Bitfinex Under Fire From New York Regulators

April 29 2019 - 12:46PM

ADVFN Crypto NewsWire

Bitcoin Global News (BGN)

April 29, 2019 -- ADVFN Crypto NewsWire -- Murky ties and

money movement through through fiat, currency, shares, Tether and

debt continue to drag Bitfinex and Tether into predicaments with

regulators and raise concerns for their users. The two companies

are owned and operated by the larger iFinex, which was used as the

the target for the New York Attorney General’s Office in the U.S.

to bring the wide range of issues at hand to light.

“New York state has led the way in

requiring virtual currency businesses to operate according to the

law. And we will continue to stand-up for investors and seek

justice on their behalf when misled or cheated by any of these

companies.” - Letitia James New York Attorney General

Attorney General Letitia James

obtained a court order against iFinex ordering them to cease

violating New York law and defrauding New York residents. The most

simple and blatant offense being that they companies have not made

their customers aware of movements made with their money holdings,

and that customers have not been made aware of changes to their

policies when made. Just two months previously it was noted by a

twitter user that Tether had removed the specific language in their

policies that the coin is backed directly by USD dollars, and

instead can now be backed in other equivalent forms of

value.

$850 Million Liquidity

Problems

For most people, simply grasping

the concept of cryptocurrencies is difficult enough. On top of

this, Tether is a stablecoin. It was created as a 1 to 1 USD backed

cryptocurrency, meaning that the issuing company would always have

the equivalent amount of USD ready to be withdrawn by customers.

However, this has clearly not been the case as the New York

Attorney General's Office has brought to light.

“Documents provided to OAG

demonstrate that by mid-2018. Bitfinex was having extreme

difficulty honoring its clients’ requests to withdraw their money

from the trading platform because Crypto Capital, which held all or

almost all of Bitfinex·s funds, refused to process customer

withdrawal requests and refused or was unable to return any funds

to Bitfinex.” - Attorney General Order Document

The New York Attorney General’s

office alleged that Bitfinex has entirely lost $850 million. The

note banking transactions that highlight it was attempted to be

covered up by tapping into Tether reserves. The company was then

forced to take out a loan to cover the new spread. Regardless of

whether users will be able to have their funds withdrawn, the

outlook is not positive for any companies involved.

“In an in-person meeting on February 21, 2019. counsel for Bittinex

and Tether explained that, in order to make up for the apparent

loss of $851 million to Crypto Capital, Bitfinex and Tether were in

the process of contemplating a transaction that would permit

Bitfinex to draw upon Tether’s cash reserves on an as-needed

basis.” - Attorney General Order Document

By: BGN Editorial Staff

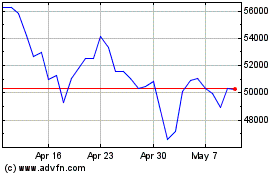

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

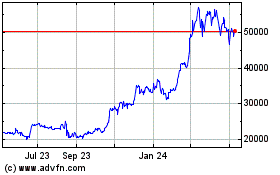

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Apr 2023 to Apr 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles