Euro Lower Amid Spanish Political Uncertainty

February 15 2019 - 1:16AM

RTTF2

The euro was lower against its most major counterparts in early

European deals on Friday, after Spanish Prime Minister Pedro

Sanchez called for a snap national election in April following a

budget defeat in Parliament on Wednesday.

The snap election is set to take place on April 28.

Sanchez's announcement came two days after his minor Socialist

government had lost a vote on its budget, when two separatist

Catalan parties withdrew their support because of the PM's refusal

to discuss the region's right to self-determination.

Sanchez's Socialists, which holds just 84 seats in the 350-seat

lower house, had been reliant on the support of Basque and Catalan

nationalist parties since assuming power in June 2018.

Opinion polls project that no single party is likely to get a

clear majority.

Figures from the statistical office Eurostat showed that

Eurozone's merchandise trade surplus came in below economists'

expectations for December.

The seasonally adjusted trade surplus fell to EUR 15.6 billion

from EUR 15.8 billion in November. Economists had expected a

surplus of EU R16.3 billion.

Exports decreased 0.1 percent month-on-month, while imports were

unchanged.

The euro dropped to 1.1268 against the greenback, from a high of

1.1297 seen at 7:00 pm ET. The next possible support for the euro

is seen around the 1.10 region.

The euro depreciated to 0.8792 against the pound from Thursday's

closing value of 0.8821. The euro is poised to find support around

the 0.86 level.

Data from the Office for National Statistics showed that UK

retail sales rebounded strongly at the start of the year, rising at

a faster-than-expected pace, led by robust clothing and footwear

sales supported by price cuts.

Retail sales including auto fuel rose 1 percent from December,

when they decreased 0.7 percent. Economists had expected a 0.2

percent gain.

The single currency weakened to a 4-day low of 124.25 against

the yen and held steady thereafter. At yesterday's close, the pair

was worth 124.76.

After falling to a 3-day low of 1.1338 against the Swiss franc

at 2:30 am ET, the euro recovered to 1.1357 in subsequent deals.

Next key resistance for the euro is likely seen around the 1.15

level.

Looking ahead, Canada existing home sales for January, U.S.

export and import prices and industrial production for the same

month, New York Fed's empire manufacturing survey and University of

Michigan's preliminary consumer sentiment index for February are

slated for release in the New York session.

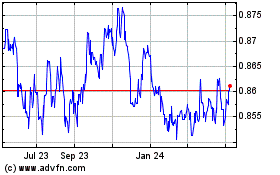

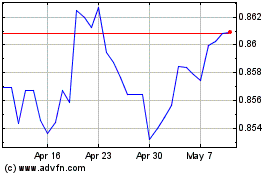

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024