Alico, Inc. (“Alico” or the “Company”) (Nasdaq: “ALCO”) today

announces financial results for the second quarter and six months

ended March 31, 2019. For the six months ended March 31,

2019, the Company recorded net income attributable to Alico

common stockholders of $5.1 million and earnings of $0.68 per

diluted common share, compared to net income attributable to Alico

common stockholders of $3.2 million and earnings of $0.39 per

diluted common share in the prior year. The increase in net income

attributable to Alico common stockholders is primarily due to

increased processed box production in the current fiscal year, as

compared to the prior fiscal year, and the impact of a valuation

allowance resulting in tax expense for the six months ended March

31, 2018. Partially offsetting this increase is (i) an increase, in

the six months ended March 31, 2019, in harvesting and hauling

costs directly related to the increased processed box production;

(ii) higher gain on sale of real estate, property and equipment and

assets held for sale recorded in the six months ended March 31,

2018, as compared to the same period in fiscal year 2019; and (iii)

a one-time deferred tax benefit attributable to the federal

corporate tax rate change enacted on December 22, 2017, that was

recorded in the six month period ended March 31, 2018.

When both periods are adjusted for non-recurring

items related to transaction costs, separation and consulting fees,

gains on sale of real estate and property and equipment, employee

stock compensation expense, tender offer, professional fees related

to corporate matters, change in fair value of derivatives,

forfeiture of stock options, net deferred tax and other valuation

allowances, the Company had adjusted income of $1.12 per diluted

common share for the six month period ended March 31, 2019,

compared to an adjusted loss of $0.18 per diluted common share for

the six months ended March 31, 2018. Adjusted EBITDA for the six

months ended March 31, 2019 and 2018 was $21.3 million and

$9.3 million, respectively.

These financial results reflect the seasonal

nature of Alico’s business and the impact of Hurricane Irma.

Historically, the second and third quarters of Alico's fiscal year

produce the majority of the Company's annual revenue and working

capital requirements are typically greater in the first and fourth

quarters. Due to Hurricane Irma, in the first six months of fiscal

year 2018 Alico harvested fruit earlier than in prior fiscal years

and in fiscal year 2019.

The Company reported the following financial results:

| (in thousands, except for per

share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

Six Months Ended March 31, |

| |

2019 |

|

2018 |

|

Change |

|

2019 |

|

2018 |

|

Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to Alico, Inc. common stockholders |

$ |

7,547 |

|

|

$ |

(5,514 |

) |

|

$ |

13,061 |

|

|

NM |

|

$ |

5,080 |

|

|

$ |

3,232 |

|

|

$ |

1,848 |

|

|

57.2 |

% |

|

EBITDA (1) |

$ |

15,231 |

|

|

$ |

8,307 |

|

|

$ |

6,924 |

|

|

83.4 |

% |

|

$ |

17,510 |

|

|

$ |

10,381 |

|

|

$ |

7,129 |

|

|

68.7 |

% |

| Earnings (loss) per diluted

common share |

$ |

1.01 |

|

|

$ |

(0.67 |

) |

|

$ |

1.68 |

|

|

NM |

|

$ |

0.68 |

|

|

$ |

0.39 |

|

|

$ |

0.29 |

|

|

74.4 |

% |

| Net cash provided by (used in)

operating activities |

$ |

18,069 |

|

|

$ |

9,438 |

|

|

$ |

8,631 |

|

|

91.4 |

% |

|

$ |

6,068 |

|

|

$ |

(251 |

) |

|

$ |

6,319 |

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See “Non-GAAP Financial Measures” at the end

of this earnings release for details regarding these measures.NM =

Not Meaningful

Alico Citrus Division Results

During the six months ended March 31, 2019,

Alico Citrus harvested 4.5 million boxes of fruit, an increase of

34.6% from the same period in the prior fiscal year. The increase

was directly related to the negative impact of Hurricane Irma on

the prior fiscal year’s harvest. With respect to the Early and

Mid-Season fruit, the Company harvested 71.9% more boxes than in

the previous fiscal year. The Company also experienced an increase

in pound solids per box. Similarly to the Early and Mid-Season

fruit, the harvesting of the Company’s Valencia fruit commenced

later than in the previous fiscal year. The harvesting of the

Valencia fruit commenced in early March of 2019, whereas in the

prior fiscal year the harvesting commenced in late January 2018.

