Record total revenue of $84.7 million increases

by 31% year-over-year

GAAP operating income of $8.8 million and

record non-GAAP operating income of $21.0 million

Net cash provided by operating activities for

the nine months of $89.2 million

Deferred revenue of $136.0 million increases by

59% year-over-year

CyberArk (NASDAQ: CYBR), the global leader in privileged

access security, today announced record total revenue and

strong financial results for the third quarter ended September 30,

2018.

“We exceeded our financial outlook across all guided metrics,

while generating record revenue and non-GAAP operating income in

the third quarter,” said Udi Mokady, CyberArk Chairman and CEO.

“Our strong results reflect our success executing our growth

strategy across sales and marketing as well as delivering

innovative solutions that help strengthen customers’ overall

security posture on premises, in the cloud and across the DevOps

pipeline. Given our strong leadership position in the privileged

access security market and our performance year to date, we are

pleased to raise our full year guidance for 2018.”

Financial Highlights for the Third Quarter Ended September

30, 2018

Revenue:

- Total revenue was $84.7 million, a 31%

increase from $64.8 million in the third quarter of 2017.

- License revenue was $46.1 million, a

29% increase compared to $35.8 million in the third quarter of

2017.

- Maintenance and Professional Services

revenue was $38.5 million, a 33% increase from $29.0 million in the

third quarter of 2017.

Operating Income:

- GAAP operating income was $8.8 million

for the quarter, compared to $1.7 million in the third quarter of

2017.

- Non-GAAP operating income was $21.0

million for the quarter, compared to $10.7 million in the third

quarter of 2017.

Net Income:

- GAAP net income was $8.1 million, or

$0.22 per diluted share, compared to GAAP net income of $1.7

million, or $0.05 per diluted share, in the third quarter of

2017.

- Non-GAAP net income was $17.8 million,

or $0.48 per diluted share, compared to $8.9 million, or $0.25 per

diluted share, in the third quarter of 2017.

The tables at the end of this press release include a

reconciliation of GAAP to non-GAAP gross profit, operating income

and net income for the three months and nine months ended September

30, 2018 and 2017. An explanation of these measures is also

included below under the heading “Non-GAAP Financial Measures.”

Balance Sheet and Cash Flow:

- As of September 30, 2018, CyberArk had

$410.0 million in cash, cash equivalents, marketable securities and

short-term deposits. This compares to $330.3 million as of December

31, 2017 and $296.8 million at September 30, 2017.

- As of September 30, 2018, total

deferred revenue was $136.0 million, a 29% increase from $105.2

million at December 31, 2017 and a 59% increase from $85.6 million

at September 30, 2017.

- During the first nine months of 2018,

CyberArk generated $89.2 million in net cash provided by operating

activities, an increase of 100% from $44.6 million in the first

nine months of 2017.

Business Outlook

Based on information available as of November 7, 2018, CyberArk

is issuing guidance for the fourth quarter and increasing its

guidance for the full year 2018 as indicated below.

Fourth Quarter 2018:

- Total revenue is expected to be in the

range of $94.75 million to $96.25 million which represents 18% to

20% year-over-year growth.

- Non-GAAP operating income is expected

to be in the range of $27.3 million to $28.5 million, or an

operating margin of 29% to 30%.

- Non-GAAP net income per share is

expected to be in the range of $0.58 to $0.60 per diluted share.

This assumes 37.9 million weighted average diluted shares.

Full Year 2018:

- Total revenue is expected to be in the

range of $328.9 million to $330.4 million, which represents 26%

year-over-year growth.

- Non-GAAP operating income is expected

to be in the range of $78.0 million to $79.2 million, or an

operating margin of 24%.

- Non-GAAP net income per share is

expected to be in the range of $1.75 to $1.77 per diluted share.

This assumes 37.2 million weighted average diluted shares.

Conference Call Information

CyberArk will host a conference call on today, Wednesday,

November 7, 2018 at 4:30 p.m. Eastern Time (ET) to discuss the

company’s third quarter financial results and its business outlook.

To access this call, dial +1 844-237-3590 (U.S.) or +1 484-747-6582

(international). The conference ID is 2673547. Additionally, a live

webcast of the conference call will be available via the “Investor

Relations” section of the company’s web site at

www.cyberark.com.

