Indian Rupee Extends Decline To All-time Low Against U.S. Dollar

September 04 2018 - 3:39AM

RTTF2

The Indian rupee continued its sharp sell-off against the U.S.

dollar on Tuesday, slumping to a historic low, as escalating global

trade tensions and higher oil prices kept investors cautious.

The fall in the rupee intensified due to a strengthening dollar,

which lifted up on fears of a Chinese slowdown and economic

turbulence in emerging market economies.

U.S.-China trade tensions remained in focus ahead of looming

U.S. tariffs on Chinese imports as early as this week.

Meanwhile, talks between U.S. and Canadian negotiators will

resume on Wednesday after they failed to reach an agreement last

week.

Besides the Indian rupee, other emerging market currencies such

as Indonesian rupiah, Turkish lira, South African rand, Russian

rouble and Mexican peso also skidded against the dollar.

Breaching the key 71.5 level, the rupee collapsed to a record

low of 71.60 against the greenback. This represented a 0.6 percent

drop from Monday's closing value of 71.16.

Indian markets fell, with the benchmark 30-share BSE Sensex

declining 154.60 points or 0.40 percent to 38,157.92, while the

broader 50-share Nifty index dropped 62.05 points or 0.54 percent

to 11,520.30.

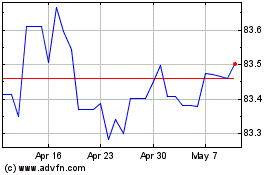

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

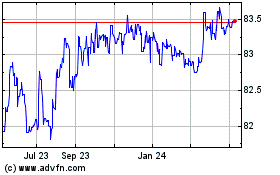

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024