Accordingly, the Company has harvested a fewer number of boxes in

the six month period ended March 31, 2019, as compared to the same

period in fiscal year 2018. The Company anticipates an overall

increase in the number of boxes harvested and revenues generated

from Valencia fruit for the 2019 harvest, as compared to the prior

fiscal year. Additionally, the Company saw a reduction in the price

per pound solids, largely attributable to the Early and Mid-Season

and Valencia crop being greater than initially anticipated

throughout Florida.

Citrus production for the three and six months

ended March 31, 2019 and 2018 is summarized in the following

table.

| (in thousands,

except per box and per pound solids data) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

|

|

|

|

Six Months Ended |

|

|

|

|

| |

March 31, |

|

Change |

|

March 31, |

|

Change |

| |

2019 |

|

2018 |

|

Unit |

|

% |

|

2019 |

|

2018 |

|

Unit |

|

% |

| Boxes

Harvested: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Early and Mid-Season |

2,120 |

|

|

597 |

|

|

1,523 |

|

|

NM |

|

3,114 |

|

|

1,811 |

|

|

1,303 |

|

|

71.9 |

% |

|

Valencias |

1,298 |

|

|

1,470 |

|

|

(172 |

) |

|

(11.7 |

)% |

|

1,298 |

|

|

1,470 |

|

|

(172 |

) |

|

(11.7 |

)% |

|

Total Processed |

3,418 |

|

|

2,067 |

|

|

1,351 |

|

|

65.4 |

% |

|

4,412 |

|

|

3,281 |

|

|

1,131 |

|

|

34.5 |

% |

|

Fresh Fruit |

33 |

|

|

24 |

|

|

9 |

|

|

37.5 |

% |

|

136 |

|

|

97 |

|

|

39 |

|

|

40.2 |

% |

|

Total |

3,451 |

|

|

2,091 |

|

|

1,360 |

|

|

65.0 |

% |

|

4,548 |

|

|

3,378 |

|

|

1,170 |

|

|

34.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pound Solids

Produced: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Early and Mid-Season |

11,735 |

|

|

3,125 |

|

|

8,610 |

|

|

NM |

|

16,873 |

|

|

9,194 |

|

|

7,679 |

|

|

83.5 |

% |

|

Valencias |

7,831 |

|

|

8,651 |

|

|

(820 |

) |

|

(9.5 |

)% |

|

7,831 |

|

|

8,651 |

|

|

(820 |

) |

|

(9.5 |

)% |

|

Total |

19,566 |

|

|

11,776 |

|

|

7,790 |

|

|

66.2 |

% |

|

24,704 |

|

|

17,845 |

|

|

6,859 |

|

|

38.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Pound Solids

per Box: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Early and Mid-Season |

5.54 |

|

|

5.23 |

|

|

0.31 |

|

|

5.9 |

% |

|

5.42 |

|

|

5.08 |

|

|

0.34 |

|

|

6.7 |

% |

|

Valencias |

6.04 |

|

|

5.89 |

|

|

0.15 |

|

|

2.5 |

% |

|

6.04 |

|

|

5.89 |

|

|

0.15 |

|

|

2.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Price per Pound

Solids: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Early and Mid-Season |