Following the conference call, a replay will be available for

one week at +1 855-859-2056 (U.S.) or +1 404-537-3406

(international). The replay pass code is 2673547. An archived

webcast of the conference call will also be available in the

“Investor Relations” section of the company’s web site at

www.cyberark.com.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in privileged

access security, a critical layer of IT security to protect data,

infrastructure and assets across the enterprise, in the cloud and

throughout the DevOps pipeline. CyberArk delivers the industry’s

most complete solution to reduce risk created by privileged

credentials and secrets. The company is trusted by the world’s

leading organizations, including more than 50 percent of the

Fortune 100, to protect against external attackers and malicious

insiders. A global company, CyberArk is headquartered in Petach

Tikva, Israel, with U.S. headquarters located in Newton, Mass. The

company also has offices throughout the Americas, EMEA, Asia

Pacific and Japan. To learn more about CyberArk, visit

www.cyberark.com, read the CyberArk blogs or follow on Twitter via

@CyberArk, LinkedIn or Facebook.

Copyright © 2018 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Non-GAAP Financial Measures

CyberArk believes that the use of non-GAAP gross profit,

non-GAAP operating income and non-GAAP net income is helpful to our

investors. These financial measures are not measures of the

Company’s financial performance under U.S. GAAP and should not be

considered as alternatives to operating income or net income or any

other performance measures derived in accordance with GAAP.

- Non-GAAP gross profit is calculated as

gross profit excluding share-based compensation expense and

amortization of intangible assets related to acquisitions.

- Non-GAAP operating income is calculated

as operating income excluding share-based compensation expense,

acquisition related expenses, facility exit and transitions costs

and amortization of intangible assets related to acquisitions.

- Non-GAAP net income is calculated as

net income excluding share-based compensation expense, acquisition

related expenses, facility exit and transitions costs, amortization

of intangible assets related to acquisitions, intra-entity IP

transfer tax effect and the tax effect of the other non-GAAP

adjustments.

The Company believes that providing non-GAAP financial measures

that exclude share-based compensation, acquisition related

expenses, amortization of intangible assets related to

acquisitions, facility exit and transitions costs, intra-entity IP

transfer tax effect and the tax effect of the non-GAAP adjustments

allows for more meaningful comparisons of its period to period

operating results. Share-based compensation expense has been and

will continue to be for the foreseeable future, a significant

recurring expense in the Company’s business and an important part

of the compensation provided to its employees. Share based

compensation expense has varying available valuation methodologies,

subjective assumptions and a variety of equity instruments that can

impact a company’s non-cash expense. The Company believes that

expenses related to its acquisitions and amortization of intangible

assets related to acquisitions, facility exit and transitions cost

and intra-entity IP transfer tax effect do not reflect the

performance of its core business and impact period-to-period

comparability.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measure to evaluate its business.

Guidance for non-GAAP financial measures excludes, as

applicable, share-based compensation expense, acquisition related

expenses, facility exit and transitions costs, amortization of

intangible assets related to acquisitions, intra-entity IP transfer

tax effect and the tax effect of the other non-GAAP adjustments. A

reconciliation of the non-GAAP financial measures guidance to the

corresponding GAAP measures is not available on a forward-looking

basis due to the uncertainty regarding, and the potential

variability and significance of, the amounts of share-based

compensation expense, amortization of intangible assets related to

acquisitions, and the non-recurring expenses that are excluded from

the guidance. Accordingly, a reconciliation of the non-GAAP

financial measures guidance to the corresponding GAAP measures for

future periods is not available without unreasonable effort.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, performance or achievements to differ significantly

from the results, performance or achievements expressed or implied

by such forward-looking statements. Important factors that could

cause or contribute to such differences include risks relating to:

changes in the rapidly evolving cyber threat landscape; failure to

effectively manage growth; near-term declines in our operating and

net profit margins and our revenue growth rate; real or perceived

shortcomings, defects or vulnerabilities in the Company’s solutions

or internal network system, or the failure of the Company’s

customers or channel partners to correctly implement the Company’s

solutions; fluctuations in quarterly results of operations; the

inability to acquire new customers or sell additional products and

services to existing customers; competition from IT security

vendors; the Company’s ability to successfully integrate recent and

or future acquisitions; and other factors discussed under the

heading “Risk Factors” in the Company’s most recent annual report

on Form 20-F filed with the Securities and Exchange Commission.

Forward-looking statements in this release are made pursuant to the

safe harbor provisions contained in the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

made only as of the date hereof, and the Company undertakes no

obligation to update or revise the forward-looking statements,

whether as a result of new information, future events or

otherwise.

