U.S. Dollar Climbs Ahead Of Fed Minutes

August 21 2019 - 2:16AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

the early European session on Wednesday, as investors await the

release of Fed minutes from the July meeting later in the day for

more clues about further rate cuts in coming months.

The Fed reduced rate by 25 basis point at its meeting on July

30-31, citing external threats to economy and weak inflation.

It was the first rate cut since 2008.

Chairman Jerome Powell referred the rate cut as a "mid-cycle

adjustment" and not the beginning of an easing cycle.

The key risk event this week is the Jackson Hole symposium,

where Powell is set to speak on monetary policy challenges on

Friday.

His comments are keenly awaited after last week's U.S. bond

yield curve inversion increased expectations of a 25 basis point

cut at the September meeting.

On the economic front, U.S. existing home sales for July will be

featured at 10:00 am ET.

The currency has been trading in a positive territory against

its major counterparts in the Asian session, excepting the

euro.

The greenback appreciated to 1.2128 against the pound, from a

low of 1.2175 seen at 10:00 pm ET. The next likely upside target

for the greenback is seen around the 1.19 level.

Figures from the Office for National Statistics showed that the

UK budget balance showed a surplus in July.

Public sector net borrowing excluding public sector banks was in

GBP 1.3 billion surplus. Nonetheless, this was smaller by GBP 2.2

billion from July 2018 and also remained below economists' forecast

of GBP 2.7 billion.

The greenback rose to 0.9806 against the franc, following a

2-day decline to 0.9772 at 5:30 pm ET. The greenback is seen

finding resistance around the 1.00 level.

After a decline to 106.22 against the yen at 5:00 pm ET, the

greenback reversed direction and advanced to 106.60. Next key

resistance for the greenback is seen around the 108.00 region.

The greenback firmed to 0.6396 against the kiwi, compared to

0.6415 hit late York Tuesday. The greenback is likely to face

resistance around the 0.62 level.

In contrast, the greenback eased off to 1.1106 against the euro,

from a high of 1.1088 it touched at 3:00 am ET. The greenback is

poised to find support around the 1.14 level.

Extending early slide, the greenback declined to a 2-day low of

1.3296 against the loonie. Should the greenback drops further, it

may face support around the 1.31 level.

The greenback pared gains to 0.6789 against the aussie, from a

high of 0.6773 hit in the Asian session. Further downtrend is

likely to take the greenback to a support around the 0.71

level.

Looking ahead, Canada consumer prices and U.S. existing home

sales for July are scheduled for release in the New York

session.

At 2:00 pm ET, the Fed release minutes from the July 30-31

meeting.

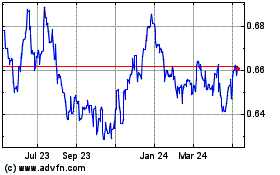

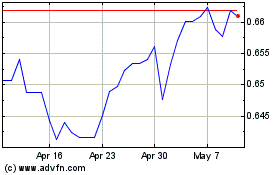

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024