Euro Falls As German, French Manufacturing Sectors Shrink Further

March 22 2019 - 3:08AM

RTTF2

The euro slipped against its major counterparts in the European

session on Friday, as the French and German manufacturing

activities contracted steeply in March, reflected by headwinds

arising from Brexit talks, U.S.-China trade dispute and soft global

demand.

Preliminary survey data from IHS Markit showed German flash

manufacturing PMI fell to a 79-month low of 44.7 from 47.6 in

February. Economists had forecast a reading of 48.0.

The flash Composite Purchasing Managers' Index, or PMI, dropped

to a 69-month low of 51.5 from 52.8 in the previous month.

Economists had forecast a score of 52.8.

The flash services PMI eased to a 2-month low of 54.9 from 55.3

in February. Economists were looking for a score of 54.8.

In France, the Composite PMI dropped to a 2-month low of 48.7

from February's 50.4. Economists had predicted a rise to 50.7.

The French services PMI fell to a 2-month low of 48.7 in March

from 50.2 in February. Economists had expected a reading of

50.6.

The manufacturing PMI slipped to a 3-month low of 48.8 in March

from 51.0 in the previous month. Economists were looking for a

score of 51.4.

European shares also fell as weak euro zone data rekindled

growth worries.

Traders remained focused on Brexit developments as well as the

next round of U.S.-China trade talks beginning next week, following

a series of conflicting reports over the progress of

negotiations.

The currency held steady against its major counterparts in the

Asian session, with the exception of the pound.

The euro declined to a 9-day low of 1.1289 against the greenback

and a 2-1/2-month low of 1.1232 against the franc, from its early

highs of 1.1391 and 1.1298, respectively. Next key support for the

euro is possibly seen around 1.11 against the greenback and 1.09

against the franc.

Reversing from its previous highs of 126.18 against the yen and

0.8684 against the pound, the euro weakened to an 11-day low of

124.78 and a 2-day low of 0.8614, respectively. On the downside,

122.00 and 0.84 are likely seen as the next support levels for the

euro against the yen and the pound, respectively.

The single currency slipped to 10-day lows of 1.5917 against the

aussie and 1.6428 against the kiwi and a 3-day low of 1.5106

against the loonie, reversing from its early highs of 1.6021 and

1.6542 and more than a 2-week high of 1.5214, respectively. Should

the euro weakens further, 1.57, 1.62 and 1.50 are possibly seen as

its next support levels against the aussie, the kiwi and the

loonie, respectively.

Looking ahead, Canada retail sales for January and consumer

inflation for February, as well as U.S. existing home sales for

February, wholesale inventories for January and Markit's services

PMI for March will be out in the New York session.

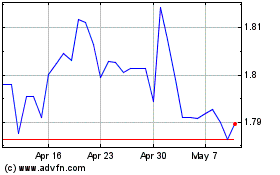

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024