Indian Rupee Collapses To Record Low Against U.S. Dollar On Trade Tensions

September 03 2018 - 6:04AM

RTTF2

The Indian rupee nosedived against U.S. dollar on Monday,

erasing its early gains, amid rising trade tensions as the U.S.

prepares to impose further $200 billion of tariffs on Chinese

imports as early as this week.

Sentiment further dampened as the United States and Canada put

off resolving their trade dispute.

The Indian rupee opened on a positive note following robust

Indian GDP data for the April-June quarter, showing a rise of 8.2

percent.

The early rise faded in late afternoon and the rupee fell to a

historic low of 71.22 against the greenback. This marked a 0.7

percent drop from a 4-day high of 70.68 seen in previous deals. The

pair was valued at 70.81 at last week's close.

The currency has thus shed almost 3.5 percent against the dollar

during the month of August.

Indian markets finished lower, with the benchmark BSE Sensex

falling 332.55 points or 0.86 percent to 38,312.52, while the

broader Nifty index dropped 98.15 points or 0.84 percent to

11,582.35.

On the economic front, survey data from IHS Markit showed that

India's manufacturing activity expanded at the weakest pace in

three months in August.

The Nikkei manufacturing Purchasing Managers' Index, or PMI,

fell to 51.7 in August from 52.3 in July. However, any reading

above 50 indicates expansion in the sector.

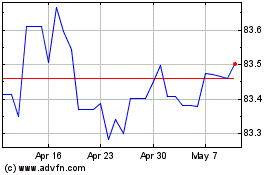

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

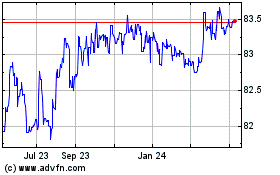

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024