PRESS

RELEASE

Clermont-Ferrand, February 11, 2019

COMPAGNIE GÉNÉRALE

DES ÉTABLISSEMENTS MICHELIN

Financial information for the year ended December

31, 2018

2018: in a challenging environment, €2,775 million

in segment operating income*, up €304 million or 11% at constant

exchange rates

€1,274 million in structural free cash

flow

2019: sustained growth in segment operating

income, even before the additional contribution from

acquisitions

-

Sales up 4.1% at constant

exchange rates.

-

Volumes up 0.9%: after

declining in the first quarter, volumes rose by 2% over the

following nine months, in markets disrupted by the

contraction in Chinese and original equipment Passenger car tire

segment demand

-

Sustained fast growth in the

Specialty businesses.

-

Further market share gains in

the 18" and larger Passenger car tire segment.

-

2.7% rebound in Truck tire

volumes in the second half.

-

The price-mix/raw materials

effect added a net €286 million, as expected.

-

The price effect totaled €255

million, confirming disciplined price management.

-

The mix effect was a very

strong €189 million, led by the growth in 18'' and larger tire

sales, the Specialty businesses and the smaller percentage of OE

business in the sales mix.

-

Priority focus was maintained

on protecting margins, particularly in markets impacted by steep

currency declines against the euro.

-

Unfavorable currency effect,

totaling a negative €271 million.

-

Competitiveness plan stepped up

in the second half, lifting total savings to €317 million for the

year and offsetting the impact of a higher inflation cost (up €38

million year-on-year).

-

€1,274 million in

structural free cash flow, confirming the Group's commitment to

improvement.

-

Faster acquisitions-led growth

(Fenner and Camso), in line with Group strategy, and greater access

to the North American market (TBC joint venture).

-

Proposed dividend of €3.70 per

share, representing a payout of 36.4% of consolidated net income

before non-recurring items.

Jean-Dominique

Senard, Chief Executive Officer, said: "In 2018, in a difficult

economic environment, Michelin demonstrated its ability to increase

operating income and sustain the improvements in structural free

cash flow achieved in recent years. The year

also saw faster deployment of the Group's strategy, with the

acquisitions of Fenner and Camso, and the creation of the TBC

wholesaling joint venture in the United States. These transactions

have strengthened the Group in key markets and provided new

opportunities to create value."

In 2019, the

Passenger car and Light truck tire markets are expected to be

mixed, with modest growth in the Replacement segment and a

contraction in the Original Equipment segment. Truck tire markets

are expected to remain stable overall, given the decline in demand

in China, while the Mining, Aircraft and Two-wheel tires markets

should remain dynamic. Based on January 2019 exchange rates,

the currency effect is expected to have a slightly favorable impact

on segment operating income. The impact of raw materials costs is

currently estimated at around a negative €100 million.

In this

environment, Michelin's objectives for 2019 are: volume growth in

line with global market trends; segment operating income exceeding

the 2018 figure at constant exchange rates and before the estimated

€150 million contribution from Fenner and Camso; and structural

free cash flow of more than €1.45 billion.**

* Formerly known as operating income from

recurring activities, segment operating income is the performance

metric for the reporting segments. It is stated before the

amortization of brands and customer lists recognized on the

acquisition of the corresponding companies, which is included in

other operating income and expenses.

** Of which €150 million from the application of IFRS 16

| (in € millions) |

2018 |

2018 at 2017 exchange rates |

2017 |

Sales |

22,028 |

22,866 |

21,960 |

| Segment operating income1 |

2,775 |

3,046 |

2,742 |

Segment operating margin |

12.6% |

13.3% |

12.5% |

Automotive &

related distribution |

11.6% |

12.3% |

12.3% |

Road transportation &

related distribution |

8.8% |

9.7% |

8.1% |

Specialty businesses &

related distribution |

19.6% |

20.2% |

19.6% |

| Other operating income and expenses |

(225) |

|

(111) |

Operating income |

2,550 |

|

2,631 |

Net income |

1,660 |

|

1,693 |

Segment EBITDA |

4,119 |

|

4,087 |

Capital expenditure |

1,669 |

|

1,771 |

Net debt |

3,719 |

|

716 |

Gearing |

31% |

|

6% |

Employee benefit obligations |

3,850 |

|

3,969 |

Free cash flow2 |

(2,011) |

|

662 |

Structural free cash flow3 |

1,274 |

|

1,509 |

ROCE4 |

14.0% |

|

13.0% |

Employees on payroll5 |

117,400 |

|

114,100 |

Earnings per share |

€9.30 |

|

€9.39 |

Dividend per share6 |

€3.70 |

|

€3.55 |

1Formerly known

as operating income from recurring activities, segment operating

income is the performance metric for the reporting segments. It is

stated before the amortization of brands and customer lists

recognized on the acquisition of the corresponding companies, which

is included in other operating income and expenses. In 2018,

amortization of acquired intangible assets amounted to €39 million

for the year.

2Free

cash flow: net cash from operating activities less net cash used in

investing activities and net cash from other current financial

assets, before distributions.

3Structural

free cash flow: free cash flow before acquisitions, adjusted for

the impact of changes in raw materials costs on trade payables,

trade receivables and inventories.

4ROCE excluding

goodwill, acquired intangible assets and associates & joint

ventures. 2017 standard tax rate of 31%; 2018 standard tax rate of

26%.

5At

period-end.

62018 dividend

to be submitted to shareholder approval at the Annual Meeting on

May 17, 2019.

Market

Review

2018/2017

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Central America |

Asia

(excluding India) |

South America |

Africa/ India Middle East |

Total |

Original equipment

Replacement |

- 2 %

+ 2 % |

- 2 %

+ 1 % |

- 1 %

+ 3 % |

+ 1 %

+ 4 % |

- 4 %

- 2 %

|

+ 3 %

- 8 % |

+ 4 %

+ 0 % |

- 2 %

+ 1 % |

Fourth quarter

2018/2017

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Central America |

Asia

(excluding India) |

South America |

Africa/ India Middle East |

Total |

Original equipment

Replacement |

- 7 %

+ 3 % |

- 8 %

+ 2 % |

+ 4 %

+ 4 % |

- 2 %

+ 7 % |

- 10 %

+ 1 % |

- 8 %

- 13 % |

- 10 %

+ 7 % |

- 7 %

+ 2 % |

*Including Turkey.

The global Original Equipment and

Replacement Passenger car and Light truck tire market was stable in

2018, with a slight 1% gain in the first half erased by a 1%

decline in the second, caused by the 5% drop in Original Equipment

demand.

-

In Europe, demand declined by 2% overall during

the year, reflecting the combined impact of (i) a 2%

contraction in Western Europe, pulled down by the drop in

automobile markets following implementation of the WLTP standards

on September 1, with Original Equipment demand down 6% in the

second half; and (ii) a robust 7% increase in Eastern Europe.

-

The North American market ended the year down

1%. After declining by 5% in the first half in the wake of the

contraction that began in second-half 2017, demand turned upwards

in the second six months for a 2% gain, lifted by strong growth in

automobile output off of favorable comparatives.

-

Demand in Asia (excluding India) tumbled 4%

overall in 2018, as the slight 1% gain in the first half was offset

by the sudden drop-off late in the year, which resulted in an 8%

decrease for the second half. The decline was primarily caused by

the downturn in the Chinese market, which swung from a 3% gain in

the first six months to a 13% plunge starting in July, due to the

highly uncertain economic environment created, in particular, by

the trade war with the United States. In the rest of the Asian

market, demand was down 1% for the year.

-

In Central America, Original Equipment demand

rose by 1% over the year, with brisk growth in the first half and a

slowdown in the second half.

-

The South American market rose 3% overall, with

an 10% gain in the first half followed by a 3% decline in the

second, dragged down by the crisis in Argentina and the uncertain

political environment in Brazil.

-

In the Africa/India/Middle East region, the

market rose by 4% overall, led by growth in India in the first

half.

-

The European market grew by 2% overall in 2018,

as demand rose by a vigorous 11% in Eastern Europe but only by a

weak 1% in Western Europe. The robust growth observed in Franceand,

Italy (up 5%), Poland and the Nordic countries (up 4%), and Spain

(up 3%) was amply offset by the impact of Brexit on the UK market

(down 5%) and by the crisis in Turkey (down 9%). Sales of

All-Season tires remained firm throughout the year, acting as the

primary driver of market growth in Europe.

-

In a favorable economic environment, demand in

North America rose by 3% overall, with an acceleration in the

second half (to 4% from 2% in the first half) fueled by a surge in

Chinese tire imports ahead of the introduction of additional import

duties.

-

In Asia (excluding India), demand ended the year

down 2% overall. After remaining relatively flat in the first half

(down 1%), the market weakened, losing 2% in the second half as the

6% contraction in China was partially offset by a 2% increase in

the rest of the region, led by Japan (up 2%) and South Korea (up

3%).

-

The Central American market rose by 4% over the

year, with Mexico driving a much faster performance in the second

half (up 7%).

-

In South America, demand fell 8% over the year

with a steep 13% plunge in the second half, reflecting the impact

of the recession in Argentina (down 18%) and the political and

economic instability in Brazil (down 15%).

-

In the Africa/India/Middle East region, demand

was stable for the year, with a 3% upturn in the second half

following on from a 2% decline in the first half. The robust 6%

growth in the Indian market was offset by a contraction in the

Middle East and Africa, due to political instability in certain

countries and weakness in the oil-price dependent economies.

2018/2017

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Central America |

Asia

(excluding India) |

South America |

Africa/ India Middle East |

Total |

Original equipment

Replacement |

+3%

+0% |

+4%

-2% |

+19%

+7% |

-8%

+4% |

-6%

-5%

|

+54%

+2% |

+10%

-1% |

+1%

-2% |

Fourth quarter

2018/2017

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Central America |

Asia

(excluding India) |

South America |

Africa/ India Middle East |

Total |

Original equipment

Replacement |

-1%

-1% |

+0%

-3% |

+28%

+5% |

+16%

+6% |

-4%

-8%

|

+31%

-4% |

+10%

-0% |

+3%

-4% |

*Including Turkey.

The number of new Truck tires sold

worldwide declined by 1% in 2018. After gaining 2% in the first

half, led by demand in North America, the market fell back 3% in

the second six months, reflecting strong headwinds from the 12%

drop in Chinese demand off of very high comparatives in an

uncertain economic environment.

-

Original equipment

-

In Europe, the Original Equipment market rose by

3% over the year. After a strong 6% showing in the first half, led

by demand in Germany (up 3%), Poland (up 24%) and Turkey (up 41%),

growth slowed significantly to just 1% in the second half due to

the downturn in Turkey and Poland. Demand remained flat in Eastern

Europe over the year.

-

In a highly favorable economic environment, the

North American market delivered very strong growth throughout the

year, for a 19% gain overall.

-

Demand in Asia (excluding India) contracted by

6% in 2018, with the Chinese market plunging 18% in the second half

alone due to an unfavorable basis of comparison and the highly

uncertain economic environment created by the trade war with the

United States. Demand in the rest of the region was shaped by the

3% decline in Japan, which was partially offset by vibrant growth

in the Indonesian market.

-

In South America, the market maintained the

rebound that began in 2017, soaring 54% on the back of strong

demand in Brazil.

-

The Africa/India/Middle East market rose by 10%

over the year, reflecting the 15% gain in Indian demand off of

favorable comparatives and a buoyant economic environment.

-

The European market was stable over the year.

After a 2% gain in the first half led by a 9% increase in Eastern

Europe, demand retreated by 2% in the second half due to the steep

fall-off in Turkey and Poland combined with robust 4% growth in

Eastern Europe.

-

Demand in North America rose by 7% overall,

lifted by the robust US economy and an increase in Chinese tire

imports late in the year ahead of the possible introduction of new

import duties. The Canadian market cooled by a slight 1% over the

year.

-

Replacement tire markets in Asia (excluding

India) retreated by 5% in 2018. After declining by 2% in the first

half, demand dropped another 8% in the second half, primarily due

to the collapse in the Chinese market caused unfavorable

comparatives and the uncertain economic environment created by the

trade war with the United States.

-

Demand in Central America ended the year up a

very strong 12% overall, despite modest 1% growth in the Mexican

market.

-

The South American market rose 2% overall, with

a 5% gain in the first half led by Brazil (up 8%) and

Argentina, followed by a 1% decline in the second half, reflecting

the slowdown to 3% growth in Brazil and the collapse of the

Argentine market.

-

In the Africa/India/Middle East region, new tire

demand edged back 1%, with (i) flat growth overall in India, where

radial tire sales advanced 12%; and (ii) a 1% decline in the Middle

East and African markets, where the political and economic

environment remains unstable.

-

Mining tires: the mining

tire market is still enjoying robust growth in demand from

international mining companies, oil companies and regional

mines.

-

Agricultural and Construction

tires: in the agricultural segment, growth in the Original

Equipment markets was mixed, while replacement demand was stable,

impacted in Europe by a sharp upturn in Asian imports. In

infrastructure, demand continued to trend upwards in both the

Original Equipment and replacement segments.

-

Two-wheel tires: motorcycle

markets experienced fast growth in both Europe and North America.

Demand in the commuting segment remains very strong in the new

markets.

-

Aircraft tires: led by the

increase in passenger traffic, the commercial aircraft tires market

is continuing to expand, with more pronounced gains in the radial

segment.

Sales stood at €22,028 million for

the year ended December 31, 2018, up 0.3% from 2017 due to the

combined impact of the following factors:

- a 0.9% or €195 million increase from

higher volumes and a €267 million increase from changes in the

scope of consolidation (mainly the consolidation of Fenner PLC over

seven months and the deconsolidation of the TCi chain following the

creation of the TBC joint venture with

Sumitomo Corporation).

- a €444 million increase from the highly

favorable price-mix effect. Prices added €255 million, thanks to

(i) the full-year impact of the price increases introduced in 2017

in non-indexed businesses to offset the impact of higher raw

materials costs, as part of the Group's disciplined price

management; and (ii) the €10 million contribution over the

year from price adjustments in the businesses subject to raw

materials indexation clauses. The mix effect added another €189

million, reflecting the still highly positive product mix, the

favorable impact of the rebound in the mining tire business and the

decline in the percentage of Original Equipment business in the

sales mix.

- a €838 million decrease from the

unfavorable currency effect, primarily stemming from

US dollar/euro rates in the first half and to the currency

crises in Argentina, Turkey and other emerging markets in the

second part of the year.

Segment operating

income amounted to €2,775 million or 12.6% of sales, versus

€2,742 million and 12.5% in 2017.

The 2018 performance reflected (i)

a €56 million increase from changes in the scope of consolidation

following the inclusion of Fenner PLC over the last seven months of

the year and the deconsolidation of TCi; (ii) a €57 million

increase from the 0.9% growth in volumes; (iii) a robust €444

million increase from the price-mix effect thanks to disciplined

price management, which cushioned (iv) the €158 million adverse

impact from raw materials costs. The €317 million increase in costs

was entirely offset by €317 million in competitiveness gains.

Depreciation and amortization expense rose by €40 million and

start-up costs by €41 million. Other factors totaled a negative €14

million for the year. Lastly, the highly unfavorable currency

effect trimmed €271 million from the reported figure.

The €225 million in net other

operating expenses corresponded primarily to the €146 million

provision for the closure of the Dundee plant, the €39 million in

amortization of acquired brands, and the costs of acquiring Fenner

and Camso.

In all, net

income came to €1,660 million.

Free cash flow ended the year at a

negative €2,011 million, a €2,673 million decline resulting from

the acquisitions of Fenner, A.T.U and Camso and the creation of the

TBC joint venture with Sumitomo Corporation. Based on this

free cash flow, less the payment of €637 million in dividends and

the €75 million in share buybacks, consolidated gearing stands at

31%, corresponding to net debt of €3,719 million.

On January 1, 2018, Michelin

introduced a new business organization, which has led to the

following changes in the reporting segments:

(1) Replacement Light truck tires

have been transferred from the Automotive segment (formerly

Passenger car and Light truck tires) to the Road transportation

segment (formerly Truck tires).

(2) Construction Truck tires have

been transferred from the Road transportation reporting segment to

the Specialty businesses segment.

| In €

millions |

Sales |

Segment operating income |

Segment operating margin |

| |

2018 |

2017 |

2018 |

2017 |

2018 |

2017 |

|

Automotive & related distribution |

11,340 |

11,953 |

1,314 |

1,465 |

11.6% |

12.3% |

| Road

transportation & related distribution |

5,852 |

5,946 |

513 |

483 |

8.8% |

8.1% |

| Specialty

businesses & related distribution |

4,836 |

4,061 |

948 |

794 |

19.6% |

19.6% |

Group |

22,028 |

21,960 |

2,775 |

2,742 |

12.6% |

12.5% |

- Automotive & related

distribution

Sales in the Automotive and

related distribution segment declined by 5.1% to

€11,340 million, from €11,953 million in 2017, mainly due to a

scope effect (TCi deconsolidation) and adverse movements in

exchange rates.

Segment operating income amounted

to €1,314 million or 11.6% of sales, versus €1,464 million and

12.3% the year before.

The decline in segment operating

margin was primarily due to adverse movements in exchange rates.

The steady enhancement in the product mix, reflecting (i) the

sustained success of the MICHELIN lines, particularly the MICHELIN

Primacy 4, MICHELIN CrossClimate +, X Ice North 4 and Alpin

6.tires, and (ii) the strong growth in the 18'' and larger segment

(up 10% in a market up 9%), as well as the disciplined pricing

policy pursued throughout the year all helped to more than offset

the decline in volumes.

- Road transportation &

related distribution

Sales in the Road transportation

and related distribution segment amounted to €5,852 million in

2018, a 1.6% decline from the €5,946 million reported the year

before.

Segment operating income came to

€513 million or 8.8% of sales, compared with €483 million and 8.1%

in 2017.

The improvement was led by a

strong price-mix effect, which amply offset the highly unfavorable

currency effect. New products and services continued to be

introduced over the period, which was shaped by the success of the

BFGoodrich lines in Europe and of the MICHELIN Agilis CrossClimate

light truck and van tires.

- Specialty businesses &

related distribution

Sales by the Specialty businesses

segment stood at €4,836 million for the year, up 19.1% from €4,061

million in 2017.

Segment operating income amounted

to €948 million or 19.6% of sales, versus €794 million and 19.6%

the year before.

The increase in segment operating

income corresponded to the robust growth in volumes led by the

sustained rebound in demand for the Group's mining tires, the solid

performance of the other businesses, the consolidation of Fenner

over the last seven months of the year, and a strong price-mix

effect that offset unfavorable exchange rate movements.

Compagnie Générale des Établissements

Michelin

Compagnie Générale des

Établissements Michelin ended the year with net income of €813

million, compared with net income of €1,029 million in 2017.

The financial statements were

presented to the Supervisory Board at its meeting on February 8,

2019. An audit was performed and the auditors' reports on the

consolidated and company financial statements were issued on

February 11, 2019.

The Chief Executive Officer will

call an Annual Shareholders Meeting on Friday, May 17, 2019 at

9:00 am in Clermont-Ferrand. He will ask shareholders to

approve the payment of a dividend of €3.70 per share, compared with

€3.55 in respect of the previous year.

The Group is planning to simplify

its legal structure by the first half of 2020, subject to obtaining

the necessary agreements.

As part of this streamlining

process, the Group's external financing operations would be

transferred to Compagnie Générale des Établissements Michelin, the

Group's parent company, while intra-group financing transactions

would be retained by a dedicated subsidiary.

In addition, all of the

international subsidiaries and affiliates would be consolidated by

Compagnie Générale des Établissements Michelin, as is already the

case for the French subsidiaries and affiliates.

2018 non-financial ratings

In 2018, Michelin was included in

several non-financial performance indices in recognition of its

sustainable development and mobility approach:

VigeoEiris -

Michelin was ranked number 1 for environmental, social and

governance (ESG) performance in the automotive industry and number

10 worldwide (out of more than 4,000 companies).

EcoVadis -

Michelin achieved a "Gold CSR Rating" for its environmental,

social, Human rights and sustainable purchasing policies.

CDP Climate

Change - Included in the "Climate Change A List 2018", Michelin

is one of 127 companies worldwide recognized as being pioneers

in the fight against climate change. More than 7,000 companies

were assessed by the CDP in 2018.

CDP Supply

Chain - Michelin was named "Supplier Engagement Leader 2019"

for its initiatives and strategy to support the energy transition

in its supply chain.

These ratings are testimony to

Michelin's unwavering commitment to sustainable mobility and

development.

-

Michelin and Sumitomo Corporation create the

second largest tire wholesaler in the United States and Mexico by

folding their wholesale and retail operations into a 50/50 joint

venture. (January 3, 2018)

-

Successful non-dilutive convertible 2023 bond

issue. (January 5, 2018)

-

Market launch of the MICHELIN Primacy 4 in

Europe. (January 2018)

-

Mobivia, the European leader in multi-brand

vehicle servicing and parts, joins forces with Michelin to expand

its A.T.U chain in Germany, Switzerland and Austria by selling the

Group a 20% stake in the chain. (February 12, 2018)

-

Implementation of the partial share buyback

management agreement. (February 14, 2018)

-

Launch of the MICHELIN AGILIS CrossClimate light

truck and van tire. (February 22, 2018)

-

The MICHELIN Road 5 high-tech Sport Touring

tire. (February 22, 2018)

-

CFAO and Michelin team up to market high-quality

tires in Kenya and Uganda. (March 21, 2018)

-

MICHELIN's MyBestRoute app wins the SITL

Technologies and Information Systems Innovation Award. (March 22,

2018)

-

MICHELIN X Multi Energy tire fuel saving for

regional transport. (April 10, 2018)

-

Jean Dominique Senard's succession plan: to

prepare for the end of the Chief Executive Officer's term of office

at the close of the 2019 Annual Meeting, shareholders at the May

18, 2018 Annual Meeting elected Florent Menegaux as General

Managing Partner and Yves Chapot as Managing Partner.

-

Acquisition of Fenner PLC, a world leader in

conveyor belt solutions and reinforced polymer products. (May 31,

2018)

-

Total and Michelin join forces to launch an

ambitious worldwide road safety education program.

(May 30, 2018)

-

In 2048, MICHELIN tires will be made using 80%

sustainable materials and 100% of tires will be recycled. (May 31,

2018)

-

Movin'On - Engaged, innovative leaders and

executives convene in Montreal for the second edition of the global

sustainable mobility summit. (June 1, 2018)

-

Michelin and Maxion Wheels receive a 2018 CLEPA

Innovation Award for the ACORUS Flexible Wheel. (June 18,

2018)

-

MICHELIN Track Connect, the first fully

networked solution for car tires, wins the 2018 Creative Prize at

the Tire Cologne trade fair. (June 18, 2018)

-

First edition of the MICHELIN guide Guangzhou.

(June 26, 2018)

-

Successful three-tranche bond offering for a

total amount of €2.5 billion. (August 29, 2018)

-

Michelin announces the launch of a new employee

share ownership plan. (September 17, 2018)

-

In Singapore, Michelin receives the "Best of the

Best" award from Red Dot for its VISION concept. (September 28,

2018)

-

Michelin Man named "Icon of the Millennium."

