Brambles Profit Rises, to Spin off IFCO RPC Unit -- Update

August 23 2018 - 7:08PM

Dow Jones News

By David Winning

SYDNEY--Logistics company Brambles Ltd. (BXB.AU) reported a

sharp rise in annual profit and said it will spin off or sell a

business that supplies crates for moving fresh produce to retailers

in Europe, Asia and the Americas.

Brambles reported a net profit of US$747.1 million for the 12

months through June, up from US$182.9 million a year ago. The

result included a US$127.9 million benefit resulting from the U.S.

tax reform while US$120 million in impairment charges that weighed

on its result a year ago weren't repeated.

Directors of the company declared a final dividend of 14.5

Australian cents a share, in line with the payout a year

earlier.

Brambles said it has decided to spin off its IFCO RPC business,

following on from February's sale of its North American recycled

whitewood pallets business to a Colorado-based private equity firm

for US$115 million including debt and subsequent sale of a stake in

an oil-and-gas joint venture with Hoover Container Solutions.

"Although both CHEP and IFCO operate pooling models, they are

distinct businesses with different financial profiles and customer

propositions," Brambles said. "There is no meaningful operational

overlap or customer-related synergies between CHEP and IFCO that

would be lost as a result of a separation."

Brambles said it will also consider whether a sale of IFCO would

be a better outcome for shareholders than a demerger.

As part of the separation, Brambles said it would "also

undertake an evaluation of its capital structure to ensure it is

optimal for supporting future growth and shareholder returns while

still maintaining a strong balance sheet and credit profile."

Brambles has been striving to engineer a business turnaround

after its stock was sold off following a rare profit warning and

hefty writedowns in the 2017 fiscal year. While asset sales have

steadied Brambles's share price, management has faced newer

challenges with labor shortages in key markets and higher fuel

prices driving up transport costs significantly. Brambles has also

contended with higher lumber costs, reflecting a strong U.S.

housing market and import tariffs.

Analysts expect Brambles to pass on the higher costs to

customers through increased prices of its products, albeit with a

time lag that could be as long as 24 months. Morgan Stanley last

month said it didn't expect Brambles to get its operating leverage

back until the 2020 fiscal year at the earliest.

Brambles's underlying profit, a measure of continuing operations

that strips out financing costs, tax and one-time items, was flat

at US$996.7 million, on a constant currency basis in the 2018

fiscal year.

Annual revenue rose by 6% to US$5.6 billion after stripping out

the impact of currency swings, in line with management's

expectation for sales growth of mid-single digits through the

cycle. Brambles has been driving growth by converting customers to

pooled solutions and broadening its global footprint.

"FY19 underlying profit will continue to reflect ongoing

input-cost inflation and other cost challenges," said Chief

Executive Graham Chipchase. "We expect the multi-year automation,

procurement and pricing initiatives we are currently undertaking to

progressively deliver efficiencies and earnings benefits over the

medium term."

-Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

August 23, 2018 18:53 ET (22:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

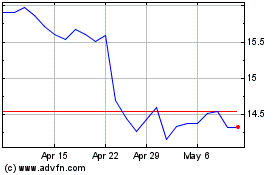

Brambles (ASX:BXB)

Historical Stock Chart

From Mar 2024 to Apr 2024

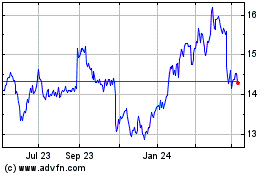

Brambles (ASX:BXB)

Historical Stock Chart

From Apr 2023 to Apr 2024