Companies Take a Piecemeal Approach to Automation Tech

April 04 2019 - 1:14PM

Dow Jones News

By Angus Loten

The growth of artificial intelligence, robotics and other

next-generation automation technologies are prompting some

corporate leaders to ask age-old business questions: How much

should we pay for this? And who is in charge?

These and other issues are among the obstacles to fully

deploying such tools cited by nearly 600 chief information

officers, tech and business directors, and other C-suite executives

surveyed by KPMG LLP.

Together they represent firms in a range of industries

world-wide, each with $1 billion or more in revenue -- including

nearly two dozen with revenue above $10 billion, according to

KPMG.

Roughly 30% said their companies have allocated $50 million or

more to smart automation projects, and more than half have already

spent at least $10 million. The initiatives include various

combinations of robotic process automation, artificial

intelligence, machine learning, cognitive computing and

analytics.

"Once a foundational investment is made in tools, staffing,

process redesign and core infrastructure including cloud, they can

be applied across a wide-ranging scope of applications and

functions to achieve scale," Cliff Justice, KPMG's head of

intelligent automation, told CIO Journal.

So far, funding is being channeled into corporate finance and

accounting functions, followed by group benefits strategies and

compliance, and industry-specific core operations, the survey

found. Other areas included supply chain and procurement and human

resources.

More than half of the officials surveyed said their firm's key

strategic goal for implementing these tools is to improve or

streamline customer services and front-office effectiveness.

Roughly a quarter said their goal is to drive revenue growth.

Yet most of these efforts are still in the pilot-project phase.

Only 17% of surveyed officials said their firms have smart

automation technologies operating at full scale. As many as 30%

haven't begun investing in smart technologies or are unsure of

their plans.

Among the top three obstacles identified as holding back full

deployments was a lack of resources -- from storage to staffing --

necessary to build up smart technologies, the survey found.

Efforts also suffer through "inadequate change management and

governance, lack of senior management sponsorship or lack of

alignment of AI goals with overall corporate objectives," Mr.

Justice said.

Similarly, the next biggest hurdles were uncertainty about the

amount of spending needed to make these deployments worthwhile,

followed by a lack of "organizational clarity and accountability"

to drive implementation projects.

That is prompting many companies to take a more piecemeal

approach to smart automation, the survey found.

"The more 'moonshot' approaches to artificial intelligence or

smart technologies have been cooling off over the last two years,"

said Craig Le Clair, vice president and principal analyst at

Forrester Inc. for enterprise architecture and business process

professionals.

He said large deployments often require data science and machine

learning expertise -- adding to recruiting costs -- while tending

to have less clear timelines or business objectives.

Instead, many firms are finding a better return on investments

in limited deployments of smart-tech building blocks, such as bots

that mimic and replace low-value and repetitive tasks, Mr. Le Clair

said.

Because smart-tech projects typically span different corporate

divisions, they can include multiple corporate leaders.

The survey found that 43% of smart technologies deployments are

led by IT units, and less than one-fifth involved IT and business

units working together. "This scenario makes for a less than ideal

outcome if a limited number of departments actually get involved,"

KPMG said.

Michael Clementi, vice president of human resources for North

America at Unilever PLC, said the key to successfully deploying

smart technologies is getting people from across the business to

work together.

Unilever recently used an AI-enabled application to identify

promising job applicants, replacing a monthslong college-recruiting

process.

Rather than lead smart-tech projects, chief executives and other

top company officials should identify business problems that need

to be solved. Tech and business unit leaders can then get together

to assess the ability of smart tools to fix those problems, he

said.

"There's a big conversation constantly about how we can

fast-track this technology," Mr. Clementi said this week at the WSJ

Pro Artificial Intelligence Executive Forum.

Write to Angus Loten at angus.loten@wsj.com

(END) Dow Jones Newswires

April 04, 2019 12:59 ET (16:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

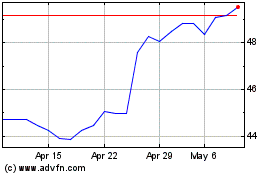

Unilever (EU:UNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

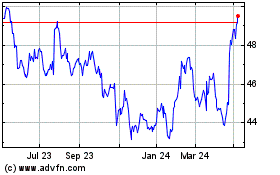

Unilever (EU:UNA)

Historical Stock Chart

From Apr 2023 to Apr 2024