(October 2, 2018)

-

Michelin launches the MICHELIN Alpin 6, the winter

tire that delivers lasting performance. (October 2, 2018)

-

Michelin presents sustainable mobility at Paris

Motorshow 2018 (October 2, 2018)

-

Michelin announces its intention to close its

Dundee plant in the United Kingdom in 2020 (November 5, 2018)

-

A new synthetic rubber plant in Indonesia for

the Group. (November 29, 2018)

-

Michelin completes the acquisition of Camso,

thereby strengthening its global leadership position in the

Specialty businesses (December 18, 2018)

A full

description of 2018 highlights

may be found on the Michelin website:

https://www.michelin.com/en

Presentation and

conference call

Full-year 2018 results will be reviewed with analysts and investors

during a presentation today, Monday, February 11, at 6:30 pm CET.

The event will be in English, with simultaneous interpreting in

French.

Webcast

The presentation will be webcast live on:

https://www.michelin.com/en/finance/

Conference call

Please dial-in on one of the following numbers from 6:20 pm

CET:

-

In France

+33 (0)1 70 71 01 59 (French) PIN code: 99794235#

-

In France

+33 (0)1 72 72 74 03 (English) PIN code:17692636#

-

In the United Kingdom

+44 (0) 207 194 3759 (English) PIN code:17692636#

-

In North America

+1 (844) 286 0643 (English) PIN code:17692636#

-

From anywhere else

+44 (0) 207 194 3759 (English) PIN code:17692636#

The presentation of financial

information for the year ended December 31, 2018 (press release,

presentation, financial report) may also be viewed at

https://www.michelin.com/en/, along with practical information

concerning the conference call.

Investor

calendar

-

Quarterly information for the

three months ended March 31, 2019: Wednesday,

April 24, 2019 after close of trading

Investor Relations

Édouard de Peufeilhoux

+33 (0) 4 73 32 74 47

+33 (0) 6 89 71 93 73 (mobile)

edouard.de-peufeilhoux@michelin.com

Matthieu Dewavrin

+33 (0) 4 73 32 18 02

+33 (0) 6 71 14 17 05 (mobile)

matthieu.dewavrin@michelin.com

Humbert de Feydeau

+33 (0) 4 73 32 68 39

+33 (0) 6 82 22 39 78 (mobile)

humbert.de-feydeau@michelin.com

|

Media Relations

Corinne Meutey

+33 (0) 1 78 76 45 27

+33 (0) 6 08 00 13 85 (mobile)

corinne.meutey@michelin.com

Individual Shareholders

Isabelle Maizaud-Aucouturier

+33 (0) 4 73 98 59 27

isabelle.maizaud-aucouturier@michelin.com

Clémence Rodriguez

+33 (0) 4 73 98 59 25

clemence.daturi-rodriguez@michelin.com

|

DISCLAIMER

This press release is not an offer to purchase or a

solicitation to recommend the purchase of Michelin shares.

To obtain more detailed

information on Michelin, please consult the documents filed in

France with Autorité des Marchés Financiers, which are also

available on our www.michelin.com website.

This press release may contain a

number of forward-looking statements. Although the Company believes

that these statements are based on reasonable assumptions as at the

time of publishing this document, they are by nature subject to

risks and contingencies liable to translate into a difference

between actual data and the forecasts made or inferred by these

statements.

20190211_PR_Michelin_FY Results

2018

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Michelin via Globenewswire

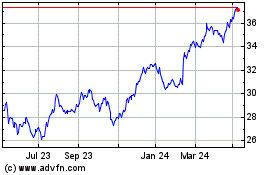

Michelin (EU:ML)

Historical Stock Chart

From Mar 2024 to Apr 2024

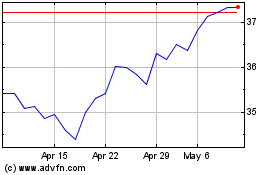

Michelin (EU:ML)

Historical Stock Chart

From Apr 2023 to Apr 2024