Bayer CEO Faces Shareholder Ire over Monsanto Deal

April 26 2019 - 11:51AM

Dow Jones News

By Ruth Bender

BONN, Germany -- Shareholders in Bayer AG let loose on Chief

Executive Werner Baumann on Friday, warning that the company's

acquisition of Monsanto Co. had put Bayer's future in jeopardy.

The German company's $63 billion purchase of Monsanto last year

has opened it up to thousands of U.S. lawsuits alleging that the

agricultural giant's Roundup weedkiller causes cancer. Investors

gathered at Bayer's annual general meeting said Mr. Baumann and his

fellow directors had underestimated the legal liabilities when

preparing the takeover.

"Management infected a healthy Bayer with the Monsanto virus, is

now playing doctor but has no healing drug at hand," said Ingo

Speich, head of corporate governance at Deka Investment, which

holds roughly 1% of Bayer.

"One has to ask critically if the due diligence was faulty,"

said Janne Werning, an analyst for environmental, societal and

governance risks at shareholder Union Investment.

Two early court defeats in the Roundup cases have sent Bayer's

share price plummeting and unnerved investors who struggle to gauge

the size of the potential liability.

Mr. Baumann and Chairman Werner Wenning vigorously defended the

Monsanto purchase and the company's due diligence.

"The acquisition was and is the right step for Bayer," Mr.

Baumann said in his 24-page address to shareholders.

Meeting attendees had to step over dead bees laid out by

environmental activists who stage protests every year.

The shareholder rebuke highlights the depth of the crisis Bayer

faces. Investor confidence in the chemicals and drugs giant was

shaken after two U.S. juries since August deemed Roundup

responsible for the plaintiffs' cancer. Bayer has lost roughly a

third of its market capitalization.

Bayer faces lawsuits from some 13,400 plaintiffs and investors

fear that the share price won't recover until the company scores a

win before a U.S. juries or on appeal. Bayer has appealed in the

first case and has said it would appeal the second. Five more

trials are set to take place in 2019.

Mr. Baumann is particularly exposed as the main architect of the

Monsanto deal, which he brokered and pushed through just days after

becoming CEO in 2016. the deal took two years to get regulatory

approval.

Some large shareholders, including Union Investment and Deka,

said they wouldn't back a motion that asks shareholders in Germany

to endorse the directors' actions in the past year.

Even if such a motion fails to gain more than 50% of the votes,

it carries no binding consequences under German law. A large rebuke

would however be an embarrassment for management and could further

undermine its standing in the investment community, analysts

say.

It could also trigger a discussion about replacing management,

though even some of the shareholders calling for a no-confidence

vote warned that a change in leadership would exacerbate Bayer's

crisis rather than help it.

Mr. Baumann said the share price losses were disappointing and

hurt. He warned the litigation could extend over several more

years.

(END) Dow Jones Newswires

April 26, 2019 11:36 ET (15:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

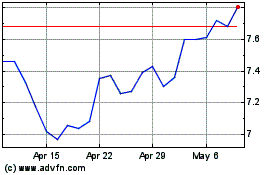

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

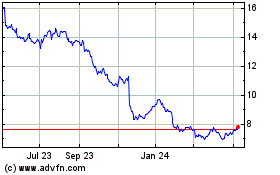

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024