$ |

2.38 |

|

|

$ |

2.83 |

|

|

$ |

(0.45 |

) |

|

(15.9 |

)% |

|

$ |

2.35 |

|

|

$ |

2.64 |

|

|

$ |

(0.29 |

) |

|

(11.0 |

)% |

|

Valencias |

$ |

2.39 |

|

|

$ |

2.84 |

|

|

$ |

(0.45 |

) |

|

(15.8 |

)% |

|

$ |

2.39 |

|

|

$ |

2.84 |

|

|

$ |

(0.45 |

) |

|

(15.8 |

)% |

NM - Not meaningful

Water Resources and Other Operations Division

Results

Operating results for the Water Resources

and Other Operations Division for the six months ended

March 31, 2019 improved by $1.2 million from the six months

ended March 31, 2018, primarily due to the Company selling its

cattle herd in late January 2018, and as such, are no longer

incurring expenses relating to calves and culls. As part of

this transaction, the Company entered into a long-term arrangement

with the purchaser for grazing rights on the ranch. The Company

continues to own the property and conduct its long-term water

dispersement program and wildlife management programs.

Other Corporate Financial

Information

General and administrative expenses increased by

$1.1 million to $8.1 million for the six months ended

March 31, 2019. The increase was primarily due to an increase

in professional fees of $2.3 million during the six months ended

March 31, 2019, related to a corporate litigation matter. This

litigation has been resolved and a settlement was reached on

February 11, 2019. The Company does not anticipate incurring

any further professional fees relating to this matter.

Additionally, as part of this settlement, the Company recorded

consulting and separation fees of $0.8 million during the six

months ended March 31, 2019. These increases were partially offset

by an adjustment to stock compensation expense as part of the

settled litigation and a decrease in payroll expenses. The Company

recorded a reduction to stock compensation expense in the amount of

$0.8 million as a result of a former senior executive forfeiting

his stock options. The reduction in payroll costs of $0.7 million

was primarily due to a reduction in (i) separation expenses of $0.4

million; (ii) accrual for paid time-off of $0.2 million; and (iii)

personnel and overtime costs of $0.1 million.

Other expense, net, which primarily consists of

interest expense, change in fair value of derivatives and gain or

loss on sale of real estate, property and equipment and assets held

for sale, was $4.8 million for the six months ended March 31,

2019, as compared to $2.5 million for the six months ended

March 31, 2018. The increase of $2.3 million is primarily

attributable to the Company recording an offsetting gain on sale of

real estate, property and equipment of $1.8 million during the six

months ended March 31, 2018.

The Company paid a second quarter cash dividend

of $0.06 per share on its outstanding common stock on April 12,

2019 to shareholders of record as of March 29, 2019.

At March 31, 2019 the Company had working

capital of $32.5 million, and had term debt, net of cash and cash

equivalents and restricted cash of $186.3 million.

About Alico

Alico, Inc. primarily operates two divisions:

Alico Citrus, one of the nation’s largest citrus producers, and

Alico Water Resources and Other Operations, a leading water storage

and environmental services division. Learn more about Alico

(Nasdaq: "ALCO") at www.alicoinc.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements are based on

Alico’s current expectations about future events and can be

identified by terms such as “plans,” “expect,” “may,” “anticipate,”

“intend,” “should be,” “will be,” “is likely to,” “believes,” and

similar expressions referring to future periods.

Alico believes the expectations reflected in the

forward-looking statements are reasonable but cannot guarantee

future results, level of activity, performance or achievements.

Actual results may differ materially from those expressed or

implied in the forward-looking statements. Therefore, Alico

cautions you against relying on any of these forward-looking

statements. Factors which may cause future outcomes to differ

materially from those foreseen in forward-looking statements

include, but are not limited to: changes in laws, regulation and

rules; changes in the political environment and agendas; weather

conditions that affect production, transportation, storage, demand,

import and export of fresh product and its by-products; increased

pressure from diseases including citrus greening and citrus canker,

as well as insects and other pests; disruption of water supplies or

changes in water allocations; pricing and supply of raw materials

and products; market responses to industry volume pressures;

pricing and supply of energy; changes in interest rates;

availability of financing for land development activities and other

growth and corporate opportunities; onetime events; acquisitions

and divestitures; seasonality; our ability to achieve the

anticipated cost savings under the Alico 2.0 Modernization Program;

customer concentration; labor disruptions; inability to pay debt

obligations; inability to engage in certain transactions due to

restrictive covenants in debt instruments; government restrictions

on land use; changes in agricultural land values; and market and

pricing risks due to concentrated ownership of stock. Other risks

and uncertainties include those that are described in Alico’s SEC

filings, which are available on the SEC’s website at

http://www.sec.gov. Alico undertakes no obligation to subsequently

update or revise the forward-looking statements made in this press

release, except as required by law.

Investor Contact:John E.

KiernanExecutive Vice President and Chief Financial Officer(239)

226-2000JKiernan@alicoinc.com

|

ALICO, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in

thousands, except share amounts) |

|

| |

| |

| |

|

|

|

|

| |

March 31, |

|

September 30, |

|

| |

2019 |

|

2018 |

|

| |

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

606 |

|

|

$ |

25,260 |

|

|

|

Accounts receivable, net |

13,997 |

|

|

2,544 |

|

|

|

Inventories |

36,111 |

|

|

41,033 |

|

|

|

Assets held for sale |

1,403 |

|

|

1,391 |

|

|

|

Prepaid expenses and other current assets |

946 |

|

|

833 |

|

|

|

Total current assets |

53,063 |

|

|

71,061 |

|

|

| |

|

|

|

|

| Restricted cash |

7,004 |

|

|

7,000 |

|

|

| Property and equipment,

net |

342,930 |

|

|

340,403 |

|

|

| Goodwill |

2,246 |

|

|

2,246 |

|

|

| Deferred financing costs, net

of accumulated amortization |

44 |

|

|

136 |

|

|

| Other non-current assets |

2,802 |

|

|

2,576 |

|

|

|

Total assets |

$ |

408,089 |

|

|

$ |

423,422 |

|

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

$ |

7,372 |

|

|

$ |

3,764 |

|

|

|

Accrued liabilities |

5,988 |

|

|

9,226 |

|

|

|

Long-term debt, current portion |

5,313 |

|

|

5,275 |

|

|

|

Income taxes payable |

1,468 |

|

|

2,320 |

|

|

|

Other current liabilities |

437 |

|

|

913 |

|

|

|

Total current liabilities |

20,578 |

|

|

21,498 |

|

|

| |

|

|

|

|

| Long-term debt: |

|

|

|

|

| Principal amount, net of

current portion |

163,599 |

|

|

169,074 |

|

|

| Less: deferred financing

costs, net |

(1,465 |

) |

|

(1,563 |

) |

|

| Long-term debt less current

portion and deferred financing costs, net |

162,134 |

|

|

167,511 |

|

|

| Lines of credit |

24,962 |

|

|

2,685 |

|

|

| Deferred income tax

liabilities |

28,930 |

|

|

25,153 |

|

|

| Deferred gain on sale |

— |

|

|

24,928 |

|

|

| Deferred retirement

obligations |

3,938 |

|

|

4,052 |

|

|

| Other liabilities |

346 |

|

|

— |

|

|

|

Total liabilities |

240,888 |

|

|

245,827 |

|

|

| Stockholders'

equity: |

|

|

|

|

|

Preferred stock, no par value, 1,000,000 shares authorized; none

issued |

— |

|

|

— |

|

|

|

Common stock, $1.00 par value, 15,000,000 shares authorized;

8,416,145 and 8,416,145 shares issued and 7,462,803 and 8,199,957

shares outstanding at March 31, 2019 and September 30, 2018,

respectively |

8,416 |

|

|

8,416 |

|

|

|

Additional paid in capital |

19,733 |

|

|

20,126 |

|

|

|

Treasury stock, at cost, 953,342 and 216,188 shares held at March

31, 2019 and September 30, 2018, respectively |

(32,496 |

) |

|

(7,536 |

) |

|

|

Retained earnings |

166,193 |

|

|

151,111 |

|

|

|

Total Alico stockholders' equity |

161,846 |

|

|

172,117 |

|

|

|

Noncontrolling interest |

5,355 |

|

|

5,478 |

|

|

|

Total stockholders' equity |

167,201 |

|

|

177,595 |

|

|

|

Total liabilities and stockholders' equity |

$ |

408,089 |

|

|

$ |

423,422 |

|

|

|

ALICO, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share amounts) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

