ECB Preparing New Long Term Loans For Banks: Minutes

February 21 2019 - 4:49AM

RTTF2

European Central Bank policymakers acknowledged that the

uncertainty surrounding the euro area growth and inflation outlook

has risen recently, thus raising the need for significant stimulus,

possibly in the form of a new batch of longer term loans for banks

to boost lending to the real economy, minutes of the January 23-24

policy session showed on Thursday.

"There was wide agreement that the continued convergence of

inflation to the Governing Council's aim in the period ahead still

required an ample degree of monetary accommodation," the ECB said

in the minutes, which it calls "account of the monetary policy

meeting". In January, the bank left its key interest rates and

forward guidance unchanged. In December, the bank ended its

four-year long massive asset purchase scheme of EUR 2.6

trillion.

Policymakers agreed that the risks to the euro area outlook had

moved to the downside on account of the persistence of

uncertainties related to geopolitical factors and the threat of

protectionism, vulnerabilities in emerging markets and financial

market volatility.

Recent data and survey outcomes have continued to be weaker than

expected, but policymakers saw the need for more information for a

thorough assessment of the implications of weaker growth for the

medium term inflation outlook. "Looking ahead, a key question was

seen to be the extent to which the weaker growth momentum might

turn out to be more persistent than currently envisaged," the

minutes said. "More information, including the March projections,

was needed to deepen the analysis and obtain greater clarity before

conclusions could be drawn about the medium-term inflation

outlook."

While considering the available policy options, the Governing

Council discussed the re-launch of cheaper longer-term loans under

the earlier scheme called Targeted Long-Term Refinancing

Operations, or TLTRO.

"While any decisions in this respect should not be taken too

hastily, the technical analyses required to prepare policy options

for future liquidity operations needed to proceed swiftly," the

minutes said.

Under the ECB's earlier tool named the targeted longer-term

refinancing operations, or TLTRO, the ECB gives longer-term loans

to financial institutions at attractive rates to boost lending in

the real economy.

Previously, the ECB launched two rounds of TLTROs - the first in

June 2014 and the second one in March 2016. The maturity period for

those loans was four years.

The next ECB Governing Council policy session is on March 7. The

latest set of ECB Staff macroeconomic projections would be unveiled

in that session.

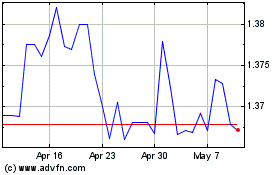

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

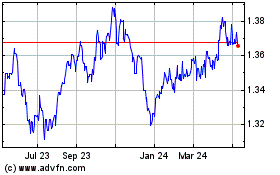

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024