U.S. Dollar Spikes Higher As Recession Worries Fade

August 16 2019 - 3:12AM

RTTF2

The U.S. dollar was higher against its most major counterparts

in the European session on Friday, as the treasury yields moved off

from yesterday's historic lows after strong July U.S retail sales

data helped ease fears over a potential recession.

The benchmark yield on 10-year Treasury note was higher by 1.57

percent, while the rate on the 30-year Treasury bond rose 2.03

percent. Yields move inversely to bond prices.

The demand for safe-haven bonds diminished following positive

comments on trade by U.S. President Trump overnight.

Trump said on Thursday that he hoped the U.S.-China trade

conflict would be relatively short and hinted at a meeting in

September.

Strong US retail sales helped reduce recessionary fears that

created turbulence in financial markets.

Official data showed that U.S. retail sales rose 0.7 percent in

July compared to a revised 0.3 percent increase in June. Economists

had expected a gain of 0.3 percent.

Investors await reports on U.S. housing Starts, building permits

and Michigan consumer sentiment index later in the day for more

direction.

The greenback showed mixed trading against its major

counterparts in the Asian session. While it rose against the franc

and the yen, it was steady against the euro. Versus the pound, it

declined.

The greenback climbed to 106.49 against the yen, from a low of

106.03 it touched at 8:30 pm ET. The greenback is seen finding

resistance around the 108.00 level.

The greenback strengthened to an 11-day high of 0.9807 against

the franc, from Thursday's closing value of 0.9764. The greenback

is likely to challenge resistance around the 1.00 mark.

The U.S. currency that finished Thursday's trading at 1.1107

against the euro advanced to a 2-week high of 1.1080. The next

possible resistance for the greenback is seen around the 1.08

mark.

Data from Eurostat showed that the euro area trade surplus

declined in June as exports logged a monthly decline amid an

increase in imports.

The trade surplus fell to a seasonally adjusted EUR 17.9 billion

in June from EUR 19.6 billion in May. In the same period last year,

the surplus totaled EUR 12.5 billion.

The greenback bounced off to 0.6776 against the aussie, from a

2-day low of 0.6795 seen at 11:00 pm ET. Next immediate resistance

for the greenback is seen around the 0.65 level. The greenback rose

to a 2-day high of 0.6423 against the kiwi from yesterday's New

York session close of 0.6447. The greenback may face resistance

around the 0.62 level, if it rises again.

In contrast, the greenback declined to an 8-day low of 1.2160

against the pound, compared to 1.2081 hit late New York Thursday.

Should the currency drops further, it may challenge support around

the 1.27 level.

The greenback edged lower to 1.3286 against the loonie from

yesterday's closing quote of 1.3313. Extension of the greenback's

downtrend is likely to see it challenging support around the 1.305

level.

The U.S. housing starts and building permits for July and

University of Michigan's preliminary consumer sentiment index for

August are scheduled for release in the New York session.

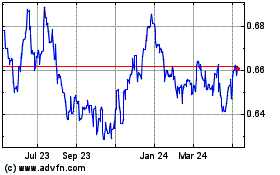

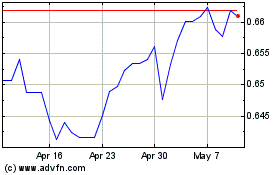

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024