Bank of Cyprus Holdings PLC Update on Project Helix (3441T)

March 19 2019 - 11:16AM

UK Regulatory

TIDMBOCH

RNS Number : 3441T

Bank of Cyprus Holdings PLC

19 March 2019

Announcement

Update on Project Helix - Agreement for the sale of a portfolio

of non-performing loans

Nicosia, 19 March 2019

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014

Further to the announcement of 28 August 2018(1) in relation to

the agreement for the sale of a portfolio of non-performing loans,

known as "Project Helix", or the "Transaction", Bank of Cyprus

Holdings Public Limited Company ("BOCH" and, together with its

subsidiaries, the "Group") announces that it has received approval

from the ECB for the Significant Risk Transfer ("SRT") benefit from

the Transaction.

This is an important step towards completion of the Transaction,

which remains subject to various outstanding conditions

precedent(1) . Completion is currently expected to occur in early

2Q2019.

As previously reported, the Transaction reduces the Group's

non-performing exposures (NPEs) by EUR2.7 bn and improves the NPE

ratio from 47% to 36%(3) . The NPE provisioning coverage ratio pro

forma for the Transaction stands at 47%(3) .

On completion, the derecognition of the Helix portfolio is

expected to have a positive impact on the capital ratios of 160

basis points(2) , resulting from the release of risk weighted

assets.

As at 31 December 2018, as previously reported, the Group's

phased-in CET1 ratio and Total capital ratio, pro forma for both

DTC(2) and Helix, stood at 15.4% and 18.3% respectively.

For further information, please contact Investor Relations at

investors@bankofcyprus.com.

[1] Further to the announcement of 28 August 2018 and updates

provided with the publication of the Group financial results for

the nine months ended 30 September 2018 and the preliminary Group

financial results for the year ended 31 December 2018

2 Refer to slide 36 of the presentation for the preliminary

Group financial results for the year ended 31 December 2018

published on 4 March 2019

3 Based on the preliminary Group financial results for the year

ended 31 December 2018

4 DTC refers to the amendments in the legislation adopted by the

Cyprus Parliament on 1 March 2019 and was published on the Official

Gazette of the Republic on 15 March 2019

Group Profile

The Bank of Cyprus Group is the leading banking and financial

services group in Cyprus, providing a wide range of financial

products and services which include retail and commercial banking,

finance, factoring, investment banking, brokerage, fund management,

private banking, life and general insurance. The Bank of Cyprus

Group operates through a total of 112 branches in Cyprus. Bank of

Cyprus also has representative offices in Russia, Ukraine and

China. The Bank of Cyprus Group employs 4,146 staff worldwide. At

31 December 2018, the Group's Total Assets amounted to EUR22.1 bn

and Total Equity was EUR2.4 bn. The Bank of Cyprus Group comprises

Bank of Cyprus Holdings Public Limited Company, its subsidiary Bank

of Cyprus Public Company Limited and its subsidiaries.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FURLLFLEVVIALIA

(END) Dow Jones Newswires

March 19, 2019 11:16 ET (15:16 GMT)

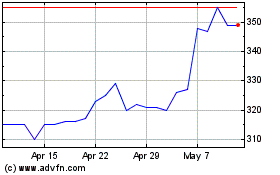

Bank Of Cyprus Holdings ... (LSE:BOCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

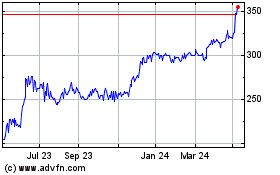

Bank Of Cyprus Holdings ... (LSE:BOCH)

Historical Stock Chart

From Apr 2023 to Apr 2024