Six Months Ended March 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Operating

revenues: |

|

|

|

|

|

|

|

|

Alico Citrus |

$ |

47,823 |

|

|

$ |

34,709 |

|

|

$ |

61,720 |

|

|

$ |

51,788 |

|

|

Water Resources and Other Operations |

698 |

|

|

891 |

|

|

1,580 |

|

|

1,345 |

|

|

Total operating revenues |

48,521 |

|

|

35,600 |

|

|

63,300 |

|

|

53,133 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Alico Citrus |

31,582 |

|

|

26,110 |

|

|

42,456 |

|

|

42,405 |

|

|

Water Resources and Other Operations |

625 |

|

|

1,657 |

|

|

1,348 |

|

|

2,313 |

|

|

Total operating expenses |

32,207 |

|

|

27,767 |

|

|

43,804 |

|

|

44,718 |

|

| Gross

profit: |

16,314 |

|

|

7,833 |

|

|

19,496 |

|

|

8,415 |

|

| General and administrative

expenses |

4,654 |

|

|

3,073 |

|

|

8,104 |

|

|

6,959 |

|

| Income from operations |

11,660 |

|

|

4,760 |

|

|

11,392 |

|

|

1,456 |

|

| Other (expense)

income: |

|

|

|

|

|

|

|

|

Interest expense |

(1,963 |

) |

|

(2,239 |

) |

|

(3,880 |

) |

|

(4,494 |

) |

|

Gain on sale of real estate, property and equipment and assets held

for sale |

1 |

|

|

99 |

|

|

23 |

|

|

1,835 |

|

|

Change in fair value of derivatives |

(33 |

) |

|

— |

|

|

(989 |

) |

|

— |

|

|

Other income, net |

23 |

|

|

— |

|

|

10 |

|

|

144 |

|

|

Total other expenses, net |

(1,972 |

) |

|

(2,140 |

) |

|

(4,836 |

) |

|

(2,515 |

) |

| Income (loss) before

income taxes |

9,688 |

|

|

2,620 |

|

|

6,556 |

|

|

(1,059 |

) |

| Income tax provision

(benefit) |

2,228 |

|

|

8,150 |

|

|

1,599 |

|

|

(4,267 |

) |

| Net income

(loss) |

7,460 |

|

|

(5,530 |

) |

|

4,957 |

|

|

3,208 |

|

| Net loss attributable to

noncontrolling interests |

87 |

|

|

16 |

|

|

123 |

|

|

24 |

|

| Net income (loss)

