Global Stocks Waver Ahead of Fed Minutes

May 22 2019 - 8:26AM

Dow Jones News

By Nathan Allen

U.S. stocks were set to open slightly lower Wednesday as markets

awaited the release of Federal Reserve minutes that could shed

light on officials' views on lowering interest rates.

Futures pointed to opening losses of 0.2% for the S&P 500

and 0.1% for the Dow Jones Industrial Average.

In Europe, the Stoxx Europe 600 was down 0.2% in midday trade,

with the U.K's FTSE 100 up 0.3% and Germany's DAX up 0.1%.

That followed a broadly positive session in Asia where Hong

Kong's Hang Seng and Korea's Kospi both gained 0.2%, Japan's Nikkei

edged up 0.1% and China's Shanghai Stock Exchange dropped 0.5%.

The minutes from the Fed's April 30-May 1 meeting should give

additional color on how its members assessed an unexpected downtick

in inflation during the first quarter and could provide hints on

future policy.

Recent low inflation has raised expectations that the Fed might

cut rates this year, but CMC markets chief market analyst Michael

Hewson said this is unlikely, given solid wage growth and low

unemployment.

U.S. indexes closed higher Tuesday, lifted by technology stocks

after the White House granted temporary exemptions to an export

blacklist against Huawei Technologies Co. But investors in Chinese

technology companies still face the fallout from the recent

resurgence in trade tensions.

Shares in video-surveillance company Hangzhou Hikvision Digital

Technology fell 5.5% Wednesday on reports that it could be the

latest company to be included on the blacklist.

Elsewhere, a U.S. federal judge ruled that chip maker Qualcomm

illegally suppressed competition for cellphone chips, in a decision

that could shake up the broader smartphone industry. Qualcomm

shares were down 12% in premarket trade.

Meanwhile, the British pound dropped after data showed U.K. core

inflation accelerated to a 2.1% annual rate in April, moving ahead

of the Bank of England's 2% target and putting pressure on the

central bank to nudge up interest rates.

Analysts at ING said the bank is likely to keep rates on hold

for now, as the overall economic picture still looks fairly benign

and the continuing uncertainty over Brexit will restrict growth in

the near term. Still, they didn't rule out the possibility of some

tightening in November in the unlikely event that a Brexit deal

goes through.

Early optimism at U.K. Prime Minister Theresa May's latest push

to gain parliamentary support for her Brexit deal evaporated as it

became apparent that she still faces an uphill battle passing the

bill.

Joshua Mahony, senior market analyst at IG, said Mrs. May's

latest plan is likely to prove as abortive as her last three

attempts, as it alienates lawmakers who had previously supported

her. Another failure to break the Brexit deadlock raises the

prospect of a vote of no confidence, and heightens chances of the

U.K. leaving the European Union without a deal, he said.

The British pound rallied immediately after her comments but

quickly returned to lower levels. Before her address, the currency

had hit a four-month low against the dollar.

U.K. banking and insurance stocks were dragged down by the

downbeat Brexit news, with Barclays PLC 1.9% lower and Lloyds

Banking Group PLC down 1.4%.

London-listed retailer Marks & Spencer Group was the biggest

loser on the FTSE 100, falling 5% after posting a sharp drop in

annual pretax profit and launching a heavily discounted rights

issue to finance its joint venture with Ocado Group. It was the

latest disappointment from the retail sector, after U.S. retailers

reported slower sales during the most recent quarter as they brace

for higher tariffs on Chinese imports.

Traders have been struggling to gauge the underlying direction

of markets, which have become increasingly volatile as tensions

between the U.S. and China have flared up in recent weeks.

"The longer the paralysis lasts the more extreme the swings are

going to be," Philippe Gijsels, chief strategy officer at BNP

Paribas Fortis, said.

The WSJ Dollar Index, which tracks the dollar against a basket

of 16 currencies, was flat.

The yield on 10-year U.S. Treasurys edged down to 2.420% from

2.428% Tuesday. Yields move inversely to prices. German 10-year

government bonds were in negative territory at -0.073%.

In commodities, global benchmark Brent crude oil was down 0.2%

at $72.01 a barrel.

(END) Dow Jones Newswires

May 22, 2019 08:11 ET (12:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

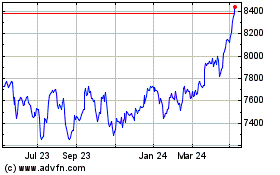

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

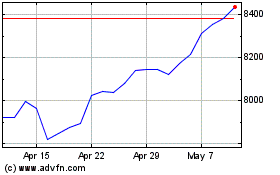

FTSE 100

Index Chart

From Apr 2023 to Apr 2024