Amcor First-Half Underlying Profit Improves

February 10 2019 - 5:07PM

Dow Jones News

By David Winning

SYDNEY--Packaging company Amcor Ltd. (AMC.AU) reported improved

underlying earnings in its fiscal first half and stuck with

full-year guidance as it advanced a planned takeover of U.S.-based

Bemis Co. (BMS).

Amcor said its net profit totaled US$267.6 million in the six

months through December, down from US$329.7 million a year ago.

After stripping out the impact of currency swings, underlying

earnings improved by 3.4% to US$328.5 million, reflecting an

improvement in volumes in Amcor's North American beverages business

and earlier mergers-and-acquisitions activity boosting its

flexibles packaging business.

Directors declared an interim dividend of 21.5 U.S. cents a

share, up 2.4% from 21 cents a year ago.

Late last month, Amcor said its acquisition of plastic food

packaging company Bemis won't now close until the second quarter of

2019 due to the recent shutdown of the U.S. government. Amcor and

Bemis need U.S. antitrust approval, but the partial shutdown had

delayed the review of shareholder meeting documentation by the

Securities and Exchange Commission.

Amcor in August agreed to buy Bemis in a stock deal worth about

US$5.26 billion. Some analysts have questioned whether Bemis

shareholders will vote in favor of the deal, given the takeover

premium has narrowed since August due to the depreciation of the

Australian currency against the dollar and weakness in Amcor's

share price.

The delay in completing the deal has led investors to focus more

on trends within Amcor's existing business, including the outlook

for raw-material costs. Management has made savings on plant

construction and procurement, while also slowing capital spending,

to counter cost headwinds.

Amcor said raw-material prices shaved about US$5 million off

earnings in its flexible-packaging business in its fiscal first

half, since it takes some months before it can raise product prices

with customers.

Still, its flexibles business delivered a US$389.8 million

profit before interest and tax in the period, up slightly on a year

earlier after stripping out the impact of currency swings. That

improvement reflected earnings from acquired businesses and the

benefits of an earlier restructuring effort.

Management said growth in demand for plastic bottles from North

American drinks makers had continued, and this benefited its

rigid-plastics business. It reported a US$148.9 million profit

before interest and tax in this division for the half year.

"We remain on track to deliver against the full-year outlook we

provided in August 2018, which has not changed," Chief Executive

Ron Delia said. "In the 2019 financial year we expect both the

Flexibles and Rigids segments to achieve solid underlying earnings

growth in constant currency terms, and cash flow is expected to be

strong."

Management said it expects free cash flow between US$200 million

and US$300 million for the year.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

February 10, 2019 16:52 ET (21:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

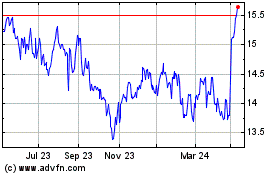

Amcor (ASX:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

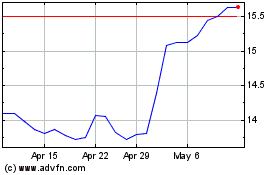

Amcor (ASX:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024