ArcelorMittal: EU Steel Tariffs Can't Halt Plummeting Prices

May 09 2019 - 3:57AM

Dow Jones News

By Nathan Allen

ArcelorMittal (MT.AE) on Thursday blamed lower first-quarter

earnings on a sharp decline in global steel prices, a trend that

was particularly pronounced in Europe, where a series of tariffs

have failed to stem the flow of cheap imports.

"We continue to face a challenge from high levels of imports,

particularly in Europe, where safeguard measures introduced by the

European Commission have not been fully effective," Chief Executive

Lakshmi Mittal said.

In January the EU agreed to a series of measures aimed at

curbing imports after the introduction of tariffs in the U.S.

diverted large volumes of the metal into Europe.

The commission imposed quotas on 26 product categories and a 25%

duty on imports exceeding those quotas.

However, ArcelorMittal has argued that the measures don't go far

enough to protect local producers, and recently committed to

temporary production cuts in the region, which it said were

necessary to adapt to the current market environment.

"It is important there is a level playing field to address

unfair competition, and this includes a green border adjustment to

ensure that imports into Europe face the same carbon costs as

producers in Europe," Mr. Mittal said.

While ArcelorMittal's quarterly steel production in the region

increased 10% on-year to 12.4 million metric tons--largely as a

result of its takeover of Italy's giant Ilva mill--operating income

dropped to $11 million from $580 million over the same period.

Average selling prices in Europe fell 9% on year to $541 a ton,

the company said, compared with a 6.4% drop in Brazil and a 12%

gain in the NAFTA region over the same period.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

May 09, 2019 03:42 ET (07:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

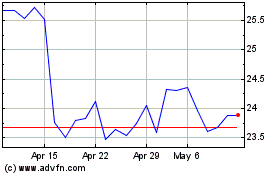

ArcelorMittal (EU:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

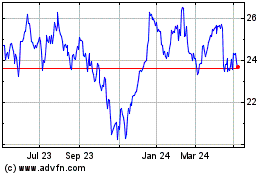

ArcelorMittal (EU:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024