attributable to Alico, Inc. common stockholders |

$ |

7,547 |

|

|

$ |

(5,514 |

) |

|

$ |

5,080 |

|

|

$ |

3,232 |

|

| Per share information

attributable to Alico, Inc. common stockholders: |

|

|

|

|

|

|

|

| Earnings (loss) per

common share: |

|

|

|

|

|

|

|

|

Basic |

$ |

1.01 |

|

|

$ |

(0.67 |

) |

|

$ |

0.68 |

|

|

$ |

0.39 |

|

|

Diluted |

$ |

1.01 |

|

|

$ |

(0.67 |

) |

|

$ |

0.68 |

|

|

$ |

0.39 |

|

| Weighted-average

number of common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

7,463 |

|

|

8,256 |

|

|

7,471 |

|

|

8,251 |

|

|

Diluted |

7,469 |

|

|

8,256 |

|

|

7,506 |

|

|

8,310 |

|

| |

|

|

|

|

|

|

|

| Cash dividends

declared per common share |

$ |

0.06 |

|

|

$ |

0.06 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

ALICO, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) (in thousands) |

|

| |

| |

| |

|

|

|

|

| |

Six Months Ended March 31, |

|

| |

2019 |

|

2018 |

|

| Net cash provided by

(used in) operating activities: |

|

|

|

|

|

Net income |

$ |

4,957 |

|

|

$ |

3,208 |

|

|

|

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: |

|

|

|

|

|

Deferred gain on sale of sugarcane land |

— |

|

|

(282 |

) |

|

|

Depreciation, depletion and amortization |

6,951 |

|

|

6,922 |

|

|

|

Deferred income tax provision (benefit) |

73 |

|

|

(4,306 |

) |

|

|

Gain on sale of real estate, property and equipment and assets held

for sale |

(23 |

) |

|

(1,835 |

) |

|

|

Change in fair value of derivatives |

989 |

|

|

— |

|

|

|

Non-cash interest expense on deferred gain on sugarcane land |

— |

|

|

688 |

|

|

|

Stock-based compensation expense |

223 |

|

|

856 |

|

|

|

Other |

(51 |

) |

|

(300 |

) |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable |

(11,453 |

) |

|

(12,229 |

) |

|

|

Inventories |

4,922 |

|

|

9,194 |

|

|

|

Prepaid expenses and other assets |

92 |

|

|

(620 |

) |

|

|

Accounts payable and accrued expenses |

370 |

|

|

(533 |

) |

|

|

Income tax payable |

(852 |

) |

|

— |

|

|

|

Other liabilities |

(130 |

) |

|

(1,014 |

) |

|

|

Net cash provided by (used in) operating activities |

6,068 |

|

|

(251 |

) |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

Purchases of property and equipment |

(9,524 |

) |

|

(7,438 |

) |

|

|

Net proceeds from sale of property and equipment and assets held

for sale |

202 |

|

|

24,612 |

|

|

|

Deposits on purchase of citrus trees |

(515 |

) |

|

— |

|

|

|

Notes receivable |

50 |

|

|

(379 |

) |

|

|

Net cash (used in) provided by investing activities |

(9,787 |

) |

|

16,795 |

|

|

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

Repayments on revolving lines of credit |

(41,360 |

) |

|

(21,424 |

) |

|

|

Borrowings on revolving lines of credit |

63,637 |

|

|

21,424 |

|

|

|

Principal payments on term loans |

(5,437 |

) |

|

(6,715 |

) |

|

|

Treasury stock purchases |

(25,576 |

) |

|

(206 |

) |

|

|

Payment on termination of Global Ag agreement |

(11,300 |

) |

|

— |

|

|

|

Dividends paid |

(895 |

) |

|

(988 |

) |

|

|

Capital lease obligation payments |

— |

|

|

(8 |

) |

|

|

Net cash used in financing activities |

(20,931 |

) |

|

(7,917 |

) |

|

| |

|

|

|

|

| Net (decrease)

