Dollar Up As Weekly Jobless Claims Hit 50-Year Low; Fed Speeches Due

April 11 2019 - 5:42AM

RTTF2

The U.S. dollar was higher against its major counterparts in the

European session on Thursday, as U.S. weekly jobless claims fell to

a 50-year low last week, while producer prices rose more than

forecast in March, reducing some of the fears over economic

slowdown. Market participants await speeches by various Fed

officials due shortly for policy cues.

Data from the Labor Department showed that U.S. producer prices

grew more than expected in March, led by higher energy prices.

The Labor Department said its producer price index for final

demand climbed by 0.6 percent in March after inching up by 0.1

percent in February. Economists had expected prices to rise by 0.3

percent.

Core producer prices, which exclude food and energy prices, also

rose by 0.3 percent in March following a 0.1 percent uptick in

February. Core prices had been expected to edge up by 0.2

percent.

Separate data showed that first-time claims for U.S.

unemployment benefits once again slid to their lowest level in

nearly 50 years in the week ended April 6.

The report said initial jobless claims fell to 196,000, a

decrease of 8,000 from the previous week's revised level of

204,000.

The continued drop surprised economists, who had expected

jobless claims to rise to 211,000 from the 202,000 originally

reported for the previous week.

Speeches by Fed governors Clarida, Williams, Bullard, Kashkari

and Bowman are scheduled shortly.

Investors also welcomed indications of progress in trade talks

between U.S. and China.

U.S. Treasury Secretary Steven Mnuchin said that a call with

Chinese Vice-Premier Liu He on Tuesday night was productive and the

two sides have settled on a mechanism to police any agreement,

including new enforcement offices.

The currency was lower against its most major counterparts in

the Asian session, as Fed minutes showed continued concerns about

slowing economic growth abroad and a likelihood of shift in

interest rates in either direction.

The greenback climbed to a 2-day high of 111.36 against the yen,

from a low of 110.90 hit at 5:45 pm ET. If the greenback rises

further, 113.00 is possibly seen as its next resistance level.

The greenback strengthened to 1.0046 against the franc, its

biggest since March 15. At yesterday's close, the pair was worth

1.0025. The greenback is poised to find resistance around the 1.02

level.

Bouncing back from a low of 1.1288 hit at 3:00 am ET, the

greenback edged up to 1.1255 against the euro. The next possible

resistance for the greenback is seen around the 1.10 level.

Preliminary data from Eurostat showed that Eurozone house price

inflation slowed in the fourth quarter of 2018 after remaining

unchanged in the previous three months.

House prices rose 4.2 percent year-on-year following a 4.3

percent increase in each of the previous two quarters. In the first

quarter, prices grew 4.5 percent.

The greenback firmed to a 3-day high of 0.6726 against the kiwi

and a 6-day high of 1.3396 against the loonie, from its early lows

of 0.6771 and 1.3309, respectively. The greenback is seen finding

resistance around 0.66 against the kiwi and 1.36 against the

loonie.

The greenback strengthened to 0.7137 against the aussie, after

falling to 0.7171 at 6:00 pm ET. The greenback is likely to find

resistance around the 0.69 level.

The greenback held steady against the pound, after having risen

to 1.3057 at 4:15 am ET. The pair had ended yesterday's trading at

1.3082.

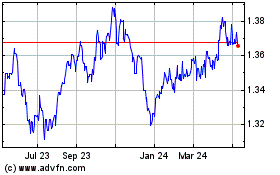

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

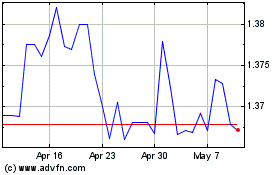

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024