Recent Highlights

- Strong U.S. product sales of A$2.2

million for third quarter of Fiscal 2019 were double second quarter

sales

- Ten presentations highlighting RECELL®

System additional clinical and economic benefits featured at

American Burn Association (ABA) 51st Annual Meeting

- Japan collaboration agreement with

COSMOTEC

- Application to market RECELL System

filed in Japan

- Equity placements completed for a total

of A$15.5 million in proceeds

AVITA Medical (ASX: AVH, OTCQX: AVMXY), a global regenerative

medicine company, announced that it filed today with the ASX its

Appendix 4C - Quarterly Cash Flow Report for the quarter ended 31

March 2019, the third quarter of its fiscal 2019. Provided below is

an update regarding the substantial accomplishments achieved during

the quarter, including the ramp up of RECELL® System sales during

the first three months of promotion of the product.

U.S. Commercial Sales of RECELL System

Active sales and marketing of the RECELL System in the U.S. for

the treatment of acute thermal burns commenced with the January

2019 national market launch, therefore the third quarter of fiscal

2019 represents the first three months of promotion for the

product. Product sales and other revenues for the quarter and nine

months ended 31 March 2019 were as follows (unaudited):

Three Months Ended

Nine Months Ended

(In thousands of AUD)

31 March

31 March

2019

2018

2019

2018

U.S. product

A$2,179

A$ -

A$3,281

A$ -

International product sales

189 238

900 845 Total product sales 2,368 238

4,181 845 Other revenue (including BARDA)

2,335

1,492 7,344 5,349

Total

revenue

A$4,703

A$1,730

A$11,525

A$6,194

“We are well ahead of our expectations for the U.S. launch of

the RECELL System and are delighted that sales doubled during this

quarter compared to the prior quarter,” said Dr. Mike Perry, Chief

Executive Officer. “The third quarter represents the first three

months of our market launch, and we have been very pleased with the

quick uptake of the RECELL System by burn centers that have been

the first movers in adopting the product. To date, 26 of the 134

burn centers within the U.S. have placed orders for the RECELL

System.”

“As we move beyond the early adopters, our collective experience

tells us that many of the remaining burn centers will follow a more

standard process for adopting the RECELL System, including an

initial evaluation of the product and advancement through their

hospital’s Value Analysis Committee (VAC), before making the formal

decision to purchase for regular use. This process can often take

six months or more to complete,” said Erin Liberto, Chief

Commercial Officer. “The recent ABA meeting added greatly to the

awareness and credibility of the RECELL System within the burn

community, and we look forward to converting this excitement into

product evaluations and the Value Analysis Committee approvals

required for adoption by additional U.S. burn centers.”

RECELL System Featured in Ten Presentations at ABA

Conference

Burn center professionals made ten presentations describing the

RECELL System at the American Burn Association (ABA) 51st Annual

Meeting held in Las Vegas April 2-5, 2019. Key results presented at

the ABA meeting included the following:

- Pediatric Treatment Outcomes:

Pediatric patients with mixed and full-thickness burns treated with

the combination of Spray-On Skin™ Cells prepared using the RECELL

System and widely meshed autografts experienced excellent healing

outcomes, with 98% of wounds healed four weeks after treatment. The

presentation was selected as a “Best of the Best Abstract” out of

more than 500 abstract submissions to the ABA meeting.

- RECELL Projected to Reduce Cost of

Treating Severe Burns: Health economic data projects that use

of the RECELL System to treat patients with severe burns could save

up to USD $28 million annually compared to treatment with the

standard of care at the Arizona Burn Center, part of the Maricopa

Integrated Health System (MIHS), a major public teaching hospital

and safety net system of care based in Phoenix.

- Long-Term Review by Co-Inventor:

Professor Fiona Wood, AM, Burns Service of Western Australia, Fiona

Stanley and Perth Children's Hospitals, described her experience

treating more than 3,500 patients with burns and other cutaneous

injuries, including a reduction in the number of surgical

procedures, earlier intervention, and reduction in time to healing

and length of stay.

- Donor Site Treatment Outcomes:

Preliminary results demonstrated that donor sites treated with the

Spray-On Skin Cells prepared using the RECELL System could be

reharvested in as little as seven days after treatment. The

presentation was awarded best in category at the ABA

conference.

