Bayer, J&J to Pay $775 Million to Settle Xarelto Litigation -- Update

March 25 2019 - 1:41PM

Dow Jones News

By Sara Randazzo

Bayer AG and Johnson & Johnson have agreed to pay $775

million to resolve claims that the blood thinner Xarelto causes

excessive bleeding, according to the companies.

The deal, reached with plaintiffs attorneys, will resolve 25,000

claims and is structured to limit liability going forward.

The two companies, which jointly developed the drug and will

evenly split the settlement cost, have won all six Xarelto cases

that have gone to trial so far.

Xarelto is Bayer's top-selling drug and remains on the market.

The companies aren't admitting liability as part of the deal, which

allows them to pull out if not enough eligible plaintiffs sign onto

it.

Bayer said Monday the settlement "allows the company to avoid

the distraction and significant cost of continued litigation" and

that it remains committed to the more than 45 million patients

world-wide who have been prescribed Xarelto.

Johnson & Johnson said "We believe this is the right thing

to do for patients and their doctors" and that they stand by the

safety of the drug.

Andy Birchfield, a lawyer at Beasley Allen who represents the

plaintiffs, said the elderly plaintiff population and a

warning-label change in 2015 that restricts future claims made now

the right time to settle. "This is really difficult and challenging

litigation," he said. "I think this provides fair compensation to

the claimants here."

The settlement resolves a legal headache for Bayer and Johnson

& Johnson, but several more remain for both companies.

Bayer is fighting claims that its popular weedkiller Roundup

causes non-Hodgkin lymphoma and other cancers; uncertainty over the

litigation and two adverse jury verdicts have depressed the

company's stock price. Other lawsuits challenge the safety of two

Bayer birth-control drugs.

Johnson & Johnson faces lawsuits claiming its talcum-based

baby powder causes cancer as well as claims over hip implants,

pelvic mesh and diabetes medication.

Plaintiffs' lawyers have flooded the airwaves in recent years

with television advertisements warning about the risks of Xarelto.

Approved in 2011, Xarelto belongs to a new generation of blood

thinners aiming to better balance keeping blood thin enough to

avoid clotting but sufficiently thick to prevent bleeding

episodes.

The lawsuits, which have accumulated mostly over the past five

or so years, claim the drugmakers played down Xarelto's risks,

resulting in injuries including internal bleeding, stroke and

death.

In light of the agreement, U.S. District Judge Eldon Fallon in

New Orleans on Monday halted litigation in his courtroom that had

consolidated thousands of Xarelto lawsuits filed in federal court.

The judge put in place extra burdens for anyone looking to pursue

claims outside the settlement process, including submitting a

report from a licensed physician supporting claims that injuries

were caused by Xarelto. Mr. Birchfield said he didn't expect many

new claims to be filed.

Under the settlement, payments will be substantially less for

anyone who was prescribed the drug after Dec. 1, 2015, when its

warning label changed, or for those whose first alleged injury came

after March 1, 2016. Payments are also capped for anyone

hospitalized for two or fewer consecutive days.

Xarelto has been a large revenue generator for Bayer, which is

looking to develop new drugs as the patents on Xarelto and other

top drugs are set to expire in coming years.

Write to Sara Randazzo at sara.randazzo@wsj.com

(END) Dow Jones Newswires

March 25, 2019 13:26 ET (17:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

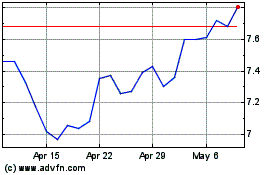

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

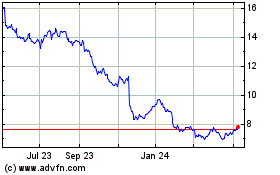

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024