UK Construction Growth Weakest In 10 Months

February 04 2019 - 3:24AM

RTTF2

UK construction growth eased further in January to its weakest

level in ten months, amid tepid growth in new orders that lead to

the weakest employment growth in more than two years, amid the

Brexit uncertainty, survey data from IHS Markit showed on

Monday.

The headline construction Purchasing Managers' Index fell to

50.6 from 52.8 in December. Economists had forecast a score of

52.5. A PMI reading above 50 suggests growth in the sector.

The index has posted above the 50.0 no-change mark in each month

since the snow related decline seen in March 2018, but the latest

expansion was the weakest seen over this ten month period of

growth, IHS Markit said.

New order growth was at an eight-month low in January, thanks to

softer demand conditions and longer sales conversion times. The

latter suggested a wait-and-see approach to spending by clients as

they wait for the uncertainty around Brexit to clear.

Slower order growth lead to the slowest expansion of employment

numbers for two-and-a-half years.

Several survey respondents noted that Brexit uncertainty had led

to hesitancy among clients and a corresponding slowdown in progress

on new projects, the survey said.

In January, all three categories of construction output recorded

weaker trends than those reported in December.

Residential work remained the strongest performing area despite

modest expansion in January which was the slowest since March 2018.

Civil engineering growth slowed sharply from December's 19-month

high.

The weakest performing area of construction was commercial work

with latest data suggesting a decline in work for the first time in

ten months.

Anecdotal evidence suggested that Brexit-related anxiety and

associated concerns about the domestic economic outlook continued

to weigh on client demand for commercial construction, IHS Markit

said.

The survey also showed that input buying growth slowed and

vendor performance was the joint-weakest since September 2016.

Input price inflation was the slowest since June 2016, largely

driven by rising prices for imported construction products and

materials.

Despite the recent weakness in growth, construction firms

remained positive about the outlook for business activity this year

with around 41 percent of the survey panel expecting a rise in

output and only 16 percent forecasting a fall. However, confidence

eased slightly from December.

Big civil engineering projects were cited as a key source of

optimism, while Brexit remained the main concern.

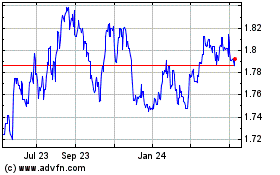

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

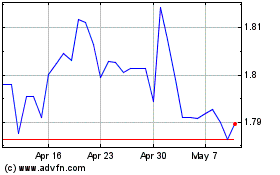

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024