Dollar Lower Amid Risk Appetite

June 28 2019 - 4:12AM

RTTF2

The U.S. dollar was lower against its major counterparts in the

European session on Friday amid risk appetite, as a two-day Group

of 20 summit began in Japan's western city of Osaka, with focus on

free trade.

U.S. President Trump and Chinese President Xi will meet on the

sidelines of the summit amid hopes that they will reach some sort

of agreement that would avoid the imposition of additional tariffs

on each other's products.

Speaking to reporters at the G-20 summit in Japan, Trump struck

an optimistic note about the upcoming meeting with Chinese

counterpart Xi Jinping, saying he expects to "have a very good

chance" of doing "something."

Investors also await reports on personal income and spending,

Chicago-area business activity and consumer sentiment due

shortly.

The currency traded mixed against its major counterparts in the

Asian session. While it fell against the franc and the yen, it was

steady against the euro and the pound.

The greenback slipped to a 2-day low of 0.9738 against the

franc, from a high of 0.9769 hit at 7:00 pm ET. The next possible

support for the greenback is seen around the 0.96 region.

The greenback that ended Thursday's trading at 1.1369 against

the euro weakened to a 3-day low of 1.1394. If the greenback

extends decline, 1.15 is possibly seen as its next support

level.

Flash data from Eurostat showed that Eurozone consumer prices

increased at a steady pace in June.

Inflation came in at 1.2 percent, the same rate as seen in May.

The rate came in line with expectations.

The greenback remained lower at 107.66 against the yen, not far

from a 2-day low of 107.56 seen at 10:30 pm ET. On the downside,

106.00 is possibly seen as the next support level for the

greenback.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan's housing starts declined for the second

month in May.

Housing starts dropped by more-than-expected 8.7 percent

year-on-year in May, following a 5.7 percent decline in April.

Economists had forecast the housing starts to fall 4.2 percent.

The U.S. currency edged lower to 1.2687 against the pound, after

rising to 1.2663 at 5:15 pm ET. The greenback is seen finding

support around the 1.29 mark.

Data from the Office for National Statistics showed that the UK

economy expanded at a faster pace in the first quarter, as

previously estimated.

Gross domestic product climbed 0.5 percent sequentially,

unrevised from the first estimate, and faster than the 0.2 percent

growth registered in the fourth quarter.

The greenback declined to near a 5-month low of 1.3085 against

the loonie and held steady thereafter. The pair had finished

Thursday's trading at 1.3094.

The greenback dropped to more than a 2-month low of 0.6711

against the kiwi and held steady thereafter. At yesterday's close,

the pair was worth 0.6698.

On the flip side, the greenback recovered to 0.7003 against the

aussie, from an early 4-week low of 0.7017. The currency is likely

to target resistance around the 0.68 mark.

Looking ahead, Canada GDP data for April and industrial product

price index for May, U.S. personal income and spending data for the

same month and University of Michigan's final consumer sentiment

index for June will be featured in the New York session.

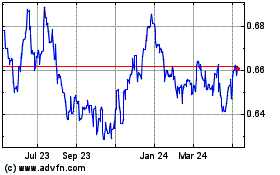

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

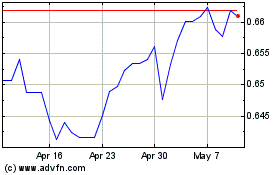

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024