Australian Dollar Weakens As RBA Slashes GDP, Inflation Outlook

February 07 2019 - 10:10PM

RTTF2

The Australian dollar slipped against its major counterparts in

the Asian session on Friday, after the Reserve Bank of Australia

downgraded its growth and inflation forecasts in the wake of global

growth worries as well as recent weak domestic data, particularly

for consumption.

In its monetary policy statement, the RBA said that the global

economic uncertainties have increased, especially due to trade

tensions, and slowing demand growth in China.

The RBA revised down its GDP growth outlook to 3 percent over

this year and 2.75 percent over 2020. In its November statement,

the central bank had projected a growth of 3.25 percent for the

year-ended 2019 and 3 percent for the year-ended 2020.

Inflation outlook was trimmed to 1.75 percent over this year

from previous estimate of 2.25 percent. The bank retained its

inflation forecast at 2.25 percent for the year-ended 2020.

The inflation downgrade reflected lower growth and expected

near-term weakness in administered and utilities price inflation,

the bank said.

Asian shares fell as the absence of any positive signs for a

resolution in the U.S.-China trade row added to renewed concerns

about global growth.

Ahead of next week's crunch trade negotiations in Beijing, CNBC

reported that a Trump-Xi meeting is highly unlikely before a March

1 deadline, but the U.S. is likely to keep tariffs at 10 percent

rather than raise them to 25 percent as scheduled.

The report came after White House economic adviser Larry Kudlow

told Fox Business the U.S. and China have a "pretty sizable

distance to go" before reaching a trade deal.

The aussie declined to more than a 4-week low of 77.44 against

the Japanese yen, from a high of 78.01 hit at 5:15 pm ET. On the

downside, 76.00 is possibly seen as the next support level for the

aussie.

Data the Ministry of Finance showed that Japan logged a current

account surplus of 452.8 billion yen in December - shy of

expectations for a surplus of 458.5 billion yen and down from 757.2

billion yen in November.

The trade balance showed a surplus of 216.2 billion yen,

exceeding forecasts for 132.4 billion yen following the 559.1

billion yen deficit in the previous month.

The aussie dropped to a 5-week low of 0.7061 against the

greenback and more than a 4-week low of 1.6060 against the euro,

off its early highs of 0.7104 and 1.5955, respectively. The next

possible support for the aussie is seen around 0.69 against the

greenback and 1.62 against the euro.

The aussie retreated to 0.9406 against the loonie, from a 2-day

high of 0.9454 seen at 5:45 pm ET. If the aussie falls further,

0.93 is possibly seen as its next support level.

The Australian currency dipped to a 2-day low of 1.0471 against

the kiwi, moving away from an early more than 2-week high of

1.0535. The aussie is poised to test support around the 1.03

region.

Looking ahead, Canada housing starts for January are due at 8:15

am ET.

In the New York session, Canada jobs data for January is set for

release.

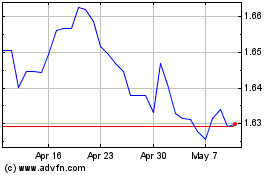

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024