Indian Rupee At Near 5-year Low Against U.S. Dollar

June 28 2018 - 3:34AM

RTTF2

The Indian rupee fell past 69 to the U.S. dollar on Thursday,

amid rising crude oil prices, coupled with lingering trade war

concerns between the U.S and China.

Indian markets also dropped, tracking weak global cues, as

traders remain skeptical about U.S. President Donald Trump's

approach to foreign policy and trade.

Trade worries persisted in view of conflicting messages from

U.S. President Donald Trump and his aides over whether he would

adopt a confrontational approach to limit Chinese investment in

America.

The benchmark BSE Sensex was down 179.47 points or 0.51 percent

at 35,038, while the broader Nifty index was down 82.30 points or

0.77 percent at 10,589 in evening trades.

Further undermining the currency was the surge in oil prices,

led by supply disruptions in Libya and Canada as well as government

data showing a bigger-than-expected drop in U.S. crude

stockpiles.

Investors became cautious ahead of expiry of June futures &

options contracts today.

The rupee depreciated to 69.19 against the US dollar, its

weakest since August 2013, when it hit a record low of 69.53. The

currency thus shed 0.4 percent to the dollar, from yesterday's

closing value of 68.94.

So far this year, the currency has lost 8.6 percent against the

U.S. dollar.

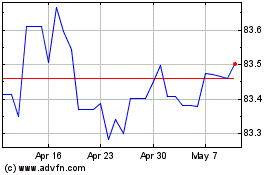

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

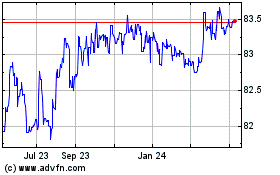

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024