70%, he said.

"We've seen significant increase in Ramadan sales, especially in

Saudi Arabia, Oman and Morocco," said Matt Zhang, head of Middle

East operations at AliExpress, the retail arm of Alibaba Group.

The sales increase occurred after Amazon, Alibaba and others

made investments in the region and began big marketing campaigns

around Ramadan.

Amazon entered the region in March 2017 with the acquisition of

local player Souq.com for $580 million. Just before Ramadan began

this year, Amazon launched its first branded Arabic-language site

in the United Arab Emirates.

Beginning in May, the U.A.E. site prominently featured a section

dedicated to Ramadan, illustrated with a crescent moon and lamp --

traditional symbols associated with the religious holidays. In

recent days, Amazon's U.A.E. site has switched to a theme around

Eid al-Fitr, the holiday of feasts and giving at the end of

Ramadan.

Last August, AliExpress upgraded its service to Saudi Arabia and

the United Arab Emirates to ensure better and more rapid

deliveries.

A number of local online retailers also have emerged, creating a

new battleground for market share. Among them are Noon.com, which

is backed by Saudi Arabia's sovereign-wealth fund and launched by

Emirati billionaire Mohamed Alabbar .

Amazon and other retailers compete to offer the biggest

discounts on items ranging from popular Ramadan foods like

candied-date confections served at the end of the day's fast, to

clothing and electronics. AliExpress has offered discounts for

specially-themes items like book holders to place the Quran or

special Ramadan lights, to the more prosaic, such as offers for

portable chargers for cellphones.

The Ramadan sales demonstrate how big online retailers are

trying to move into the Middle East, where many people are under

age 30 and tech savvy yet still do most of their shopping in

bricks-and-mortar retail.

Online retail sales in the Middle East surpassed $80 billion for

the first time in 2018, growing 22% from 2017, according to an

estimate from the Ecommerce Foundation, a Netherlands-based

industry body. While small compared with Europe, where online sales

were $535 billion last year, the Mideast market is growing faster

than any other market, and has plenty of scope to keep expanding,

analysts said.

"There is a huge amount of demand -- and there is a gap to

fill," said Anne-Laure Malauzat, principal at consulting firm Bain

& Co.

Lulu Joukhdar, a 25-year-old Saudi, said she recently shopped

for the first time on several online retail sites, including

Dubai's Namshi, to buy thobes, a traditional, often colorful dress

that women wear during Ramadan celebrations. She used to buy such

clothes at markets but wanted to avoid the Ramadan traffic in her

home city of Jeddah, Saudi Arabia.

"I found better deals and styles online," she said.

One reason that e-commerce has been slow to take off in the

Middle East in the past has been the paucity of offerings. There

were also questions about service and shipping charges, as few

online retailers have warehouses in the region and the local mail

carriers have spotty reputations.

"Delivery is still a struggle. You order your product, and it

takes forever to get to you," said Ms. Malauzat, adding that often

it is simply more practical to go to a physical store.

Both Amazon and Noon have developed their own local logistical

arms.

Retailers need Middle East consumers to buy online more often

for the region to become an important driver of business growth.

For instance, according to Bain, Saudi consumers spend the same

amount in one purchase online as their British counterparts, but

British consumers purchase online items 18 times a year on average

compared with two to three times annually for average Saudis.

Online retailers are working to build trust and brand

recognition now in the Middle East, said Ulugbek Yuldashev, chief

executive and founder of regional discount retailer AWOK.com.

"There are still many customers to win over," Mr. Yuldashev

said.

--Donna Abdulaziz contributed to this article.

Corrections & Amplifications The chart in an earlier version

of this article incorrectly listed annual sales in the region in

millions instead of billions. (June 2, 2019)

(END) Dow Jones Newswires

June 03, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

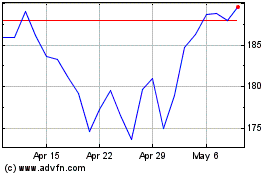

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

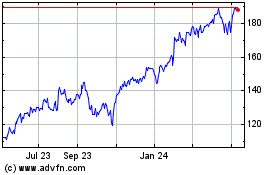

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024