CYBERARK

SOFTWARE LTD. Consolidated Statements of Operations

U.S. dollars in thousands (except per share data)

(Unaudited)

Three Months Ended

Nine Months Ended September 30, September 30,

2017 2018 2017 2018 Revenues:

License $ 35,818 $ 46,130 $ 99,088 $ 125,745 Maintenance and

professional services 29,000 38,523 82,245 108,404

Total revenues 64,818 84,653 181,333 234,149

Cost of revenues: License 2,161 2,614 5,652 7,521 Maintenance and

professional services 8,801 9,530 24,577 27,619

Total cost of revenues 10,962 12,144 30,229 35,140

Gross profit 53,856 72,509 151,104

199,009 Operating expenses: Research

and development 11,369 14,980 30,144 41,772 Sales and marketing

32,877 37,880 90,055 107,983 General and administrative 7,927

10,870 22,214 29,483 Total operating

expenses 52,173 63,730 142,413 179,238

Operating income 1,683 8,779 8,691 19,771 Financial income,

net 816 1,407 2,491 3,473

Income before taxes on income 2,499 10,186 11,182

23,244 Tax benefit (taxes on income) (818 )

(2,092 ) 1,281 (352 ) Net income $ 1,681

$ 8,094 $ 12,463 $ 22,892 Basic

net income per ordinary share $ 0.05 $ 0.22 $ 0.36 $

0.64 Diluted net income per ordinary share $ 0.05 $

0.22 $ 0.34 $ 0.62 Shares used in computing

net income per ordinary shares, basic 34,979,389

36,485,724 34,703,328 35,981,177

Shares used in computing net income per ordinary shares, diluted

36,184,151 37,475,729 36,153,515

36,894,457

Share-based

Compensation Expense: Three Months Ended Nine

Months Ended September 30, September 30,

2017 2018 2017 2018 Cost

of revenues $ 701 $ 957 $ 1,658 $ 2,370 Research and development

1,775 2,237 4,607 5,748 Sales and marketing 2,459 3,770 6,148 9,061

General and administrative 2,267 3,371

6,230 8,492 Total share-based

compensation expense $ 7,202 $ 10,335 $ 18,643 $

25,671

CYBERARK

SOFTWARE LTD. Consolidated Balance Sheets U.S.

dollars in thousands (Unaudited) December 31,

September 30, 2017 2018

ASSETS CURRENT ASSETS: Cash and cash equivalents $

161,261 $ 205,247 Short-term bank deposits 107,647 127,695

Marketable securities 34,025 53,532 Trade receivables 45,315 29,707

Prepaid expenses and other current assets 7,407 8,413

Total current assets 355,655 424,594

LONG-TERM ASSETS: Property and equipment, net 9,230

13,596 Intangible assets, net 15,664 16,374 Goodwill 69,217 83,156

Marketable securities 27,407 23,544 Severance pay fund 3,692 3,669

Other long-term assets 2,368 21,379 Deferred tax asset

19,343 23,076 Total long-term assets

146,921 184,794

TOTAL ASSETS $ 502,576

$ 609,388

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES: Trade payables $ 1,960 $ 2,841

Employees and payroll accruals 25,253 25,861 Accrued expenses and

other current liabilities 10,209 7,623 Deferred revenues

66,986 84,176 Total current liabilities

104,408 120,501 LONG-TERM LIABILITIES:

Deferred revenues 38,249 51,838 Other long-term liabilities 242

1,218 Accrued severance pay 5,712 5,692

Total long-term liabilities 44,203 58,748

TOTAL LIABILITIES 148,611 179,249

SHAREHOLDERS' EQUITY: Ordinary shares of NIS 0.01 par

value 91 95 Additional paid-in capital 249,874 291,087 Accumulated

other comprehensive income (loss) 107 (577 ) Retained earnings

103,893 139,534 Total shareholders'

equity 353,965 430,139

TOTAL

LIABILITIES AND SHAREHOLDERS’ EQUITY $ 502,576 $ 609,388

CYBERARK SOFTWARE

LTD. Consolidated Statements of Cash Flows U.S.