- Treatment of Extensive Burns:

Patients with extensive burns, greater than 50% total body surface

area (TBSA), treated with Spray-On Skin Cells in combination with

widely meshed autografts healed as quickly as patients with smaller

burn injuries provided the same treatment combination, despite the

far greater clinical challenges associated with treatment for burns

over 50% TBSA.

- Publication Recognition: The

2018 publication of the RECELL System pivotal trial in

second-degree burns in the Journal of Burn Care & Research was

recognized during the “The Year in Review: The Top Journal

Publications” session of the ABA meeting.

Patients from the pediatric, donor site and large TBSA

presentations were treated under Investigational Device Exemption

(IDE) programs which allowed the use of the RECELL System to treat

patients in advance of the September 2018 market approval in the

U.S. The pediatric, treatment of donor sites, and extensive burns

presentations include classes of patients that fall outside of the

currently approved U.S. product labeling. Healthcare professionals

should read the INSTRUCTIONS FOR USE - RECELL® Autologous Cell

Harvesting Device (https://recellsystem.com/) for a full

description of indications for use and important safety information

including contraindications, warnings and precautions.

Funding and technical support for the development of the RECELL

System is provided by the Biomedical Advanced Research and

Development Authority (BARDA), under the Assistant Secretary for

Preparedness and Response, within the U.S. Department of Health and

Human Services, under ongoing USG Contract No. HHSO100201500028C.

Programs funded under the BARDA contract include two randomized,

controlled pivotal clinical trials, the Compassionate Use and

Continued Access programs, development of the health economic model

demonstrating the cost savings associated with the RECELL System,

and two randomized, controlled clinical trials in pediatric burn

patients.

Japan Collaboration and Application for Approval

In February AVITA Medical entered into a collaboration with

COSMOTEC, an M3 Group company, to market and distribute the RECELL

System for the treatment of burns and other wounds in Japan. In

addition, COSMOTEC filed on 25 February 2019 a Japan’s

Pharmaceuticals and Medical Devices Act (“JPMDA”) application for

approval to market the RECELL System in Japan. The JPMDA has

accepted the application and review is expected to take nine months

to a year.

COSMOTEC has extensive experience marketing medical devices and

other products into hospitals and surgical suites throughout Japan,

including specialties requiring a high level of training such as

cardiovascular treatment, making them an ideal partner for AVITA

Medical. COSMOTEC is wholly owned by the M3 Group, a major

healthcare company with great physician access in Japan and other

markets. The filing of the JPMDA application is a major milestone,

and AVITA Medical looks forward to making the RECELL System

available to patients in Japan.

Third Quarter Fiscal 2019 Financial Results

(Unaudited)

(All amounts are in thousands of AUD except where noted)

A copy of the Appendix 4C - Quarterly Cash Flow Report for the

third quarter of fiscal 2019, the quarter ended 31 March 2019, is

attached. Operations for the quarter were focused primarily on the

U.S. national market launch of the RECELL System for the treatment

of acute thermal burns, and the preparation and conduct of further

clinical development of the RECELL System.

During the quarter ended 31 March 2019, total cash receipts were

A$4,848, an increase of A$2,015 or 71% compared to the prior

quarter ended 31 December 2018. Cash receipts from customers for

the quarter ended 31 March 2019 were A$2,513, an increase of

A$1,655 or 193% compared to the prior quarter due to the

commencement of the U.S. national market launch of the RECELL

System. Cash received from BARDA during the current quarter

totalled A$1,724, a decrease of A$251 or 13% compared to the prior

quarter. The decrease was the result of wind-down of certain

activities associated with supporting the U.S. FDA approval of

RECELL System as well as Compassionate Use and Continued Access

programs. Through 31 March 2019, cumulative payments of A$24.36

million have been received under the BARDA contract.