increase in cash and cash equivalents and restricted

cash |

(24,650 |

) |

|

8,627 |

|

|

| Cash and cash equivalents and

restricted cash at beginning of the period |

32,260 |

|

|

3,395 |

|

|

| |

|

|

|

|

|

Cash and cash equivalents and restricted cash at end of the

period |

$ |

7,610 |

|

|

$ |

12,022 |

|

|

| Non-GAAP Financial

Measures |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

|

|

|

|

|

|

| (in thousands) |

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

Six Months Ended March 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

| Net income (loss) attributable

to common stockholders |

$ |

7,547 |

|

|

$ |

(5,514 |

) |

|

$ |

5,080 |

|

|

$ |

3,232 |

|

|

Interest expense |

1,963 |

|

|

2,239 |

|

|

3,880 |

|

|

4,494 |

|

|

Income tax provision (benefit) |

2,228 |

|

|

8,150 |

|

|

1,599 |

|

|

(4,267 |

) |

|

Depreciation, depletion and amortization |

3,493 |

|

|

3,432 |

|

|

6,951 |

|

|

6,922 |

|

| EBITDA |

15,231 |

|

|

8,307 |

|

|

17,510 |

|

|

10,381 |

|

|

|

|

|

|

|

|

|

|

|

Transaction costs |

— |

|

|

12 |

|

|

— |

|

|

88 |

|

|

Stock compensation expense (1) |

255 |

|

|

242 |

|

|

570 |

|

|

473 |

|

|

Separation and consulting agreement expense (2) |

800 |

|

|

— |

|

|

800 |

|

|

188 |

|

|

Tender offer expense |

— |

|

|

— |

|

|

32 |

|

|

— |

|

|

Professional fees relating to corporate matters |

1,783 |

|

|

— |

|

|

2,283 |

|

|

— |

|

|

Change in fair value of derivatives |

33 |

|

|

— |

|

|

989 |

|

|

— |

|

|

Forfeiture of stock options (3) |

(823 |

) |

|

— |

|

|

(823 |

) |

|

— |

|

|

Gains on sale of real estate and property and equipment and assets

held for sale |

(1 |

) |

|

(99 |

) |

|

(23 |

) |

|

(1,835 |

) |

| |

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

17,278 |

|

|

$ |

8,462 |

|

|

$ |

21,338 |

|

|

$ |

9,295 |

|

| |

|

|

|

|

|

|

|

| (1) Includes stock

compensation expense for current executives. |

|

|

|

| (2) Includes

consulting and compensation fees for former CEO. |

|

|

|

| (3) Includes

forfeitures of stock options by former CEO, resulting in expense

recapture. |

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Adjusted

Income (Loss) Per Diluted Common Share |

|

|

|

|

|

|

| (in thousands) |

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

Six Months Ended March 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

| Net income (loss) attributable

to common stockholders |

$ |

7,547 |

|

|

$ |

(5,514 |

) |

|

$ |

5,080 |

|

|

$ |

3,232 |

|

|

One-time deferred tax adjustment due to new tax legislation |

— |

|

|

1,250 |

|

|

— |

|

|

(10,077 |

) |

|

Valuation allowance on capital loss carryforward |

— |

|

|

6,060 |

|

|

— |

|

|

6,060 |

|

|

Transaction costs |

— |

|

|

12 |

|

|

— |

|

|

88 |

|

|

Stock compensation expense (1) |

255 |

|

|

242 |

|

|

570 |

|

|

473 |

|

|

Separation and consulting agreement expense (2) |

800 |

|

|

— |

|

|

800 |

|

|

188 |

|

|

Tender offer expense |

— |

|

|

— |

|

|

32 |

|

|

— |

|

|

Professional fees relating to corporate matters |

1,783 |

|

|

— |

|

|

2,283 |

|

|

— |

|

|

Change in fair value of derivatives |

33 |

|

|

— |

|

|

989 |

|

|

— |

|

|

Forfeiture of stock options (3) |

(823 |

) |

|

— |

|

|

(823 |

) |

|

— |

|

|

Gains on sale of real estate and property and equipment and assets

held for sale |

(1 |

) |

|

(99 |

) |

|

(23 |

) |

|

(1,835 |

) |

|

Tax impact |

(322 |

) |

|

84 |

|

|

(532 |

) |

|

388 |

|

| |

|

|

|

|

|

|

|

| Adjusted net income (loss)

attributable to common stockholders |

$ |

9,272 |

|

|

$ |

2,035 |

|

|

$ |

8,376 |

|

|

$ |

(1,483 |

) |

|

|

|

|

|

|

|

|

|

| Diluted common shares |

7,469 |

|

|

8,256 |

|

|

7,506 |

|

|

8,310 |

|

| |

|

|

|

|

|

|

|

| Adjusted income (loss) per

diluted common share |

$ |

1.24 |

|

|

$ |

0.25 |

|

|

$ |

1.12 |

|

|

$ |

(0.18 |

) |

| |

|

|

|

|

|

|

|

| (1) Includes stock

compensation expense for current executives. |

|

|

|

|

| (2) Includes

consulting and compensation fees for former CEO. |

|

|

|

|

| (3) Includes

forfeitures of stock options by former CEO, resulting in expense

recapture. |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Adjusted Free Cash

