EssilorLuxottica Slips as 2019 Vision Lacks Clarity -- Update

March 08 2019 - 6:08AM

Dow Jones News

(Adds analyst comments, share movement.)

--Shares in EssilorLuxottica slipped after the company released

combined 2018 figures for the newly merged Essilor and Luxottica

businesses

--The eyewear maker said net profit for the year fell on an

adjusted pro forma basis

--EssilorLuxottica's 2019 guidance and comments on its future

plans failed to dispel questions, analysts said

By Cristina Roca

Shares in EssilorLuxottica SA (EL.FR) traded lower Friday after

the company reported decreased 2018 net profit when adjusting for

the merger of its two constituent businesses, and set out goals for

the year ahead.

Reported net profit at the company--which was created in October

2018 when Italy's luxury eyewear maker Luxottica merged with

France's optical-lens manufacturer Essilor--was 1.16 billion euros

($1.31 billion). On an adjusted pro forma basis, net profit was

EUR1.87 billion, representing a 1.7% decline from 2017.

At 1032 GMT, EssilorLuxottica shares traded 5.3% lower at

EUR102.90.

The results are uneventful, but it is what comes next that

counts, Citi analyst Mauro Baragiola said.

For 2019, EssilorLuxottica said it expects sales to grow between

3.5% and 5% at constant-exchange rates. The company added that it

sees net profit for the period, adjusted for the expenses from the

Essilor-Luxottica combination and other special items, growing at

1-1.5 times the pace of sales growth.

Analysts' consensus expectations are around the top end of

EssilorLuxottica's guided range, which implies small downgrades to

estimates, Goldman Sachs analyst Veronika Dubajova said.

EssilorLuxottica's revenue guidance seems feasible, at least as

far as the low end of the targeted range is concerned, Mr.

Baragiola said. However, investors still run the risk of being

disappointed this year, as integrating the two companies might

prove more complicated than it seems on paper, he said.

The eyewear company said it was considering governance issues,

but gave no update on plans regarding its leadership, a topic that

has had investors concerned during the past few months. Questions

on how the new company will be structured also persist, Mr.

Baragiola said.

EssilorLuxottica said it expects synergies from the merger of

the two businesses to range from EUR420 million to EUR600 million

as a net yearly impact on its operating profit within the next five

years. The company also said it sees revenue synergies in the

EUR200 million to EUR300 million range.

EssilorLuxottica's reported revenue was EUR10.8 billion for

2018. On an adjusted pro forma basis, revenue for the year was

EUR16.16 billion, representing a 1.2% year-on-year decline.

EssilorLuxottica said that this represents 3.2% revenue growth at

constant-exchange rates, and that both the Essilor and Luxottica

businesses contributed to the result.

EssilorLuxottica reported separate 2018 figures for each of its

two constituent businesses. Essilor's 2018 revenue was EUR7.46

billion, up 0.8% from 2017. Luxottica's sales for the year were

EUR8.93 billion, down 2.8% from the year before due to currency

headwinds. Luxottica's net profit for the year was EUR900 million,

down 14% year-on-year, EssilorLuxottica said.

The company declared a dividend of EUR2.04 a share, to be

approved at its annual meeting on May 16.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

March 08, 2019 05:53 ET (10:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

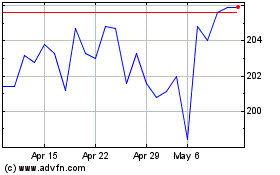

Essilorluxottica (EU:EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

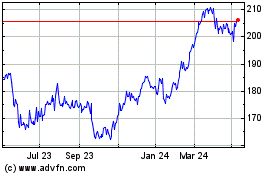

Essilorluxottica (EU:EL)

Historical Stock Chart

From Apr 2023 to Apr 2024