As the result of the U.S. national market launch of the RECELL

System and related initiatives, overall payments for operating

expenses increased during the third quarter of fiscal 2019. During

the quarter ended 31 March 2019, payments related to sales and

marketing, staffing, administrative and corporate costs for the

current quarter totalled A$9,578, a A$611 or 7% increase compared

to the quarter ended 31 December 2018. The increase was in a large

part due to the November 2018 hiring of the U.S. sales force for

commercialization of the RECELL System, a team that was in place

for the entire quarter ended 31 March 2019. During the quarter

ended 31 March 2019, payments related to product manufacturing and

operating costs totalled A$919, a A$565 or 160% increase compared

to the quarter ended 31 December 2018. The increase was directly

related to the increase in sales during the current quarter. These

increases were partially offset by payments for research and

development, which during the current quarter totalled A$925, a

A$644 or 41% decrease compared to the quarter ended 31 December

2018. The decrease was the result of the wind-down of certain

activities associated with supporting the U.S. FDA approval of the

RECELL System as well as the Compassionate Use and Continued Access

programs. As a result of the national launch of the RECELL System

in the U.S. in January 2019, and the expansion of research and

development, payments for operating expenses will increase in

future quarters. These expense payments will be partially offset by

receipts from customers and receipts under the BARDA contract.

Total net cash used in operating activities during the quarter

ended 31 March 2019 was A$6,481, a A$102 or 2% decrease compared to

the quarter ended 31 December 2018. The current quarter decrease in

net cash used in operating activities resulted from the increase in

total cash receipts partially offset by the increase in payments

for operating expenses.

During the quarter ended 31 March 2019, net proceeds provided by

Tranche 2 of an institutional placement of shares to U.S.,

Australian and international institutional and sophisticated

investors, and under a Share Purchase Plan, was A$15,536. Cash and

cash equivalents held at 31 March 2019 was A$38,902.

Future cash requirement will be dependent upon the success of

AVITA Medical’s efforts to commercialize the RECELL System,

particularly in the U.S., and the timing and magnitude of clinical

and other research and development programs the Company elects to

undertake to expand its product pipeline. Until such time that the

Company generates sufficient cash flow from operations, it expects

to fund its future cash requirements through a combination of

current cash resources, and potentially the issuance of shares and

debt financing.

ABOUT AVITA MEDICAL LIMITED

AVITA Medical is a regenerative medicine company with a

technology platform positioned to address unmet medical needs in

burns, chronic wounds, and aesthetics indications. AVITA Medical’s

patented and proprietary collection and application technology

provides innovative treatment solutions derived from the

regenerative properties of a patient’s own skin. The medical

devices work by preparing a REGENERATIVE EPIDERMAL SUSPENSION™

(RES™), an autologous suspension comprised of the patient’s skin

cells necessary to regenerate natural healthy epidermis. This

autologous suspension is then sprayed onto the areas of the patient

requiring treatment.

AVITA Medical’s first U.S. product, the RECELL® System, was

approved by the U.S. Food and Drug Administration (FDA) in

September 2018. The RECELL System is indicated for use in the

treatment of acute thermal burns in patients 18 years and older.

The RECELL System is used to prepare Spray-On Skin™ Cells using a

small amount of a patient’s own skin, providing a new way to treat

severe burns, while significantly reducing the amount of donor skin

required. The RECELL System is designed to be used at the point of

care alone or in combination with autografts depending on the depth

of the burn injury. Compelling data from randomized, controlled

clinical trials conducted at major U.S. burn centers and real-world

use in more than 7,000 patients globally, reinforce that the RECELL

System is a significant advancement over the current standard of

care for burn patients and offers benefits in clinical outcomes and

cost savings. Healthcare professionals should read the INSTRUCTIONS

FOR USE - RECELL® Autologous Cell Harvesting Device

(https://recellsystem.com/) for a full description of indications

for use and important safety information including

contraindications, warnings and precautions.

In international markets, AVITA Medical’s products are marketed

under the RECELL System brand to promote skin healing in a wide

range of applications including burns, acute wounds, scars and

vitiligo. The RECELL System is TGA-registered in Australia and

CFDA-cleared in China.

To learn more, visit www.avitamedical.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This letter includes forward-looking statements. These

forward-looking statements generally can be identified by the use

of words such as “anticipate,” “expect,” “intend,” “could,” “may,”

“will,” “believe,” “estimate,” “look forward,” “forecast,” “goal,”

“target,” “project,” “continue,” “outlook,” “guidance,” “future,”

other words of similar meaning and the use of future dates.

Forward-looking statements in this letter include, but are not

limited to, statements concerning, among other things, our ongoing

clinical trials and product development activities, regulatory

approval of our products, the potential for future growth in our

business, and our ability to achieve our key strategic, operational

and financial goal. Forward-looking statements by their nature

address matters that are, to different degrees, uncertain. Each

forward- looking statement contained in this letter is subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statement.

