Michelin : Investor Day: Michelin reaffirms its growth strategy, confirms its ambitious objectives for 2020 and announces sha...

April 04 2019 - 9:59AM

PRESS

RELEASE

Almeria - April 4, 2019

COMPAGNIE GÉNÉRALE

DES ÉTABLISSEMENTS MICHELIN

At its Investor Day, Michelin reaffirms its growth

strategy, confirms its ambitious objectives for 2020 and announces

a €500 million share buyback program between 2019-2023

Following an introduction by

Jean-Dominique Senard, Chief Executive Officer, reminding

participants of the Group's sustained progress over the years,

Florent Menegaux, Managing General Partner, reviewed the four

domains of growth addressed by the strategy presented in 2016.

-

Tires, the Group's core business: the Group's

ability to innovate, the strength of its brand and its broad market

access mean that it can offer increasingly higher performance

tires, perfectly aligned with each customer's needs.

-

Services and solutions: tire-related services,

connected mobility and fleet management solutions are helping to

deliver more efficient mobility for B2B customers.

-

Experiences: the curation businesses enable B2C

customers to enjoy outstanding mobility experiences while deepening

their affinity with the MICHELIN brand.

-

Expansion in high-tech materials: Mr. Menegaux

explained the growth outlook for Fenner, led by its expertise in

reinforced polymers. He also presented the two joint ventures in

metal 3D printing and hydrogen mobility with, respectively, Fives

Industrie and Faurecia, which will provide new sources of growth

beyond the 2020 plan.

Scott Clark, Executive Vice

President Automotive Business, Motorsports, Experiences, and

Vincent Rousset-Rouvière, Senior Vice President, Automotive

Original Equipment Business Line, described the growth dynamics in

the Tier 1 Passenger car and Light truck tire markets. The Group's

ability to innovate to meet the needs of OEMs, the power of the

MICHELIN brand and the enhanced market access to end-users were

presented as the Group's primary growth drivers in the most

profitable markets.

Serge Lafon, Executive Vice

President, Specialties Business, and Bruce Brackett, Senior Vice

President, Mining Business Line, reviewed the fundamentals

supporting structural growth in the mining and off-the-road

markets. They explained how Michelin's customer-focused

technological lead and Camso's contribution and close strategic fit

will help to deliver market share gains in these profitable

specialty businesses.

Marc Henry, Chief Financial

Officer, then confirmed that the 2020 targets for operating income,

the competitiveness plan, structural free cash flow and ROCE would

be met.

Yves Chapot, General Manager,

presented an initial overview of the Group's direction beyond 2020,

particularly the implementation of a new competitiveness plan with

higher targets for manufacturing performance and reductions in

overheads. The Group's growth, combined with competitiveness gains

and the optimization of inventory, will enable a sustained

improvement in structural free cash flow through 2025. Mr. Menegaux

confirmed the Group's dividend policy and announced the launch of a

€500 million share buyback plan for the 2019-2023 period.

In conclusion, Mr. Menegaux

reaffirmed the commitment of all Michelin employees to meeting the

Group's ambitious growth objectives in support of sustainable

mobility.

Investor Relations

Edouard de Peufeilhoux

+33 (0) 4 73 32 74 47

+33 (0) 6 89 71 93 73 (mobile)

edouard.de-peufeilhoux@michelin.com

Matthieu Dewavrin

+33 (0) 4 73 32 18 02

+33 (0) 6 71 14 17 05 (mobile)

matthieu.dewavrin@michelin.com

Humbert de Feydeau

+33 (0) 4 73 32 68 39

+33 (0) 6 82 22 39 78 (mobile)

humbert.de-feydeau@fr.michelin.com

|

Media Relations

Corinne Meutey

+33 (0) 1 78 76 45 27

+33 (0) 6 08 00 13 85 (mobile)

corinne.meutey@michelin.com

Individual Shareholders

Isabelle Maizaud-Aucouturier

+33 (0) 4 73 98 59 27

isabelle.maizaud-aucouturier@michelin.com

Clémence Rodriguez

+33 (0) 4 73 98 59 25

clemence.daturi-rodriguez@michelin.com

|

DISCLAIMER

This press release is not an offer to purchase or a

solicitation to recommend the purchase of Michelin shares. To

obtain more detailed information on Michelin, please consult the

documents filed in France with Autorité des Marchés

Financiers, which are also available from the https://www.michelin.com/en

website.

This press release may contain a

number of forward-looking statements. Although the Company believes

that these statements are based on reasonable assumptions as at the

time of publishing this document, they are by nature subject to

risks and contingencies liable to translate into a difference

between actual data and the forecasts made or inferred by these

statements.

20190404 Michelin PR Investor Day

Conclusion

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Michelin via Globenewswire

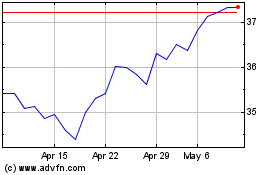

Michelin (EU:ML)

Historical Stock Chart

From Mar 2024 to Apr 2024

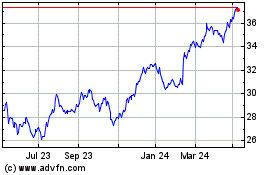

Michelin (EU:ML)

Historical Stock Chart

From Apr 2023 to Apr 2024