Flow |

|

|

|

|

|

|

|

| (in thousands) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

Six Months Ended March 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Net cash provided by (used in)

operating activities |

$ |

18,069 |

|

|

$ |

9,438 |

|

|

$ |

6,068 |

|

|

$ |

(251 |

) |

| Adjustments for non-recurring

items: |

|

|

|

|

|

|

|

|

Transaction costs |

— |

|

|

12 |

|

|

— |

|

|

88 |

|

|

Separation and consulting agreement expense (1) |

800 |

|

|

— |

|

|

800 |

|

|

188 |

|

|

Tender offer expense |

— |

|

|

— |

|

|

32 |

|

|

— |

|

|

Professional fees relating to corporate matters |

1,783 |

|

|

— |

|

|

2,283 |

|

|

— |

|

|

Tax impact |

(472 |

) |

|

(3 |

) |

|

(605 |

) |

|

(68 |

) |

| Capital expenditures |

(6,066 |

) |

|

(3,877 |

) |

|

(9,524 |

) |

|

(7,438 |

) |

| Adjusted Free Cash Flow |

$ |

14,114 |

|

|

$ |

5,570 |

|

|

$ |

(946 |

) |

|

$ |

(7,481 |

) |

| |

|

|

|

|

|

|

|

| (1) Includes

consulting and compensation fees for former CEO. |

|

|

|

|

Alico utilizes the non-GAAP measures EBITDA,

Adjusted EBITDA, Adjusted Income (Loss) per Diluted Common Share

and Adjusted Free Cash Flow among other measures, to evaluate the

performance of its business. Due to significant depreciable assets

associated with the nature of our operations and, to a lesser

extent, interest costs associated with our capital structure,

management believes that EBITDA, Adjusted EBITDA, Adjusted Income

(Loss) per Diluted Common Share, and Adjusted Free Cash Flow are

important measures to evaluate our results of operations between

periods on a more comparable basis and to help investors analyze

underlying trends in our business, evaluate the performance of our

business both on an absolute basis and relative to our peers and

the broader market, provide useful information to both management

and investors by excluding certain items that may not be indicative

of our core operating results and operational strength of our

business and help investors evaluate our ability to service our

debt. Such measurements are not prepared in accordance with

accounting principles generally accepted in the United States

(“U.S. GAAP”) and should not be construed as an alternative to

reported results determined in accordance with U.S. GAAP. The

non-GAAP information provided is unique to Alico and may not be

consistent with methodologies used by other companies. EBITDA is

defined as net income (loss) before interest expense, provision

(benefit) for income taxes, depreciation and amortization. Adjusted

EBITDA is defined as net income (loss) before interest expense,

provision (benefit) for income taxes, depreciation and amortization

and adjustments for non-recurring transactions or transactions that

are not indicative of our core operating results, such as gains or

losses on sales of real estate, property and equipment and assets

held for sale. Adjusted Income (Loss) per Diluted Common Share is

defined as net income (loss) adjusted for non-recurring

transactions divided by diluted common shares. Adjusted Free Cash

Flow is defined as cash provided by (used in) operating activities

adjusted for non-recurring transactions less capital expenditures.

The Company uses Adjusted Free Cash Flow to evaluate its business

and this measure is considered an important indicator of the

Company's liquidity, including its ability to reduce net debt, make

strategic investments, and pay dividends to common stockholders.

The Company’s definition of Adjusted Free Cash Flow does not

represent residual cash flows available for discretionary

spending.

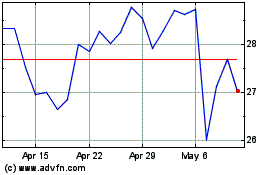

Alico (NASDAQ:ALCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

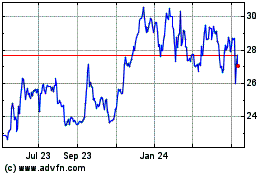

Alico (NASDAQ:ALCO)

Historical Stock Chart

From Apr 2023 to Apr 2024