By Christopher Mims

When tenants first walk into their new apartment at the Brandon

Place complex in Oklahoma City, they aren't likely to notice

anything out of the ordinary for 2019 -- there are smart locks on

the door with keycode entry, and contemporary thermostats with LCD

touch screens. During their move-in briefing, they're told the

unit's smart systems can be operated from Amazon.com Inc.'s

Alexa-powered devices. But they aren't told how hard Amazon worked

to get those devices into their new home.

While Amazon's smart-speaker competitors, Alphabet Inc.'s Google

and Apple Inc., are striving to grow their user base by luring

individual buyers with more elegant or higher-quality products,

Amazon has figured out a way to get into millions of homes without

consumers ever having to choose its hardware and services in the

first place. Amazon's Alexa Smart Properties team, a little known

part of its Alexa division, is working on partnerships with

homebuilders, property managers and hoteliers to push millions of

Alexa smart speakers into domiciles all across the U.S.

Amazon is hoping to find a new way to build market share by

offering discounted hardware, customized software and new ways for

property managers to harvest and use data.

For Amazon, the appeal is obvious: Adding millions of new users

to its services and gaining access to data like their voice-based

wish lists and Alexa-powered shopping habits will put it further

ahead of the competition which, at the moment, doesn't have a

significant presence in rental properties and new-home

construction.

For tenants like those at Brandon Place, the smart-home upgrades

can mean getting amenities they wouldn't be able to install

themselves in a rental property. It also means being able to add

other Alexa-controlled devices, like speakers, smart plugs and

lights, more easily.

However, tenants and home buyers aren't necessarily given a

choice of smart-home technology. It might be impossible, or at

least harder, to switch to Google Home and Nest products, or those

compatible with Apple's HomeKit and the Siri voice assistant.

And there's a question of privacy: Renters, home buyers and

hotel guests are all surrendering more data as a result of these

innovations, and may not be aware of all the parties monitoring

their smart-home interactions.

'Hey Alexa, Pay My Rent'

Last November, Amazon announced its partnership with Zego, now a

subsidiary of PayLease, one of the largest rent-payment services in

the U.S.

Zego has created a system that can be installed in apartments;

each apartment gets a network of smart-home devices and a hub, the

wireless radio that helps smart devices in the home to connect to

the internet. Tenants either receive one of Amazon's Echo speakers

or bring their own, and can use it to control the apartment's

thermostat and locks, as well as other Alexa-compatible smart-home

devices the tenants add on, which now range from light bulbs to

microwave ovens. The system is already in more than 30,000

apartments across the U.S.

Zego also offers an app that tenants can download on their

phones and use to request repairs and even pay the rent. Even those

capabilities may soon extend to the Echo speaker.

"We envision a day when you can say 'Hey Alexa, pay my rent,'

and it will transfer that money from a resident's bank account,"

says PayLease chief executive Dirk Wakeham. He says his company is

aiming to roll out its Zego-built, Alexa-compatible smart-home

system to more than six million apartments in the U.S. within five

years.

As with all Alexa services, Amazon records audio requests users

make through its devices, and gives users the ability to delete

them. But Zego's system doesn't have access to any interactions

with Alexa in the apartment unless they are specifically passed to

the Zego system through an Alexa app (Amazon calls its apps

"skills"), created by Zego and approved by Amazon. Through that

skill and its own mobile app, Zego collects data specific to its

own hub and connected devices, including the smart thermostats and

locks -- enough data to paint a picture of the tenant's

experience.

"We can predict if residents are happy based on their digital

interactions with the service, which gives us more information

about whether they will renew their leases," says Zego CEO Adam

Blake. The signals that inform this prediction include the

sentiments of tenants during in-app chats with apartment managers,

whether and how many smart home devices they've added to their

apartment, and if they pay rent on time, he says.

A big driver of increased smart-home technology in rental

complexes is the potential for property managers to save money.

Simplifying the ability to grant access to contractors, change door

locks and cut back on heating or air conditioning in vacant units

helps reduce costs, says Nick Stefanov, director of IT at BSR, an

owner of apartment complexes in Texas, Arkansas, Louisiana and

Oklahoma. Mr. Stefanov says his company began rolling out Zego

systems in January, and has installed them in 225 units.

Eventually, Alexa-fied apartments with smart locks and

pre-installed Echo devices might even replace rental agents.

Initial data from trials of such systems indicates that people are

twice as likely to rent an apartment when no human is present to

try and sell them on it, says Mr. Wakeham.

The Zego partnership is the biggest push Amazon has made so far

with rental properties, but it is working on other ways to get into

homes en masse. Lennar Corp., the nation's largest home builder by

revenue (and second-largest by units), began offering Amazon's

smart speakers in an unspecified portion of the 35,000 new homes it

constructed in 23 states last year. The company will continue to

offer Alexa-powered smart speakers in new homes in 2019 and beyond,

says David Kaiserman, president of Lennar's special situations

group. A Lennar spokesman declined to say whether Amazon offered

any consideration for being featured in the company's announcement

of its new smart homes.

The global market for smart-home devices is growing quickly,

according to IDC, which projected that shipments of all smart-home

devices will increase 27% in 2019 compared to 2018. Excluding smart

TVs, IDC projects that 358 million smart speakers, thermostats,

lights, home security and other devices will ship this year. One in

four American adults now owns a smart speaker of some sort. Several

estimates peg Amazon's share of the smart-speaker market at around

two thirds of all smart speakers in use, while Google represents at

most a quarter. Apple's HomePod has about a 4% market share.

Google is also making a push to partner with builders and

property managers. KB Homes, the fifth largest builder in the U.S.

by units, offers Google Assistant-powered systems to buyers who

request them in a handful of communities, and in one development in

Irvine, Calif., they're a standard feature. Century Communities,

the ninth-largest builder in the U.S., has begun including a Nest

Hub in the more than 10,000 new homes they construct every year,

says a Google spokeswoman. Alliance Residential will roll out

Google Nest thermostats and Google Home Minis across 25,000 luxury

apartments, in a collaboration with yet another third-party smart

apartment technology and services company, Dwelo.

Apple has announced no formal partnerships with builders or

property owners.

Welcome to the Hotel Alexa

Job postings on Amazon's own website indicate the company

aspires in the future to push its Alexa service and Echo devices

into stadiums and hospitals. A spokeswoman said senior-living

communities and vacation-rental operators were also in the

company's sights.

In some cases, Amazon is willing to share data, insights and

even some of the revenue that flows from putting smart devices in

living spaces.

Marriott, for example, is the launch partner for Amazon's Alexa

for Hospitality service. Amazon is building out dashboards for

Marriott and any other hotelier that wants to use its service.

These hubs for data and insight will allow Amazon to measure and

pass on information about "guest engagement" with the in-room Alexa

devices, which will be capable of doing everything from making

restaurant recommendations to adjusting the thermostat and ordering

fresh towels. They will not, however, allow hotels to hear guests'

actual voice recordings.

All of these partnerships are consistent with Amazon's larger

strategy, which is to get more people using its services and locked

into its Alexa ecosystem. Ultimately, even the presence of Echo

speakers might not be necessary to continue the expansion. Amazon

offers Alexa to any manufacturer who would like to integrate the

service into its products. As companies like Zego develop their

hardware, speakers of their own devising could be part of the

system. Eventually, it could be as if the buildings themselves were

extensions of Alexa -- and Amazon's ever-growing empire.

"The devices are just endpoints," says Rohit Prasad, vice

president and head scientist at Amazon's Alexa Artificial

Intelligence, speaking about the company's existing array of Echo

smart speakers. It's getting people into Amazon's retail ecosystem

-- where they can shop, sign up for Prime, and give their data to

Amazon so it can continue to expand and improve its services --

that really matters.

For more WSJ Technology analysis, reviews, advice and headlines,

sign up for our weekly newsletter. And don't forget to subscribe to

our Instant Message podcast.

(END) Dow Jones Newswires

June 01, 2019 00:14 ET (04:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

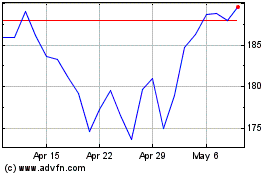

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

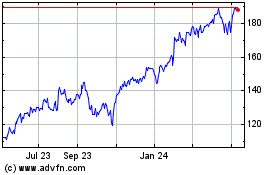

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024