Dollar Muted After U.S. GDP Data

June 27 2019 - 5:22AM

RTTF2

The U.S. dollar showed muted trading against its major opponents

in the European session on Thursday, after a data showed that the

pace of U.S. economic growth was unrevised from the previous

estimate for the first quarter.

Data from the Commerce Department showed that real gross

domestic product increased at an annual rate of 3.1 percent in the

first quarter, unrevised from the estimate released last month and

in line with economist estimates.

The unrevised rate of GDP growth in the first quarter still

reflects a significant acceleration from the 2.2 percent increase

seen in the fourth quarter of 2018.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits increased more than expected in the week

ended June 22.

The report said initial jobless claims rose to 227,000, an

increase of 10,000 from the previous week's revised level of

217,000.

Optimism about a potential U.S.-China trade deal prevailed ahead

of the highly anticipated meeting between President Donald Trump

and Chinese leader Xi Jinping at the G-20 summit in Japan that will

kick on tomorrow.

According to a report in The South China Morning Post, the U.S.

and China have agreed to a tentative truce in their trade dispute

that would help avert the next round of tariffs on an additional

$300 billion of Chinese imports.

U.S. President Donald Trump voiced optimism over the possibility

of a trade agreement with China but said he is still considering

imposing "very substantial" tariffs on all Chinese imports if the

two countries are unable to reach a deal during the G20 summit.

The currency rose against its most major counterparts in the

Asian session, following a media report that the U.S. and China

have tentatively agreed to a truce in their trade conflict.

The greenback retreated to 0.9768 against the franc, from a

6-day high of 0.9814 hit at 1:20 am ET. Further downtrend may take

the currency to a support around the 0.96 region.

Following an 8-day high of 108.16 seen at 2:30 am ET, the

greenback pulled back to 107.77 versus the Japanese yen. The

greenback is seen finding support around the 106.00 region.

Data from the Ministry of Economy, Trade and Industry showed

that Japan retail sales rose a seasonally adjusted 0.3 percent on

month in May - shy of expectations for a gain of 0.6 percent

following the downwardly revised 0.1 percent drop in April.

On a yearly basis, retail sales were up 1.2 percent - in line

with expectations and up from the downwardly revised 0.4 percent

increase in the previous month.

The U.S. currency pared gains to 1.1381 against the euro, from a

high of 1.1348 touched at 1:15 am ET. The next possible support for

the greenback is seen around the 1.15 level.

Survey data from the European Commission showed that Eurozone

economic sentiment deteriorated more-than-expected in June.

The economic sentiment index dropped to 103.3 in June from 105.2

in May. The score was forecast to fall to 104.7.

The greenback held steady against the pound, after having

declined to a 2-day low of 1.2725 at 6:45 am ET. On the downside,

1.30 is possibly seen as the next support level for the

greenback.

The U.S. pending home sales for May will be out at 10:00 am

ET.

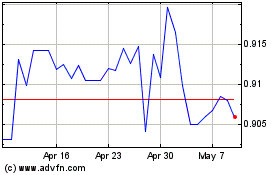

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024