dollars in thousands (Unaudited) Nine Months

Ended September 30, 2017 2018

Cash flows from operating activities: Net income $ 12,463 $

22,892 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 5,731 7,327

Amortization of premium on marketable securities 286 270

Share-based compensation expenses 18,643 25,671 Deferred income

taxes, net (3,387 ) (6,669 ) Decrease (increase) in trade

receivables (222 ) 15,608 Increase in prepaid expenses and other

current and long-term assets (578 ) (5,669 ) Increase (decrease) in

trade payables (913 ) 771 Increase in short term and long term

deferred revenues 12,074 34,298 Increase (decrease) in employees

and payroll accruals 384 (2,315 ) Decrease in accrued expenses and

other current and long-term liabilities (279 ) (3,031 ) Increase in

accrued severance pay, net 382 3

Net cash provided by operating activities 44,584

89,156

Cash flows from investing

activities: Investment in short and long term deposits (14,132

) (19,768 ) Investment in marketable securities (28,303 ) (47,316 )

Proceeds from maturities of marketable securities 13,217 31,198

Purchase of property and equipment (3,840 ) (7,130 ) Payments for

business acquisitions, net of cash acquired (41,329 )

(18,450 ) Net cash used in investing activities

(74,387 ) (61,466 )

Cash flows from financing

activities: Proceeds from withholding tax related to employee

stock plans - 2,220 Proceeds from exercise of stock options

2,080 14,038 Net cash provided by

financing activities 2,080 16,258

Increase (decrease) in cash, cash equivalents and restricted

cash (27,723 ) 43,948 Cash, cash equivalents and restricted

cash at the beginning of the period 174,156

162,518 Cash, cash equivalents and restricted cash at

the end of the period $ 146,433 $ 206,466

CYBERARK

SOFTWARE LTD. Reconciliation of GAAP Measures to Non-GAAP

Measures U.S. dollars in thousands (except per share

data) (Unaudited) Reconciliation

of Gross Profit to Non-GAAP Gross Profit: Three

Months Ended Nine Months Ended September 30,

September 30, 2017 2018 2017

2018 Gross profit $ 53,856 $ 72,509 $ 151,104 $

199,009 Plus: Share-based compensation - Maintenance &

professional services 701 957 1,658 2,370 Amortization of

intangible assets - License 1,195 1,444

3,030 4,118 Non-GAAP gross

profit $ 55,752 $ 74,910 $ 155,792 $ 205,497

Reconciliation of

Operating Income to Non-GAAP Operating Income: Three

Months Ended Nine Months Ended September 30,

September 30, 2017 2018 2017

2018 Operating income $ 1,683 $ 8,779 $ 8,691

$ 19,771 Plus: Share-based compensation 7,202 10,335 18,643 25,671

Amortization of intangible assets - Cost of revenues 1,195 1,444

3,030 4,118 Amortization of intangible assets - Sales and marketing

249 198 784 595 Acquisition related expenses - - 686 268 Facility

exit and transitions costs 342 253

342 253 Non-GAAP operating

income $ 10,671 $ 21,009 $ 32,176 $ 50,676

Reconciliation of Net Income to Non-GAAP

Net Income: Three Months Ended Nine Months

Ended September 30, September 30, 2017

2018 2017 2018 Net income $

1,681 $ 8,094 $ 12,463 $ 22,892 Plus: Share-based compensation

7,202 10,335 18,643 25,671 Amortization of intangible assets - Cost

of revenues 1,195 1,444 3,030 4,118 Amortization of intangible

assets - Sales and marketing 249 198 784 595 Acquisition related

expenses - - 686 268 Facility exit and transitions costs 342 253

342 253 Taxes on income related to non-GAAP adjustments (1,757 )

(4,764 ) (9,046 ) (12,957 ) Intra-entity IP transfer tax effect,

net - 2,243 -

2,243 Non-GAAP net income $ 8,912 $ 17,803

$ 26,902 $ 43,083 Non-GAAP net income

per share Basic $ 0.25 $ 0.49 $ 0.78 $ 1.20

Diluted $ 0.25 $ 0.48 $ 0.74 $ 1.17

Weighted average number of shares Basic

34,979,389 36,485,724 34,703,328

35,981,177 Diluted 36,184,151

37,475,729 36,153,515 36,894,457

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181107005818/en/

CyberArkInvestor Contact:Erica Smith,

+1-617-558-2132ir@cyberark.comorMedia Contact:Liz Campbell,

+1-617-558-2191press@cyberark.com

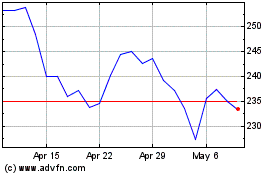

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

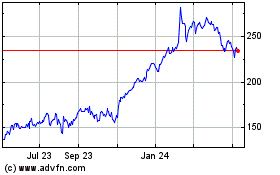

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Apr 2023 to Apr 2024