Euro Climbs Amid Risk Appetite

April 12 2019 - 3:12AM

RTTF2

The euro advanced against its major counterparts in the European

session on Friday amid risk appetite, as investors took mixed trade

data from China in their stride and looked ahead to the start of

the U.S. corporate earnings season, with JP Morgan Chase & Co

and Wells Fargo & Co set to report their financial results

later in the day.

Official data showed today that China's exports rose 14.2

percent in March from a year earlier, beating analysts'

expectations and marking the strongest growth in five months.

However, imports dropped an annual 7.6 percent, worse than

analysts' forecasts for a 1.3 percent fall and widening from

February's 5.2 percent fall.

Data from Eurostat showed that Eurozone industrial output fell

less than expected in February.

Industrial production fell 0.2 percent month-on-month in

February, reversing a 1.9 percent rise in January. Economists had

forecast a 0.6 percent decline.

Data from Destatis showed that Germany's wholesale price

inflation rose further in March.

The wholesale price index rose 1.8 percent year-on-year in

March, following a 1.6 percent rise in February.

The currency has been trading higher against its major

counterparts in the Asian session.

The euro strengthened to a 3-week high of 0.8657 against the

pound, from a low of 0.8616 seen at 5:00 pm ET. The next possible

resistance for the euro is seen around the 0.88 level.

The single currency spiked up to 1.1319 against the greenback,

its highest since March 26. This follows a low of 1.1251 touched at

5:00 pm ET. The euro is poised to find resistance around the 1.15

level.

After falling to a 2-day low of 1.1281 against the franc at 5:15

pm ET, the euro reversed direction and appreciated to a new 3-week

high of 1.1328. The euro is seen finding resistance around the 1.15

level.

The euro firmed to more than a 3-week high of 126.71 against the

yen, after falling to 125.61 at 5:00 pm ET. If the euro rises

further, 129.00 is possibly seen as its next resistance level.

On the flip side, the euro retreated to 1.5777 against the

aussie, 1.6754 against the kiwi and 1.5069 against the loonie, from

its early 9-day high of 1.5853, near 2-month high of 1.6787 and

near a 2-week high of 1.5100, respectively. On the downside, 1.55,

1.66 and 1.48 are likely seen as the next support levels for the

euro against the aussie, the kiwi and the loonie, respectively.

Looking ahead, U.S. export and import prices for March and

University of Michigan's preliminary consumer sentiment index for

April will be released in the New York session.

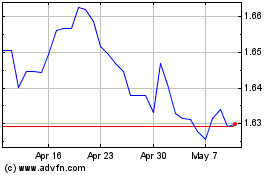

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024