PVH Corp. Completes Acquisition of Gazal Corporation Limited

May 31 2019 - 4:15PM

Business Wire

Acquisition Completed to Give PVH Full Control of its Brands

in Australia

PVH Corp. [NYSE:PVH] announced today it completed the

acquisition of the approximately 78% of the outstanding shares of

Gazal Corporation Limited (“Gazal”), PVH’s long-term partner

in Australia, not previously owned.

The transaction is expected to result in a material increase to

PVH’s 2019 earnings per share on a GAAP basis, as PVH expects to

record a noncash gain to write-up to fair value its equity

investments in Gazal and PVH Brands Australia Pty Limited (a joint

venture between PVH and Gazal). The transaction is expected to be

slightly accretive to PVH’s 2019 earnings on a non-GAAP basis,

which excludes the noncash gain.

Four key members of management of Gazal and the joint venture

have entered into employment agreements and are expected to remain

in their roles for at least two years. These executives exchanged

approximately 25% of their interests in Gazal for approximately 6%

of the outstanding stock of the PVH subsidiary that is the parent

company of the acquirer.

“Our decision to acquire Gazal is aligned with PVH’s strategic

priority to expand our worldwide reach by assuming more direct

control over our brands’ regional licensed businesses. By joining

forces now, we believe we’re well positioned to capture the

significant growth in the Australia and New Zealand markets,”

said Emanuel Chirico, PVH Corp. Chairman and CEO. “We are

pleased to welcome Gazal into our PVH family and continue driving

our business forward together.”

About PVH Corp.

PVH is one of the most admired fashion and lifestyle companies

in the world. We power brands that drive fashion forward – for

good. Our brand portfolio includes the iconic CALVIN

KLEIN, TOMMY HILFIGER, Van

Heusen, IZOD, ARROW, Speedo*, Warner’s, Olga

and Geoffrey Beene brands, as well as the

digital-centric True & Co. intimates brand. We market

a variety of goods under these and other nationally and

internationally known owned and licensed brands. PVH has over

38,000 associates operating in over 40 countries and $9.7

billion in annual revenues.

*The Speedo brand is licensed for North

America and the Caribbean in perpetuity

from Speedo International Limited.

About Gazal

Based in Sydney, Gazal is a leading apparel

supplier and retailer in Australasia. Gazal manages PVH

Brands Australia Pty Limited, which licenses and operates in Oceana

PVH’s iconic lifestyle apparel brands, led by CALVIN

KLEIN and TOMMY HILFIGER, as well as other licensed

and Gazal-owned brand names, such as Pierre Cardin,

Bracks and Nancy Ganz.

PVH CORP. SAFE HARBOR STATEMENT UNDER THE PRIVATE

SECURITIES LITIGATION REFORM ACT OF 1995: Forward-looking

statements made in this press release, including, without

limitation, statements relating to PVH Corp’s (the “Company”)

earnings, future plans, strategies, objectives, expectations and

intentions, are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Investors are

cautioned that such forward-looking statements are inherently

subject to risks and uncertainties, many of which cannot be

predicted with accuracy, and some of which might not be

anticipated, including, without limitation, (i) the Company’s

plans, strategies, objectives, expectations and intentions are

subject to change at any time at the discretion of the Company;

(ii) the Company may be considered to be highly leveraged, and

uses a significant portion of its cash flows to service its

indebtedness, as a result of which the Company might not have

sufficient funds to operate its businesses in the manner it intends

or has operated in the past; (iii) the levels of sales of the

Company’s apparel, footwear and related products, both to its

wholesale customers and in its retail stores, the levels of sales

of the Company’s licensees at wholesale and retail, and the extent

of discounts and promotional pricing in which the Company and its

licensees and other business partners are required to engage, all

of which can be affected by weather conditions, changes in the

economy, fuel prices, reductions in travel, fashion trends,

consolidations, repositionings and bankruptcies in the retail

industries, repositionings of brands by the Company’s licensors and

other factors; (iv) the Company’s plans and results of

operations will be affected by the Company’s ability to manage its

growth and inventory; (v) the Company’s operations and results

could be affected by quota restrictions and the imposition of

safeguard controls (which, among other things, could limit the

Company’s ability to produce products in cost-effective countries

that have the labor and technical expertise needed), the

availability and cost of raw materials, the Company’s ability to

adjust timely to changes in trade regulations and the migration and

development of manufacturers (which can affect where the Company’s

products can best be produced), changes in available factory and

shipping capacity, wage and shipping cost escalation, and civil

conflict, war or terrorist acts, the threat of any of the

foregoing, or political and labor instability in any of the

countries where the Company’s or its licensees’ or other business

partners’ products are sold, produced or are planned to be sold or

produced; (vi) disease epidemics and health related concerns,

which could result in closed factories, reduced workforces,

scarcity of raw materials and scrutiny or embargoing of goods

produced in infected areas, as well as reduced consumer traffic and

purchasing, as consumers become ill or limit or cease shopping in

order to avoid exposure; (vii) the failure of the Company’s

licensees to market successfully licensed products or to preserve

the value of the Company’s brands, or their misuse of the Company’s

brands and (viii) other risks and uncertainties indicated from

time to time in the Company’s filings with the Securities and

Exchange Commission.

Risks and uncertainties related to the acquisition include,

among others: competitive responses to the acquisition; costs,

charges or expenses resulting from the acquisition; the inability

to recognize the expected benefits of the acquisition; the

inability to integrate the acquired business without disruption to

the acquired business or existing operations; and any changes in

general economic and/or industry specific conditions.

The Company does not undertake any obligation to update publicly

any forward-looking statement, whether as a result of the receipt

of new information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190531005341/en/

Dana PerlmanTreasurer and Senior Vice President, Business

Development & Investor Relations(212)

381-3502investorrelations@pvh.com

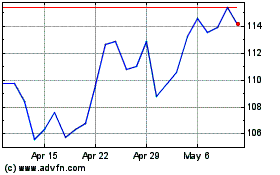

PVH (NYSE:PVH)

Historical Stock Chart

From Mar 2024 to Apr 2024

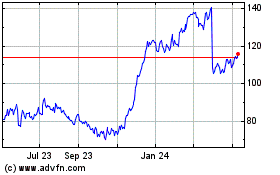

PVH (NYSE:PVH)

Historical Stock Chart

From Apr 2023 to Apr 2024