Applicable risks and uncertainties include, among others, the

timing of regulatory approvals of our products; physician

acceptance, endorsement, and use of our products; failure to

achieve the anticipated benefits from approval of our products; the

effect of regulatory actions; product liability claims; risks

associated with international operations and expansion; and other

business effects, including the effects of industry, economic or

political conditions outside of the company’s control. Investors

should not place considerable reliance on the forward-looking

statements contained in this letter. Investors are encouraged to

read our publicly available filings for a discussion of these and

other risks and uncertainties. The forward-looking statements in

this letter speak only as of the date of this release, and we

undertake no obligation to update or revise any of these

statements.

+Rule 4.7B

Appendix 4C

Quarterly report for entities subject

to Listing Rule 4.7B

Introduced 31/03/00 Amended 30/09/01, 24/10/05, 17/12/10, 01/09/16

Name of entity

AVITA Medical Limited

ABN

Quarter ended (“current

quarter”)

28 058 466 52331 March 2019

Consolidated statement of cash flows

Current quarter$A’000

Year to date(9

months)$A’000

1. Cash flows from operating activities 1.1

Receipts from customers 2,513 3,718 1.1a Receipts from government

contract (BARDA) 1,724 7,828 1.2 Payments for (a) research and

development (925 ) (4,020 ) (b) product manufacturing and operating

costs (919 ) (2,298 ) (c) advertising and marketing (2,265 ) (6,262

) (d) leased assets (263 ) (777 ) (e) staff costs (4,593 ) (11,948

)

(f) administration and corporate costs

(2,457 ) (6,367 ) 1.3 Dividends received - - 1.4 Interest received

93 190 1.5 Interest and other costs of finance paid - - 1.6 Income

taxes paid - - 1.7 Government grants and tax incentives - 2,441 1.8

Other (provide details if material) 611 611

1.9 Net cash used in operating activities

(6,481 ) (16,884

)

Consolidated statement of cash flows

Current quarter$A’000

Year to date(9

months)$A’000

2. Cash flows from investing activities 2.1

Payments to acquire: (a) property, plant and equipment (501 )

(1,223 ) (b) businesses (see item 10) - - (c) investments - - (d)

intellectual property - - (e) other non-current assets - - 2.2

Proceeds from disposal of: (a) property, plant and equipment (b)

businesses (see item 10) - - (c) investments - - (d) intellectual

property - - (e) other non-current assets - - 2.3 Cash flows from

loans to other entities - - 2.4 Dividends received (see note 3) - -

2.5 Other (provide details if material) - -

2.6 Net cash used in investing activities

(501 ) (1,223

) 3. Cash flows from financing

activities 3.1 Proceeds from issues of shares 16,983 45,037 3.2

Proceeds from issue of convertible notes - - 3.3 Proceeds from

exercise of share options - - 3.4 Transaction costs related to

issues of shares, convertible notes or options (1,447 ) (4,192 )

3.5 Proceeds from borrowings - - 3.6 Repayment of borrowings - -

3.7 Transaction costs related to loans and borrowings - - 3.8

Dividends paid - - 3.9 Other (provide details if material) -

-

3.10 Net cash from financing

activities 15,536

40,845

Consolidated statement of cash flows

Current quarter$A’000

Year to date(9

months)$A’000

4.

Net increase in cash and cash

equivalents for the period

4.1 Cash and cash equivalents at beginning of quarter/year to date

30,342

14,825

4.2 Net cash used in operating activities (item 1.9 above) (6,481 )

(16,884 ) 4.3 Net cash from used in investing activities (item 2.6

above) (501 ) (1,223 ) 4.4 Net cash from financing activities (item

3.10 above) 15,536 40,845 4.5 Effect of movement in exchange rates

on cash held 6 1,339

4.6 Cash and

cash equivalents at end of quarter 38,902

38,902

5.

Reconciliation of cash and cash

equivalentsat the end of the quarter (as shown in the

consolidated statement of cash flows) to the related items in the

accounts

Current quarter$A’000

Previous quarter$A’000

5.1 Bank balances 38,902 30,342

5.2 Call deposits - - 5.3 Bank overdrafts - - 5.4 Other (provide

details) - -

5.5 Cash and cash equivalents at end

of quarter (should equal item 4.6 above)

38,902 30,342

6.

