Efficiency: Name of the Game in Oil & Gas

February 28 2019 - 10:00AM

InvestorsHub NewsWire

Efficiency: Name of the Game in Oil

& Gas

February 28, 2019 -- InvestorsHub NewsWire -- Microcap

Speculators -- Federal Reserve Chairman Jerome Powell’s

testimony mentioned how oil and gas prices and the cost of just

about everything else that uses oil and gas has been pushed down by

the shale boom in West Texas, where drilling is getting ever more

efficient. For investors in the industry it is about finding

companies that are providing this efficiency, both in drilling and

on their balance sheets.

One company hitting this market, Camber Energy

(CEI), turned a nearly 30 million shareholders’ deficit

into $2.3 million of positive shareholders’ equity, increasing

liquidity and extinguishing debt.

Today we are highlighting: Camber Energy,

Inc. (CEI), Ensco plc. (NYSE:

ESV), Cenovus Energy, Inc. (CVE), Transocean Ltd. (NYSE:

RIG), and Antero Resources Corporation (NYSE:

AR).

We mentioned above that, Camber Energy, Inc. (CEI)

(Market Cap:

$5.489M,

Share Price:

$0.4352)

spent a lot of 2018 cleaning up the company and improving its

efficiency. Along with extinguishing shareholder debt, the

company completed a one-for-twenty-five reverse split stock, among

several other steps which is why CEI just received a letter from

the NYSE American about regaining compliance with several of the

NYSE American’s continued-listing standards.

Oil & Gas investors seeking competent fiscal management and

efficient operations should research CEI.

______

Ensco plc. (NYSE:

ESV) (Market Cap: $1.800B, Share Price:

$4.12) announced it will hold its fourth quarter and

full-year 2018 earnings conference call at 9:00 a.m. CT (10:00 a.m.

ET and 3:00 p.m. London) on Thursday, 28 February 2019. The

earnings release will be issued before the New York Stock Exchange

opens that morning.

______

Cenovus Energy Inc. (CVE) (Market Cap:

$11.243B, Share Price: $9.15) announced it would cut

its capital spending for 2019 by 4 % amid a broader turnaround

plan, but raised its oil sands production forecast. The

company said it plans to invest between C$1.2 billion ($901.1

million) and C$1.4 billion in 2019 with the majority of the budget

going to its Foster Creek and Christina Lake oil sands

operations.

______

Transocean Ltd. (NYSE:

RIG) (Market Cap: $5.026B, Share Price:

$8.24) recently announced their 4Q numbers despite

revenue increasing compared with this time last year; the numbers

were seen as lackluster. The most impressive number is the

company’s respectable EBITDA margin despite much lower contract

rates and a 62% fleet utilization rate.

______

Antero Resources Corporation (NYSE:

AR) (Market Cap: $2.774B, Share Price: $8.99)

also released its 4Q numbers recently and faired a touch better

than RIG. AR’s output topped the 3 billion cubic feet

equivalent per day (Bcfe/d) mark for the quarter, which was a

record for the company. Overall, production surged 18% sequentially

and 37% year over year. The company produced an average of

162,077 barrels per day for the quarter, which was up 51% compared

with the prior-year period.

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a six-month term

consulting agreement with CEI dated 11/15/18. The agreement

calls for $28,000 in cash, and 200,000 restricted 144 shares of CEI

per month. All payments were made directly by Camber Energy, Inc.

to Regal Consulting, LLC. to provide investor relations services,

of which this article is a part of. Regal Consulting also

paid one thousand dollars cash to microcapspeculators.com to

distribute this article. Regal Consulting may have a position

in the securities mentioned in this article at the time of

publication, and may increase or decrease its position without

notice. This article is based on public information and the

opinions of Regal Consulting. CEI was given an opportunity to edit

this article. This article contains forward-looking statements that

are subject to certain risks and uncertainties that could cause

actual results to differ materially from any results predicted

herein. Regal Consulting is not registered with any financial

or securities regulatory authority, and does not provide or claim

to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Microspeculators.com Full Legal Disclaimer Click Here.

Contact Information:

Company Name: Microcap Speculators

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

Website: http://microcapspeculators.com/

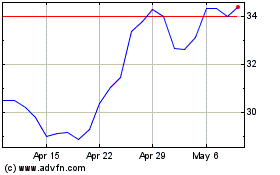

Antero Resources (NYSE:AR)

Historical Stock Chart

From Mar 2024 to Apr 2024

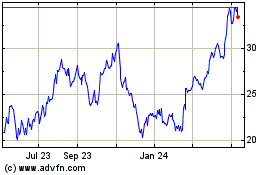

Antero Resources (NYSE:AR)

Historical Stock Chart

From Apr 2023 to Apr 2024