Indian Rupee Slides To Record Low Against U.S. Dollar

August 12 2018 - 11:53PM

RTTF2

The Indian rupee plunged against the U.S. dollar on Monday,

reaching an all-time low, as concerns over the contagion effects of

slumping Turkish lira hurt emerging market assets.

The Turkish lira hit a fresh record low this morning after

closing down as much as 16 percent on Friday as U.S. President

Donald Trump doubled steel and aluminum tariffs on Turkey, raising

concerns the country may plunge into a financial crisis.

Indian shares declined, tracking weakness among global peers, as

a renewed rout in the Turkish lira dampened sentiment.

The benchmark BSE Sensex was down almost 113.53 points or 0.30

percent at 37,756 while the broader Nifty index was down 37 points

or 0.32 percent at 11,393.

Breaching the key 69 level, the rupee dipped 0.9 percent to a

record low of 69.64 against the greenback in morning deals and

recovered thereafter. The pair was valued at 69.02 when it closed

deals on Friday.

To prevent a sharp fall in the rupee, the Reserve Bank of India

reportedly intervened in the forex market and sold dollars.

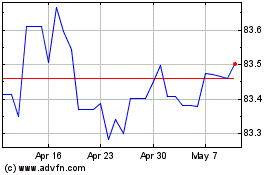

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

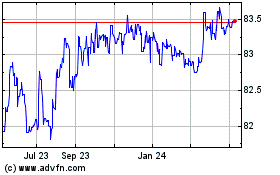

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024