Payments to directors of the entity and

their associates

Current quarter$A'000

6.1 Aggregate amount of payments to these parties included in item

1.2 (258 ) 6.2 Aggregate amount of cash flow from loans to these

parties included in item 2.3 6.3 Include below any

explanation necessary to understand the transactions included in

items 6.1 and 6.2 6.1 Executive Director remuneration (166k),

Directors fees (64k), Clinical Advisory Board fees (11k), and

Bioscience Consultancy (17k)

7.

Payments to related entities of the

entity and their associates

Current quarter$A'000

7.1 Aggregate amount of payments to these parties included in item

1.2 7.2 Aggregate amount of cash flow from loans to these parties

included in item 2.3 7.3 Include below any explanation

necessary to understand the transactions included in items 7.1 and

7.2

8.

Financing facilities availableAdd

notes as necessary for an understanding of the position

Total facility amountat quarter

end$A’000

Amount drawn atquarter

end$A’000

8.1 Loan facilities 8.2 Credit standby arrangements

8.3 Other (please specify) 8.4

Include below a description of each facility above, including the

lender, interest rate and whether it is secured or unsecured. If

any additional facilities have been entered into or are proposed to

be entered into after quarter end, include details of those

facilities as well.

9. Estimated cash outflows for next quarter

$A’000 9.1 Research and development

1,000 9.2 Product manufacturing and operating costs

1,000 9.3 Advertising and marketing 1,500 9.4 Leased assets 250 9.5

Staff costs 5,000 9.6 Administration and corporate costs 1,500 9.7

Other (provide details if material)

9.8

Total estimated cash outflows* 10,250 *

Pertains to outflows only, inflows from customer receipts

and government contracts, which totalled $4,848 for the quarter

ended 31 March 2019 and are expected to increase in future

quarters, are not included.

10.

Acquisitions and disposals

ofbusiness entities(items 2.1(b) and 2.2(b)

above)

Acquisitions Disposals

10.1 Name of entity

10.2 Place of incorporation or registration

10.3 Consideration for

acquisition or disposal

10.4 Total net assets

10.5 Nature of business

Compliance

statement 1 This statement has been prepared in

accordance with accounting standards and policies which comply with

Listing Rule 19.11A. 2 This statement gives a true and fair view of

the matters disclosed.

Dale Sander

Chief Financial Officer

30 April 2019

Notes 1. The quarterly report provides a basis

for informing the market how the entity’s activities have been

financed for the past quarter and the effect on its cash position.

An entity that wishes to disclose additional information is

encouraged to do so, in a note or notes included in or attached to

this report. 2. If this quarterly report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 107: Statement of Cash Flows apply to

this report. If this quarterly report has been prepared in

accordance with other accounting standards agreed by ASX pursuant

to Listing Rule 19.11A, the corresponding equivalent standard

applies to this report. 3. Dividends received may be classified

either as cash flows from operating activities or cash flows from

investing activities, depending on the accounting policy of the

entity. + See chapter 19 for defined terms 1

September 2016

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190429005900/en/

U.S. MediaSam Brown, Inc.Christy CurranPhone

+1-615.414.8668christycurran@sambrown.com

O.U.S MediaMonsoon CommunicationsSarah KemterPhone

+61 (0)3 9620 3333Mobile +61 (0)407 162

530sarahk@monsoon.com.au

Investors: Westwicke PartnersCaroline CornerPhone

+1-415-202-5678caroline.corner@westwicke.com

AVITA Medical LtdDale A. SanderChief Financial

OfficerPhone +1-661-367-9178dsander@avitamedical.com

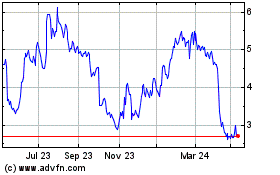

AVITA Medical (ASX:AVH)

Historical Stock Chart

From Mar 2024 to Apr 2024

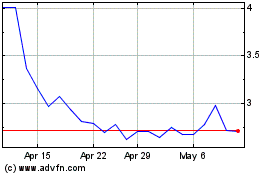

AVITA Medical (ASX:AVH)

Historical Stock Chart

From Apr 2023 to Apr 2024